Contents

Sold puts with a delta hedge gives us a curve similar to a short strangle.

Let’s take a look.

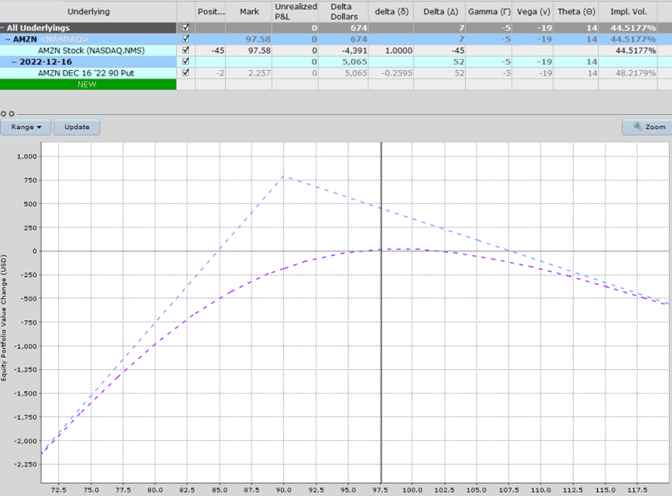

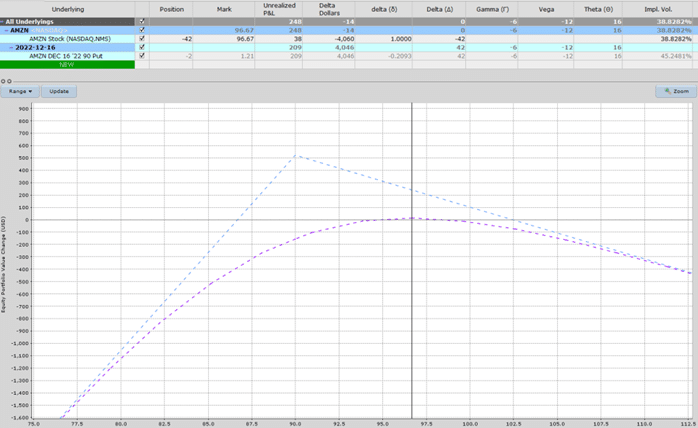

Below is the “payoff diagram.”

Or some people call it the “risk graph,” depending if you see the glass half-full or half-empty.

The term “payoff diagram” suggests showing us how much money we might make.

The term “risk graph” suggests showing us how much money we could lose.

Above is the graph on November 16, 2022, when we sold two Amazon (AMZN) puts with a strike price of $90, expiring exactly one month later on December 16.

We also sold 45 shares of AMZN stock.

Note that the peak of the expiration graph occurs at the $90 strike price.

Because we sold stock, we want the price of AMZN to drop.

But the short puts prefer to have the price of AMZN be at $90 or higher at expiration.

That is when the short puts collect the maximum credit.

The ideal price at expiration at which P&L is optimized for both the short puts and the short stock is at the strike price of the puts.

Each short put is valued at $2.26 per share.

Each share of stock is valued at $97.58.

If AMZN is at $90 at expiration, our profit would be $793, as calculated below:

2 x $226 = $452

45 x ($97.58 – $90) = $341

Total = $793

The above number is only the theoretical maximum.

We are not going to hold to expiration. And it is unlikely that the price will land right on $90.

The Greeks

The short puts and short stock combined give us the following Greek:

Delta: 7

Theta: 14

Vega: -19

Gamma: -5

The Greeks of this trade are characteristic of option selling strategies.

That is, we have positive theta and negative vega.

We profit from time passing.

Ideally, we like to keep delta and gamma small since these represent price movement.

We minimize the effect of price movements on our P&L.

Price Moved

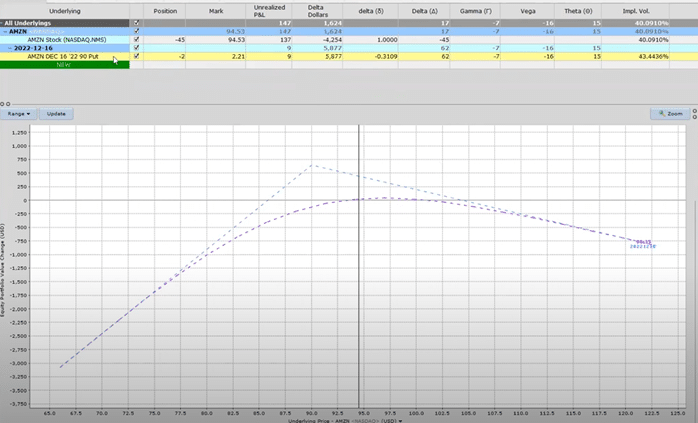

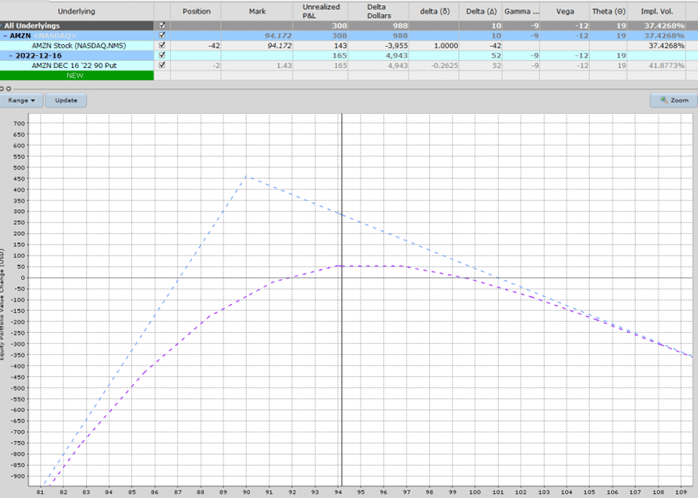

Speaking of price movement, one week later, on November 23, the AMZN price moved down to $94.53.

The position delta is positive 17. So we sell another 17 shares to delta hedge and bring delta down to zero.

BEFORE:

AFTER:

Possible Take Profit

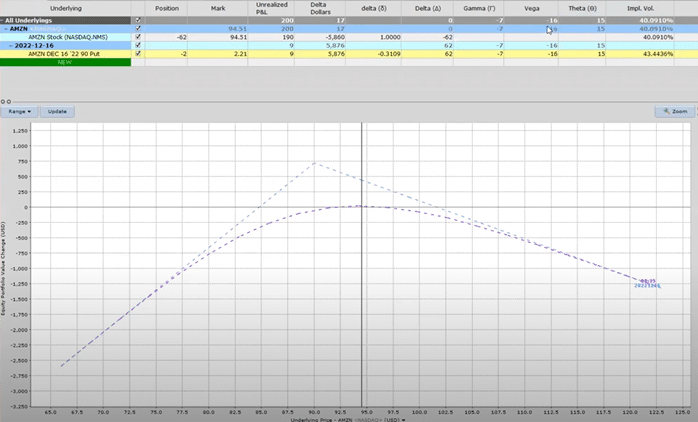

On November 30th, P&L is looking good at +210. It would be perfectly acceptable to take profits here.

Otherwise, we could adjust back to neutral and hold for a few more days.

From the above screenshot, we see that now we are negative 20 deltas for our position.

BEFORE:

If we were to adjust, we would buy 20 shares of AMZN to give the following graph:

AFTER:

Time to Close

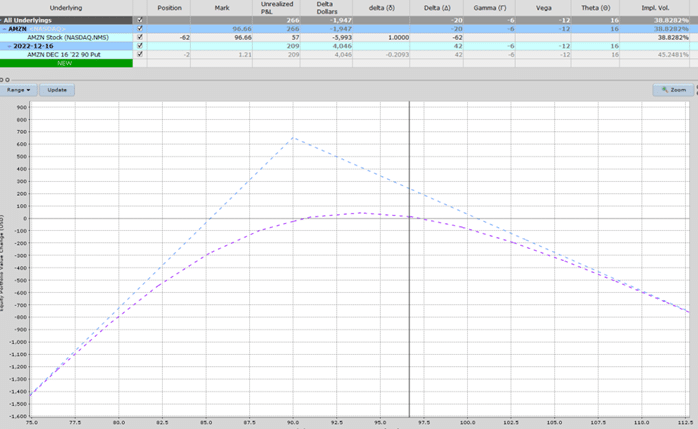

On December 4th – Beautiful and easy trade currently sitting at +275. Time to close.

Conclusion

It is interesting to combine options with stock.

Unlike a short strangle where we have to move an option for adjustment, we just need to buy or sell the stock, which in many ways, is much easier.

First, stocks are more liquid with a tighter bid/ask spread.

They get filled very quickly. You can set up price triggers to buy and sell based on the underlying price.

And for those who get some satisfaction from seeing a delta=0 number on your analytical software, using stocks allows you to get a delta as precisely to near zero as possible – not that it will matter a lot.

Because as soon as the price moves, the gamma will move the delta out of its zero position.

In any case, using stocks while trading with options can be quite enjoyable.

FAQ

What is a short put?

A short put is an options trading strategy where an investor sells a put option with the expectation that the price of the underlying asset will rise or remain stable, allowing them to profit from the premium received.

What is a delta hedge?

A delta hedge is an options trading strategy that involves adjusting the position in the underlying asset to maintain a neutral delta, which means that the value of the portfolio is not affected by small changes in the price of the underlying asset.

How does a short put with delta hedge work?

When an investor sells a short put option, they receive a premium in exchange for the obligation to buy the underlying asset at a predetermined price (strike price) if the option is exercised by the buyer.

To delta hedge a short put position, the investor sells a certain amount of the underlying stock to offset the positive delta of the short put.

What are the benefits of a short put with delta hedge?

A short put with delta hedge allows investors to profit from the premium received when selling the put option, while also limiting their downside risk by maintaining a neutral delta.

The other advantage is that it takes advantage of volatility skew by selling the expensive OTM options.

What are the risks of a short put with delta hedge?

The main risk of a short put with delta hedge is that if the price of the underlying asset falls sharply, the investor may be forced to buy the asset at a higher price than the current market value. This can result in significant losses, particularly if the investor has not hedged their position effectively.

How do you manage a short put with delta hedge?

To manage a short put with delta hedge, investors should regularly monitor the position and adjust the delta hedge as needed to maintain a neutral delta.

They should also set stop-loss orders to limit their losses if the price of the underlying asset falls sharply.

Additionally, investors may choose to close the position early if the price of the underlying asset rises or if they are no longer comfortable with the risk profile of the position.

What are some best practices for trading a short put with delta hedge?

Some best practices for trading a short put with delta hedge include choosing a strike price that is below the current market price of the underlying asset, selecting an expiration date that allows for enough time to profit from the premium received, and carefully monitoring the position to ensure that the delta hedge is maintained effectively.

Additionally, investors should have a clear exit strategy in place and should be comfortable with the risks involved in the position before opening the trade.

We hope you enjoyed this article about Amazon sold puts with delta hedging.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.