Contents

Forgive the dissertation-sounding title.

We will try to explain this as simply as we can, focusing on the main concepts without going into the weeds of the more detailed areas.

Exchange Traded Products (ETPs) is just a term to encompass both Exchange Traded Funds (ETFs) and Exchange Traded Notes (ETNs) – the difference between the two is one of those detailed weeds that we don’t need to get into.

VXX is an example of a volatility ETN, while SVIX is an example of a volatility ETF.

There are many other such volatility products.

For today’s discussion, we will use the VXX as an example.

It tracks the S&P 500 VIX Short-Term Futures Index.

It gives traders exposure to the VIX Futures.

It is “short-term” because it targets only the next upcoming expiration contracts and the next expiration cycle, not cycles that are 4 to 7 months out.

Why Does The Price Of VXX Go Down?

A weekly chart of VXX over the last five years looks like this:

It tends to go down most of the time.

Its value decays so much that it must do regular reverse stock splits to maintain a reasonable price.

Unlike the price of items in a store, the price of the VXX is not directly driven by the supply and demand of people buying the VXX symbol.

The main driver of the price of VXX and other volatility ETPs is the VIX Futures roll yield.

The other potential secondary factor is beta slippage (which is another weed that we will not get into).

VIX Futures Versus VIX Index

Don’t confuse VIX Futures with the VIX index.

The VIX index is the volatility index of the S&P 500 index that you can see here…

Its value is based on S&P 500 options prices.

The supply and demand of S&P put and call options drive the VIX.

The VIX Futures contracts are freely traded by market participants speculating on the future value of the VIX index.

Hence, VIX Futures prices are driven by the supply and demand of market participants on the VIX Futures.

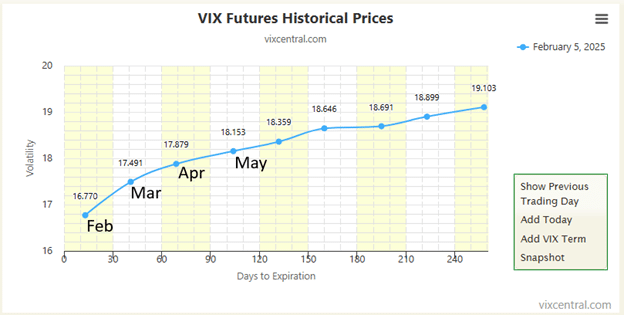

Below, we can see the VIX Futures prices as of February 5th, 2025…

Future contracts have expirations.

The next expiration date is February.

The first blue dot shows this.

The value of those contracts is at 16.77.

There are 13 days left till expiration.

The expiration cycle after that is the March expiration.

Those contracts have a value of 17.49.

The VIX index right now, on February 5th, is at around 16.

The person buying the April VIX Futures contract at 17.87 is betting that VIX will reach 17.87 or higher at some time between now and April expiration.

The VIX Futures curve that you see above (known as the VIX term structure) is what is normally expected in stable market conditions.

The price of the May contracts is higher than that of April’s.

April is higher than that of March, etc.

This is reasonable since the more time till the expiration of the Futures contract, the more time one has for the VIX to spike up to those levels.

This shape is known as contango, where the longer-dated VIX futures are priced higher than near-term ones.

The first upcoming expiration, we will call M1 for “month 1”.

The next expiration is called M2.

In our example, M1 is the Feb expiration, and M2 is the March expiration.

As the February contracts get closer and closer to expiration, their value will get closer and closer to the VIX index.

In this case, the value of 16.77 is expected to drop towards the VIX of 16.

Obviously, the VIX is moving all the time, so it is a moving target.

Similarly, the March contract also tries to converge to the VIX index as it gets closer to expiration.

M1 and M2 are important because the VXX is a mixture of M1 and M2 contracts.

At the beginning of the cycle, the VXX will hold 100% of M1 contracts.

It needs to be rebalanced every day because if it does not, then all of the M1 contracts will eventually expire, and nothing is left in the VXX.

Therefore, every day, it rebalances to hold less of the M1 contract and more of the M2 contracts – until at M1 expiration, it will have 100% of the M2 contracts (at which point, the M2 becomes the new M1).

If you think about it, it must sell M1 contracts and buy M2 contracts daily.

We just saw that M1 is lower than M2.

Therefore, it is selling low and buying high.

It is losing money.

This is known as value erosion and is why the VXX value goes down.

This happens in the condition you see above, where M1 and M2 are above the VIX index, and the VIX term structure is in contango.

We say there is a positive roll yield.

Backwardation

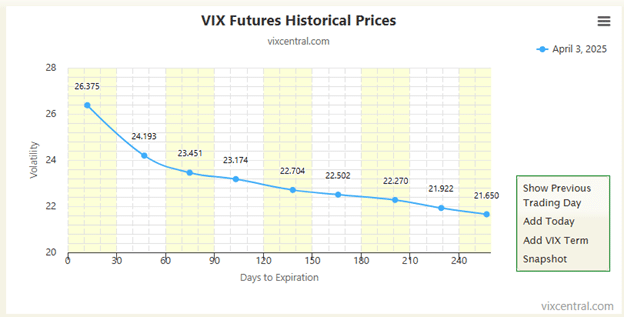

Now let’s look at the VIX Futures term structure as of April 3rd, 2025:

This shape of the term structure, where the longer-dated VIX futures are priced lower than near-term ones, is called “backwardation.”

Speculators expect the VIX to be high in the near term and back down to normal or low in the future.

In this case, M1 and M2 are lower than the VIX index, which is around 28 at the time.

M1 and M2 are expected to rise in price to converge to the VIX index.

Since VXX holds both M1 and M2, its value should go up.

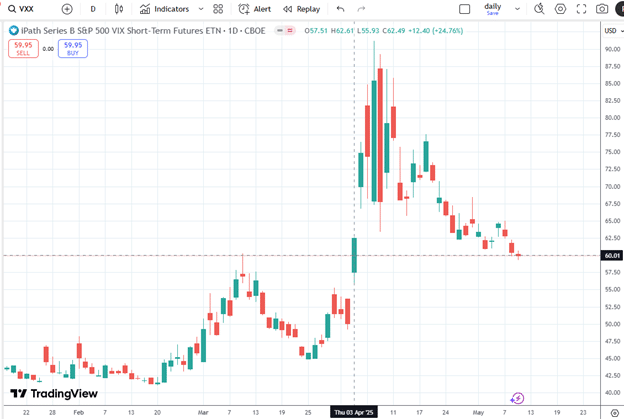

And the daily chart of the VXX shows this:

This condition where M1 and M2 are below the VIX index is when the VXX has a negative roll yield.

Summary

VXX is a “long volatility” product.

That means if VIX volatility increases (which it did in April), the VXX generally also goes up.

When VIX goes down, the VXX generally goes down.

Due to the effect of positive roll yield from the rebalancing of M1 and M2 under normal market conditions, the VXX experiences value erosion such that its value can decay even when VIX remains flat.

The VXX holds a combination of M1 and M2 VIX Futures contracts.

There is no direct cause and effect between the VIX index and VIX Futures.

However, the price relationship between the VIX index and the VIX Futures contract prices determines whether the VXX has a positive roll yield or a negative roll yield, determining if the VXX price goes down or up respectively.

A positive roll yield occurs most of the time under normal market conditions.

In this case, M1 and M2 are higher than the VIX index.

They will tend to go down to converge to the VIX index at expiration.

This causes VXX prices to go down.

A negative roll yield occurs during market uncertainty and market crashes.

In this case, M1 and M2 are lower than the VIX index, which causes the VXX price to go up.

This is just an intro article into the volatility space.

We don’t want anyone seeing the down-trending VXX graph to get into their heads and naively short the VXX product directly, like shorting shares of stock.

This is not a good idea because you have unlimited risk in the event of a large spike in volatility.

While being on the short side of volatility is generally the right side to be on, there are much better ways to short volatility than to short ETP products like the VXX directly.

Just watch volatility trader Brent Osachoff’s video, in which he said that anyone shorting these ETPs directly during the financial crisis would be toast.

He doesn’t short volatility ETPs directly but uses more effective methods instead.

As a side note, trading certain volatility ETPs may have different tax treatments and generate a K1 (ask your accountant).

We hope you enjoyed this article on how roll yield drives the price of volatility ETPs

If you have any questions, send an email or leave a comment below.