A reverse calendar spread is a type of horizontal spread, a type of spread where the time strike is used.

Still, the contract expirations are different, where the trader benefits from a directional move in the short term and then collects the theta burn after the move happens.

However, this spread is not typically used by individual investors or traders due to its large margin requirements and other potential spread options.

Contents

Understanding Reverse Calendar Spreads

A reverse calendar spread is a short calendar spread, and its mechanics are pretty simple when you break it down.

First, you must identify a stock you think will experience greater near-term volatility and slowly steady out.

Instruments that have news pending or earnings are what come to mind.

After identifying the stock you want to trade, you look to buy a near-term contract and sell a longer-dated one at the same strike.

Since this is a horizontal spread, it’s important that the same strike price expires on a further date.

Finally, after the event has occurred, many traders will close out the position with profit due to the high margin requirements and the possibility of being short a long-dated option.

This spread is useful because puts or calls can be used to build out the spread depending on your directional bias for the move.

Similar to verticals, a reverse calendar put spread looks for prices to increase, and a reverse calendar call spread looks for prices to decrease.

Advantages Of Reverse Calendar Spreads

As we discussed above, the reverse calendar spread shines when you look for near-term volatility to pick up.

This is not the only advantage of this kind of spread, though; here are some additional advantages of the Reverse Calendar:

Theta Advantage – With the Reverse Calendar being a directional spread, this advantage depends on being correct on the move. But as the price moves away from the short strike and in the direction of the long strike, theta is working for you, as is the price.

Credit Spread – Given the setup of the Reverse Calendar, you will receive a credit when you execute the trade. This makes it a potential option for investors looking for cash flow in their accounts.

Management Options – One more obscure advantage of the Reverse Calendar is its ability to be creatively managed. There are two main management techniques (outside of closing early); both require a larger account or some setup.

The first of these is on a Reverse Calendar Put spread.

You execute the put spread on a stock you think will decline in the near term and then rise in the long term.

You can capitalize on the downward movement with the purchased short-term put, close that leg, and now hold a cash-secured put to purchase the shares if they hit your strike.

The second is a version of the covered call. Let’s say you own 100+ shares of a stock. With the long call, you can sell a Reverse Calendar Call Spread to take advantage of any near-term price increase.

Then, similar to the put example, close the long call with profit, hold the short call, and remain covered by the shares you hold.

This is like a leveraged-covered call.

Risks and Disadvantages

Now that we have looked at the possible advantages, let’s look at some of the risks and disadvantages associated with Reverse Calendars.

Margin Requirements – One of the main drawbacks to this type of spread is the high margin requirement to place the trade. Because you are covering the longer-dated short contract with a shorter-dated long contract, many brokers will require the same margin as a naked short.

Price Risk – With this being a directional spread, price risk is a concern for these. If you are in a Reverse Calendar Call Spread and the price continues to fall, your profit is limited to the credit, assuming you can exit the position before the expiration of the long call. The short contract will help offset the loss with the theta decay, but you are capped on that gain.

Complexity and Management – Given the margin requirements and multiple legs of this trade, another drawback is the need for constant management. These spreads must be closely monitored because you will have a naked short option once the near-term contract expires. Additionally, some brokers may not allow you to trade these spreads without the highest-level options trading package they allow (level 3 options at TD Ameritrade, for example).

Assignment – The last potential risk for the Reverse Calendar Spread is early assignment. While it is rare in American-style options, your short contract may get assigned early, and that would put you either long or short 100 shares of the underlying per contract. This is the main reason for the large margin requirements.

Examples

Now that we have looked at Reverse Calendar Spreads, how to set them up, and their advantages and disadvantages, let’s look at some examples.

Below are examples of both a call and a put Reverse Calendar Spread.

Reverse Calendar Call Spread

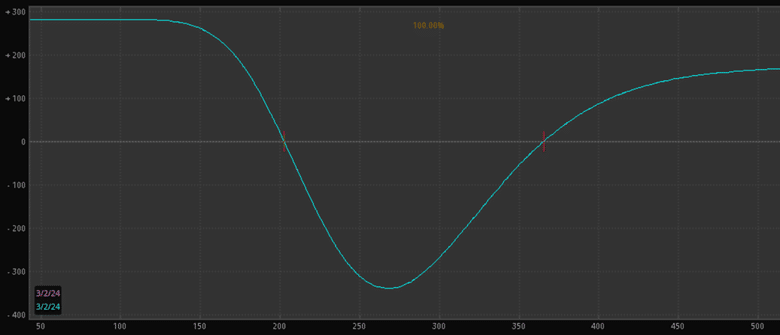

Below is a Reverse Calendar Call Spread on AMD stock.

AMD is trading at around $200/share at the time of this writing.

The trade is to sell an April/May $260 Calendar Call Spread on the stock.

This gives us almost $60 in price appreciation before we are looking at a loss and puts our maximum loss at the $260/share mark.

Additionally, if the price skyrockets, we will be profitable over the $360/share mark, as shown by the “U” shaped profile below.

The net credit for the trade is around $260/contract in income.

A final note on this trade: TD and Tradestation will not allow you to place it without level 3 options clearance/100 shares to cover the short call portion of it.

Reverse Calendar Put Spread

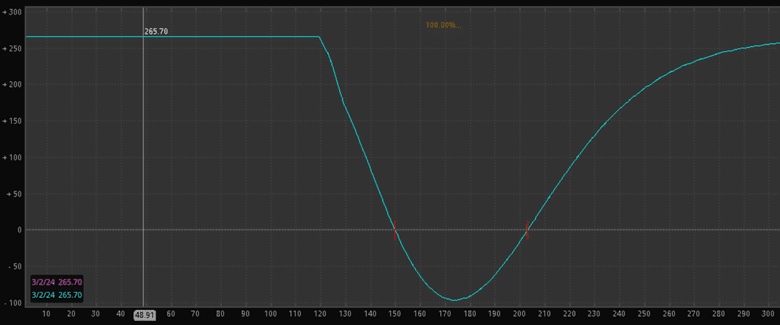

Below is a Reverse Calendar Put Spread on AMD with the same underlying price of around $200/share.

This trade is to sell an April/May $170 Calendar Spread.

This trade looks to capitalize on price appreciation on the underlying.

Still, similar to the call spread above, it will also profit if the price craters below $150/share, creating a similar “U” shaped profile.

The net credit on this trade is around $270 per contract, and the margin required to place it is $16,000 (the same cost at a $160 Strike Cash Secured Put).

This trade can be placed with level 2 options clearance at most brokerages as long as you have the cash to cover the short put.

Final Thoughts

There you go, a short primer on the reverse calendar spread.

You can see that this is a great tool to use if you have the account size for them.

They benefit from a directional move in the short term and then slowly continue to profit from the theta decay of the short contract.

Given this trade’s complexity and capital requirements, though, many other options are available to achieve the same goal.

If directional credit spreads are something that you want to utilize, verticals and butterflies could be better choices.

These require far less capital, less managing, and no fear of being in a naked short option.

If you are willing to allocate the capital required for the Reverse Calendar Put Spread, you could be better off trading a regular Cash Secured Put and rolling it if you don’t want to get assigned the shares.

While these spreads are incredibly powerful and have the potential to be incredibly profitable, given all of the potential drawbacks and the margin requirements, they just don’t make a lot of sense for anyone but the most seasoned trader.

With alternatives like verticals and butterflies, your capital could be better deployed there.

We hope you enjoyed this article on reverse calendar spreads.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.