Options traders use a lot of lingo and shorthand expressions that make communication more concise. But if you are just learning, all this lingo can be confusing.

Whenever someone says:

“Selling a put spread.”

“Sell a put credit spread.”

“Sell a put vertical.”

“Initiate a bull put spread.”

“Start a put credit spread.”

It all means the same thing.

As a new options trader, you may wonder how it all means the same.

And why doesn’t everyone consistently use the same expression to avoid confusing us?

Any experienced option trader will understand all of the above to mean:

“Sell a put option and buy a put option at a lower strike with the same expiration.”

And now you do too, after reading this article.

This sentence is very wordy and cumbersome to say and to write.

Therefore, the people in the industry use shorthand expressions instead.

Contents

An Example

Let’s look at a concrete example of selling a put credit spread:

On June 14, 2023, FedEx (FDX) was trading at $280.

Sell 1 July 21 FDX $210 put @ $2.70

Buy 1 July 21 FDX $200 put @ $1.44

Net Credit: $130

For put options with the same expirations, the higher strike option is always more valuable than, the lower strike options.

That is why we can receive $270 from selling the $210 put option.

And we only have to pay $144 to buy the lower strike option.

We received a credit of $130 to initiate this trade. This is called a “put credit spread.”

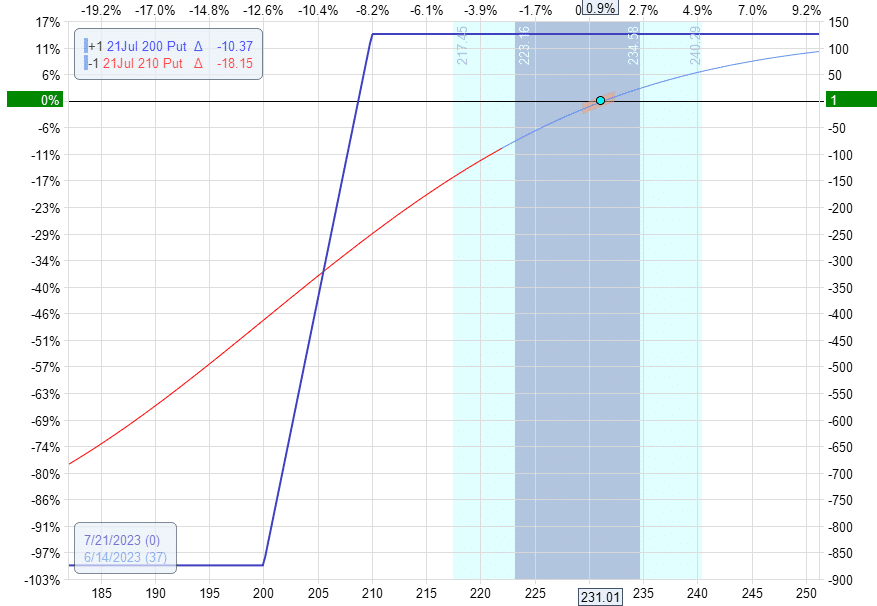

The payoff diagram would look like this:

Delta: 7.76

Theta: 2.5

Vega: -6

We can see that this is a bullish trade because the position delta is positive, and the curved today line is sloping up.

Now you understand why this spread is also called a “bull put spread.”

Vertical Spreads

A “spread” is when we buy one option and sell another option.

A “vertical spread” is when those options are at the same expiration.

We can have “put vertical spreads” and “call vertical spreads.”

In our example, we have a put vertical spread because the strike of both put options is in the same expiration.

Saying “put vertical” does not tell us which option is being sold or bought.

But if someone says: “sell a put vertical,” then we know that we are selling a higher strike put option and buying a lower strike put option, as in our example.

If someone says: “buy a put vertical,” that is something different.

That is when we buy a higher strike put and sell a lower strike put option.

We would have to pay a debit. And this would be called a debit spread.

Therefore if the expression has the words “buy” or “debit” in it, it means something else.

Buying a put vertical is not the same as selling a put vertical. Initiating a put debit spread is different from starting a put credit spread.

Using in Context

Suppose you read somewhere that “to make an all-put broken-wing butterfly more bullish, we sell a put credit spread with the upper-long leg.”

What does that mean?

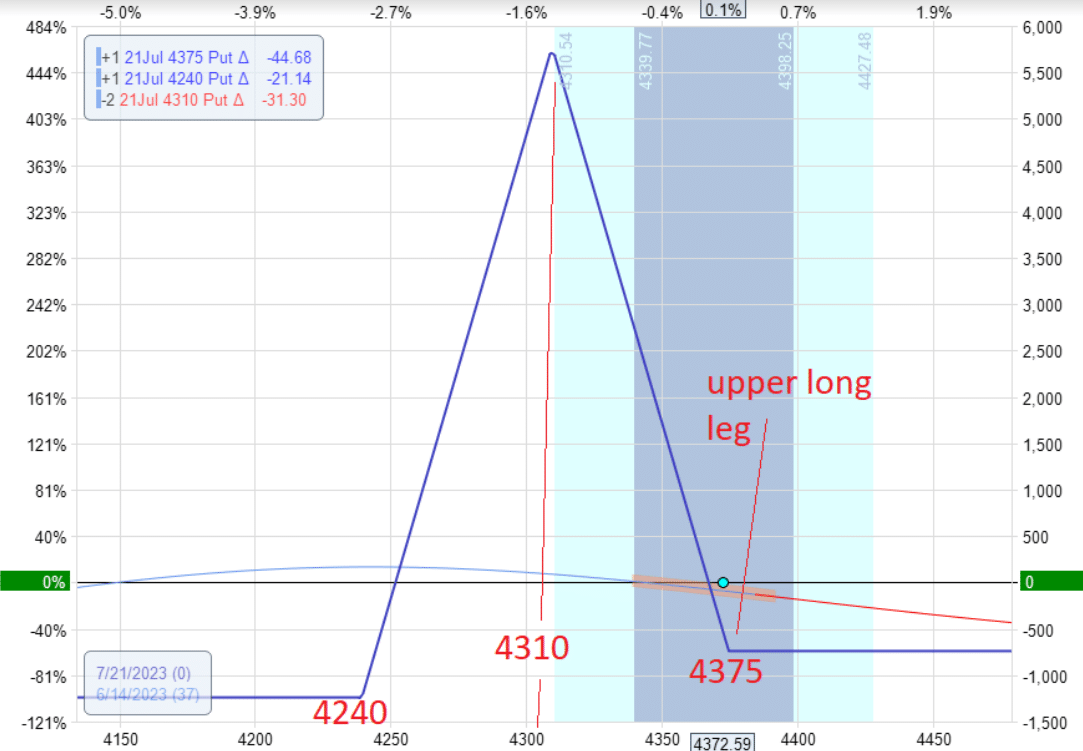

Here is an example of a broken wing butterfly composed of all put options:

Oh no, more lingo.

What is an “upper-long leg”?

A leg is another word to mean option.

“Long” means that it is an option that we bought. “Short” means it is an option that we sold.

In this butterfly, we sold two middle put options with strike 4310.

We bought the put option with strike 4240.

And we bought the put option with strike 4375.

Therefore, we are short the 4310 option.

We are long the 4240 option.

And we are long the 4375 option.

Which one is the upper-long option?

The one with the largest number.

The 4375 option is the upper-long leg of this butterfly.

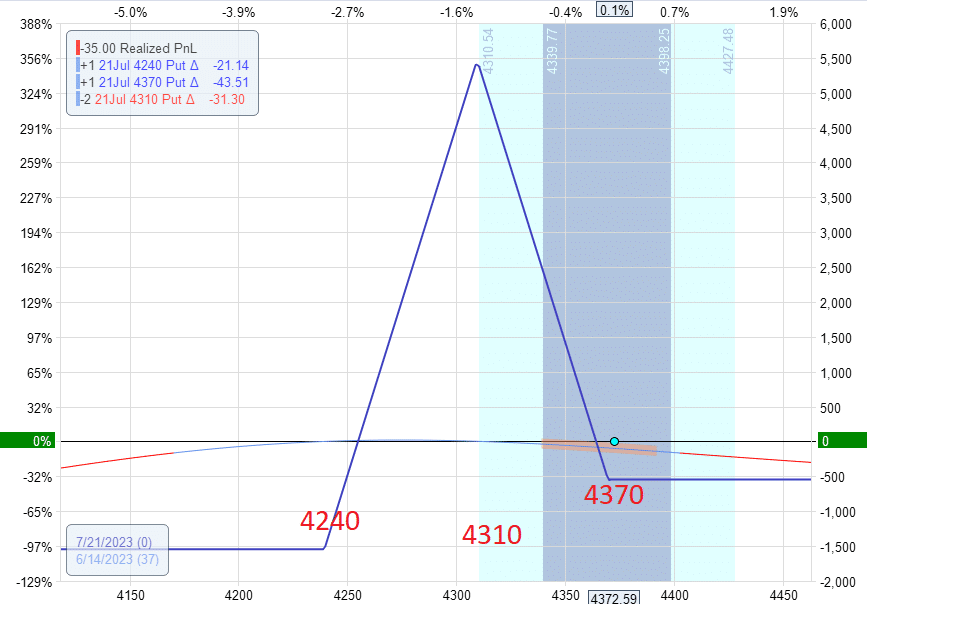

Now we want to “sell a put credit spread,” which is the same as “selling a put vertical” because the only way you can sell a put vertical is to sell a credit spread.

They are just different words to mean exactly the same thing.

Recall from above what “selling a put vertical” means.

It means selling a put option and buying another one at a lower strike”.

So therefore, we sell the 4375 put option and buy the 4370 put option, which results in this new butterfly:

Conclusion

When learning any new field of study, we need to first learn the new vocabulary and expressions.

The better we understand the fundamentals, the easier it will be to pick up the more advanced concepts.

We hope you enjoyed this article on put credit spread lingo.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.