Since the after hours low on election night, stock have been on an unprecedented tear.

$MS for example, is up around 20% in just a few days. Simply amazing.

Small caps have also raltrump lied hard, with the Russell 2000 around 160 points higher than the overnight low on Feb 8th which equates to a 14.2% move in 36 hours.

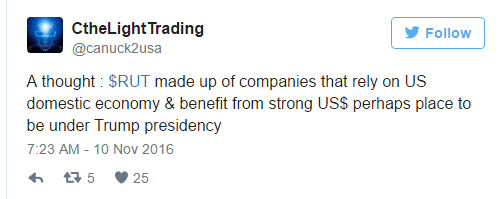

CtheLightTrading thinks the reason for the outperformance is due to the Russell being made up of companies that benefit from a strong domestic economy. Makes sense to me, so maybe there is more upside left in $RUT.

While some pundits were predicting stocks to tank should Trump win, there has definitely been a collective sigh of relief from traders now that the uncertainty has been taken out of the equation.

While some pundits were predicting stocks to tank should Trump win, there has definitely been a collective sigh of relief from traders now that the uncertainty has been taken out of the equation.

Is it likely that stocks will continue to move up in a straight line? Doubtful, but it is a bullish time of year seasonally and a lot of managers will now be left trying to play catch up.

The most likely scenario is a pause to consolidate the recent gains, followed by further (more subdued) rallies.

Let’s take a look at a few ways to play the current market using option strategies.

BULLISH TRADES

The following strategies will perform well if markets continue to move higher:

- Bull Put Spread

- Bull Call Spreads

NEUTRAL TRADES

The following trades will perform well if the market consolidates and trades sideways:

- Short Strangle and Straddle

- Iron Condor

- ATM Butterfly

BEARISH TRADES

The following trade will perform well if the market reverses the recent gains:

- Bearish Butterflies

- Bear Call Spread

- Bear Put Spread

We’re coming into a seasonally very strong time of the year and despite the huge gains last week, have not yet reached overbought levels.

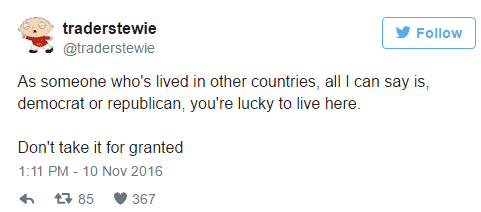

Patience is the key here and they best play might be to sit out for another 3-4 days until things settle down a bit. @traderstewie agrees:

For what it’s worth, I think the market heads slightly higher, then pauses. Therefore, bullish or neutral trades (entered in around 5 days’ time) would be the way to go.

Trade safe out there.