Check Point Software Technologies is not a stock I have followed in detail, but it was brought to my attention by fellow SeeItMarket contributor Venky Srinivasan.

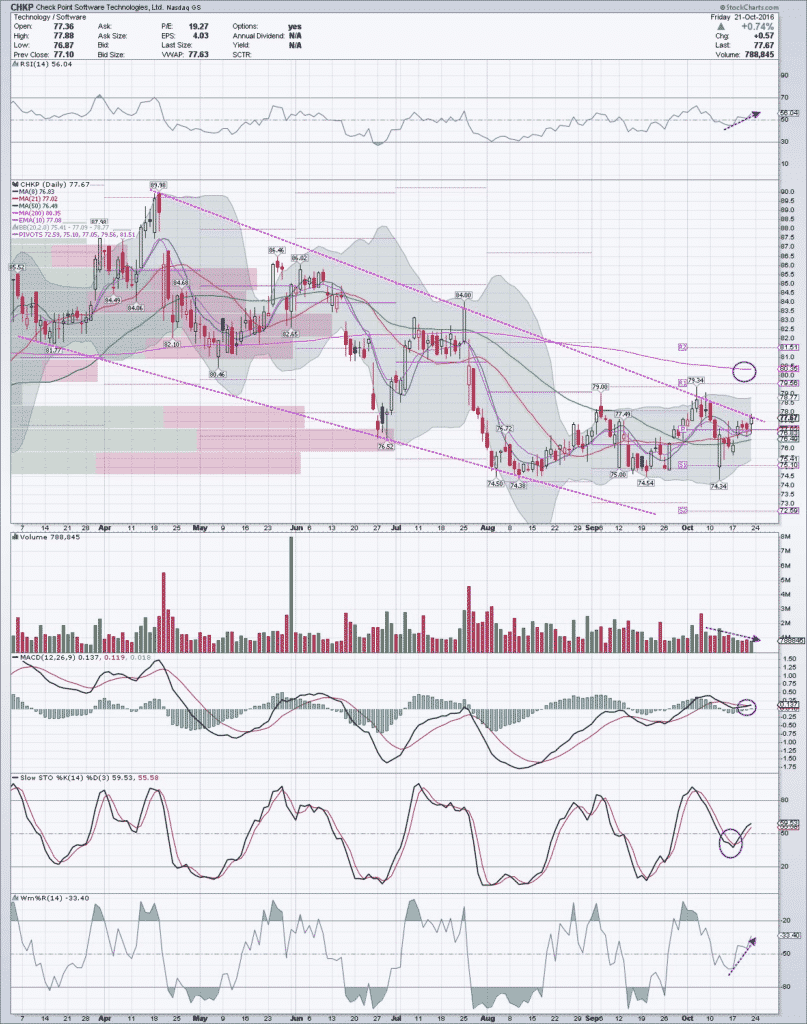

Below is a chart posted by Venky on Twitter over the weekend. There is a clearly defined downtrend channel that was broken today as $CHKP rose to $78.40.

The 200 day SMA is just above at around $80.

CHKP has an earnings announcement on October 31st so that could be the catalyst for a move in the stock. According to voiceregistrar.com, CHKP has “managed to surpass quarterly earnings per share estimates in 9 of the trailing three fiscal years, and has a positive trend with an average surprise of 75%”.

According to Hilary Kramer of InvestorPlace, cybersecurity is an attractive space to be in right now, especially with the DDoS attacks over the weekend.

“While there’s nothing good about bad cybersecurity, this news does bode well for Check Point Software Technologies Ltd. From an investment standpoint, these recent headlines confirm that cybersecurity is a good sector to bet on, while Check Point — one of the largest pure-play vendors in the world — remains one of the best plays in the space.”

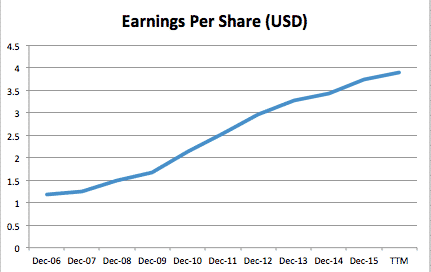

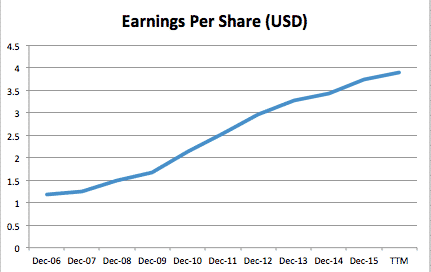

Check Point’s earnings have been steadily rising which is also a good sign.

POTENTIAL OPTION PLAYS

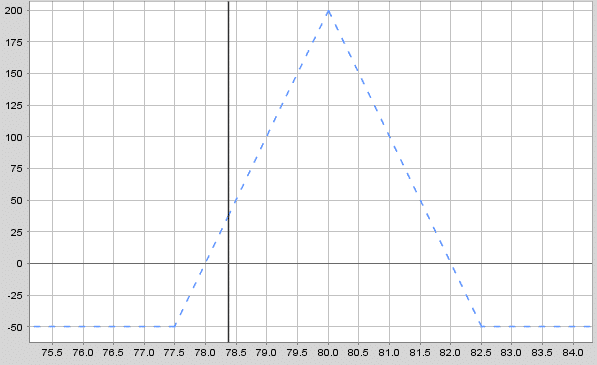

- BULLISH BUTTERFLY

Assuming traders are bullish on CHKP, a bullish butterfly centered around the $80 level could be a good option. If the stock rallies, it could be drawn to this level which is approximately 2% higher than the current price. The stock could consolidate around that level.

Trade Details: CHKP 2.5 Point Wide Bullish Butterfly

Trade Setup:

Buy 1 CHKP November 18th 77.50 call @ $2.70

Sell 2 CHKP November 18th 80.00 call @ $1.40

Buy 1 CHKP November 18th 82.50 call @ $0.60

Cost: $52.50 per contract

2. BULLISH CALL SPREAD

Trade Details: CHKP 5 Point Wide Bullish Call Spread

Trade Setup:

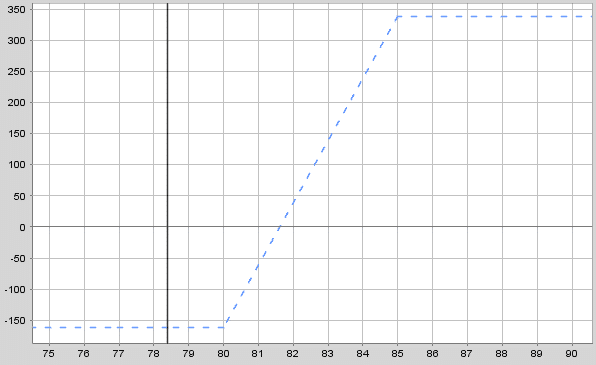

Buy 1 CHKP January 20th 80.00 call @ $2.45

Sell 1 CHKP January 20th 85.00 call @ $0.85

Cost: $160.00 per contract

This bullish spread will be profitable if CHKP ends above $81.60 by January 20th. The risk / reward is greater than 2:1 so not a bad set up for bullish traders.

3. PUT CREDIT SPREAD

Trade Details: CHKP 5 Point Wide Put Credit Spread

Trade Setup:

Sell 1 CHKP January 20th 77.50 put @ $2.75

Sell 1 CHKP January 20th 72.500 put @ $1.25

Cost: $150.00 per contract

Basically the opposite of the trade above, where the trade is risking $350 to make $150. The advantage of this set up is that the trade is profitable provided the stock stays above $76 so there is a much greater margin for error and higher probability of profit. Considering the stock has really strong support at $75, this could be a good set up for more conservative traders.

Let me know in the comments below what you think of CHKP and which of the 3 strategies above would be your choice, or suggest another potential trade.

Thanks for reading!

3-Part Long Strangle Video Series

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.