Contents

This is an interesting question that came to me via a reader.

It assumes that the reader is familiar with trading futures.

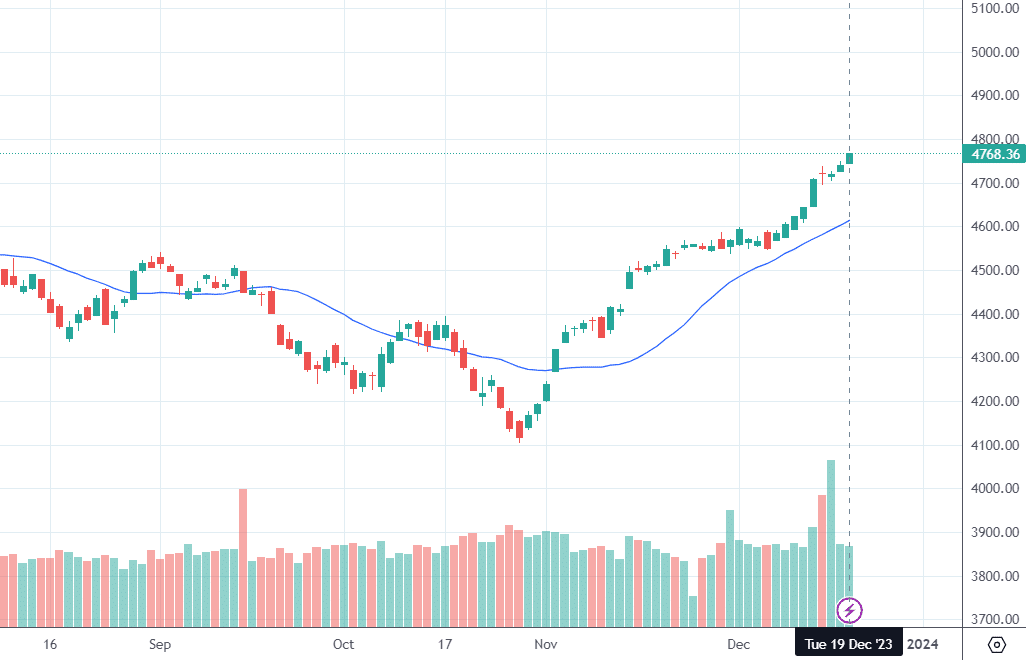

As an example, the S&P 500 index (SPX) on December 19, 2023, is looking quite bullish:

Suppose that a trader wants to sell a put option to collect the premium and take a bet on a continued upward trend.

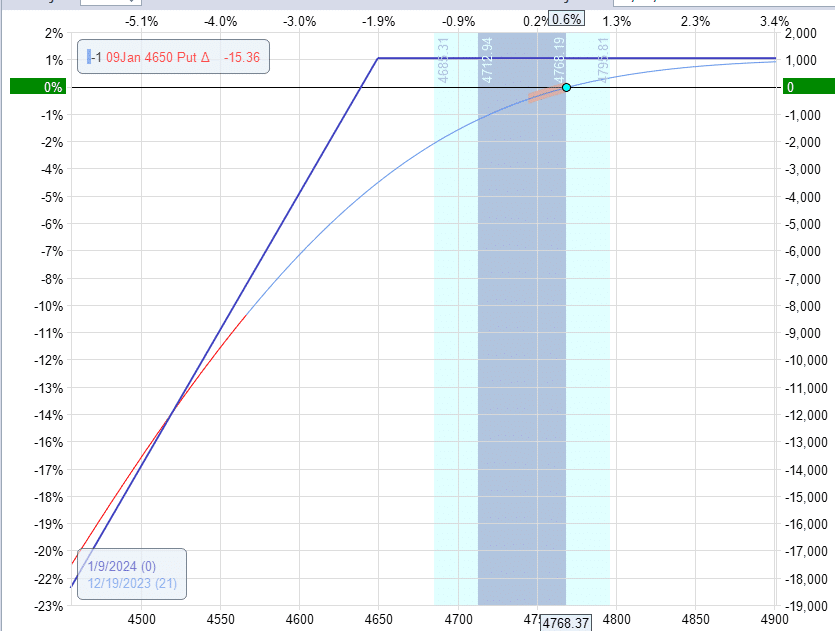

Selling one contract of the 4650 put option on SPX with expiration 21 days away would give a credit of $1040.

The strike price is around the 15 delta on the option chain.

The risk graph shows a large downside risk in the event of a market drop:

The trader is nervous because the market has already increased a lot and is over-extended in the short term.

The RSI on the daily chart is already above the 80 overbought level.

The VIX is at a multi-year low at 12.5.

While this indicates less fear in the market, it could also mean that the market is prone to a correction and for VIX to revert higher back to its mean and a corresponding drop in the SPX.

If the SPX drops 130 points, the trade loses about $5000. If the SPX drops 260 points, this trade would lose $14,000.

Based on the graph, it can be seen that the loss accelerates as the price moves down.

Dropping twice as far means losing almost three times as much.

If you think you can get out of the trade fast enough.

Maybe. But remember that SPX did drop 260 points in one day in the not-so-distant past on March 12, 2020.

The trader would like to protect against a possible market crash and adhere to the 2% rule, which states that no trader should lose more than 2% of the portfolio value.

If the trader’s portfolio is $100,000, he would not want this trade to lose more than $2000.

While there are many ways to hedge this trade, we will hedge with futures in this example. Why?

Because someone asked this question.

As with most hedges, it will not be a precise and 100% hedge.

Therefore, the trader would like the hedge to trigger at the $1000 loss level to have an extra buffer of protection.

Step 1: Determine the Delta to Hedge

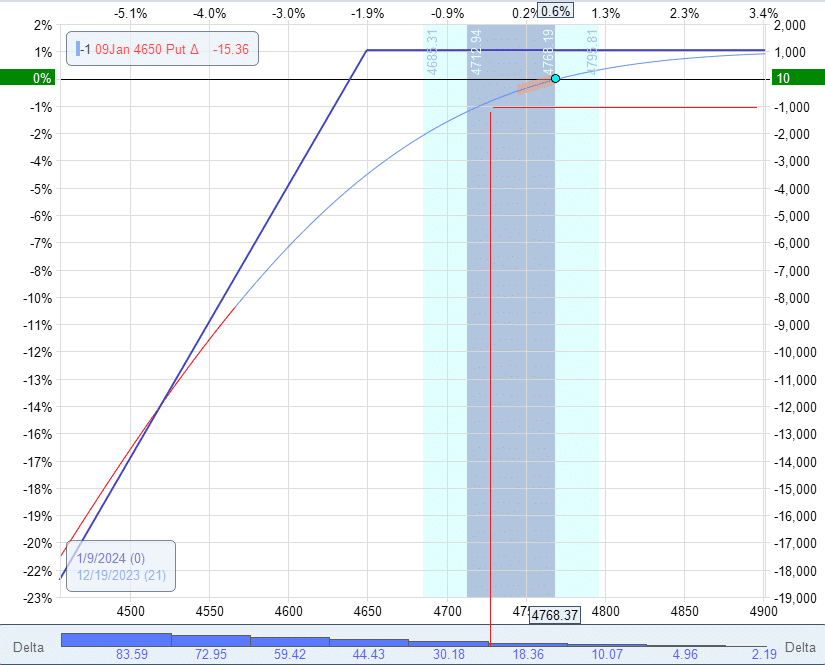

Step 1 is to determine the amount of delta that the trade would have at the $1000 loss level.

Delta is the Greek option that indicates how directional or bullish the trade is.

A delta of 100 is like owning 100 shares of the underlying.

Turning on the Delta histogram in OptionNet Explorer shows that the $1000 loss level would occur when the price of SPX drops to 4720.

And the delta would be approximately 25 at that point.

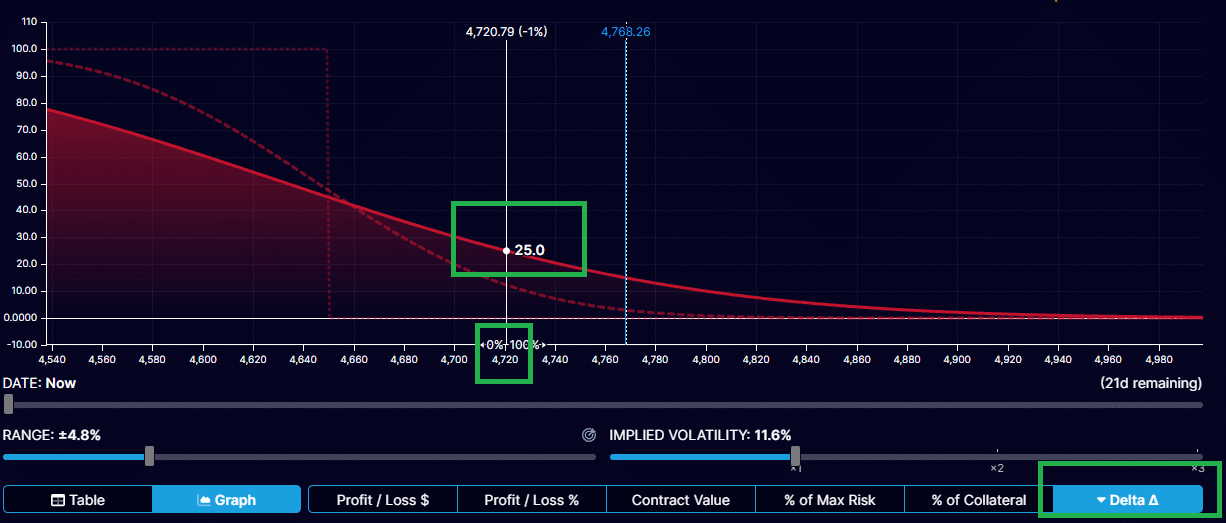

Modeling the same trade in OptionStrat and asking it to graph the current Delta curve, we get the same result of 25 deltas.

Being in a trade with 25 delta is like owning 25 underlying shares.

In this case, we can not own SPX because it is an index.

But if we could, it would be like having 25 shares of SPX at $4720 per share.

For every dollar point value drop, we would lose $25.

If SPX drops from $4720 to $4700, we would lose 20 x $25 = $500.

This is only an approximation because the delta changes are the price changes.

Step 2: Determine the Micro Futures Contracts Needed

If and when SPX drops to 4720, we want to neutralize the delta as best we can.

So that we don’t bleed money as SPX continues to drop.

We need to take an opposing position such that for every point that SPX drops, we gain $25. This hedges our directional risk.

E-mini S&P 500 futures (/ES) contract tracks the S&P 500 Index.

While the actual dollar value differs from the SPX, the ES moves nearly point for point with the SPX – more or less.

In other words, SPX could be at 4768.36, and the ES could be at 4820.25.

However, if SPX drops by 20 points, the ES would drop approximately 20 points.

If SPX gains 50 points, the ES would gain 50 points (not exactly, but approximately).

With this theory in place, we need to sell enough ES such that for every point that ES drops, we gain $25.

How many futures contracts is that?

The ES has a $50 multiplier.

That means if you own one ES contract and the ES moved up one point, you gain $50. If you sell one /ES contract and the ES moves down one point, you profit $50.

If you sold half of an ES contract and the ES moved down one point, you gain $25 – exactly what we need to perform our hedge.

Unfortunately, it is not possible to sell half an /ES contract.

This will not work.

The ES is too big.

Fortunately, the Micro E-mini S&P 500 futures contract (/MES) exists.

It moves the same as the /ES and has the same point value as the ES.

However, its dollar multiplier is $5 instead of $50.

You can say that it is one/tenth the size.

Therefore, if you sell 5 MES contracts, you will gain $5 x 5 = $25 for every point drop in the MES – exactly what we need for our hedge.

Step 3: Setting the Order

The trader can manually watch the SPX to see if and when it drops below $4720.

If it does, then manually sell 5 MES contracts.

That’s it.

That’s the hedge.

However, if the trader doesn’t want to stare at the screen, he can set a price alert on his trading platform to pop up a notification or send him a text message.

He can then rush to his computer (or phone) to sell the MES contract.

If the trader wants to automate the sale of the MES contract, he could enter a pending “Stop Market” order to sell 5 MES contracts at the specified stop price.

Now, we need to determine what that specified stop price is.

How do we know what price MES is at when SPX is at 4720?

We look at the correlation between the two prices.

Suppose we see that MES is at 4820 when SPX is at 4768.

That means that MES would approximately be at 4772 when SPX is at 4720.

So, the trader enters a pending “Stop Market” order to sell 5 MES contracts at the market price if MES drops below the stop price of 4772.

This advance order type would be triggered if and when MES is at or below 4772.

When that happens, the order will sell five contracts at market price.

It is important to use “Stop Market” and not “Stop Limit” order type.

If you do “Stop Limit,” it may not fill (especially if the market is dropping fast).

You want “Stop Market” because you are telling the system to sell those five contracts at whatever market price you can get – just sell them.

Conclusion

In this example, we hedged a short put option with futures.

The same concept can be applied to a bull put spread or iron condor or even applied at a portfolio level.

You just need to think about how much dollar amount you want to hedge.

If you are unfamiliar with futures, there are other ways to hedge a portfolio with ETFs or options (which we will get into in other articles).

We hope you enjoyed this article on how to hedge a short options position with futures.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Gavin,

Thank you for this useful article.

Hedging is a complex topic that many market participants do not have an adequate grasp of. Your brief but concrete explanation using a practical example is really helpful. It would be very good if you could expand on the topic in one or more articles, if they don’t already exist (I haven’t read your blog in full yet).

In particular, the correct calculation for hedging a portfolio consisting of various positions in terms of the underlyings and strategies used would certainly not only help me, but also many other readers of your website.