Also recognized as the ‘Dow Jones Industrial Average’, the Dow 30 stocks list measures 30 of the largest public companies in terms of economic performance.

The Dow Jones Industrial Average is also considered to be one of the three major U.S. stock indexes along with the S&P 500 and NASDAQ Composite Index.

The Dow Jones Industrial Average has been around for more than 125 years.

Contents

- List of DOW 30 (Dow Jones Industrial Average) Companies

- Important Facts About the DOW 30 Stock Market Index

- FAQs about the DOW Jones Industrial Average (DOW 30)

- Final Thoughts

After being established in 1896, it has been a solid measurement of the economy’s performance for a lengthy period of time.

It has also served as an excellent long-term investment opportunity for millions of investors over the years.

It’s important to understand each of the companies that are currently listed and representing the DOW 30.

Many of these companies have been around for many years and have proven track records of success in the U.S. economy.

For example, companies like Coca Cola and Microsoft are perfect examples of these types of companies that have earned the right to be listed in the Dow Jones Industrial Average.

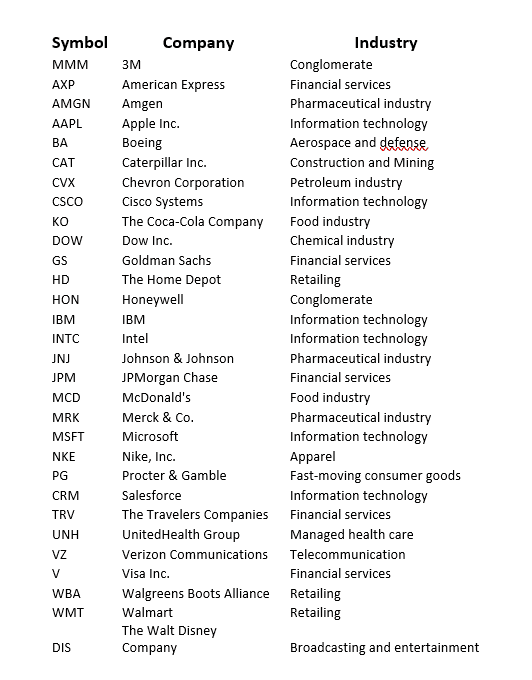

List of DOW 30 (Dow Jones Industrial Average) Companies

The DOW 30 occasionally adds or removes a company from the index.

Here is an updated list of companies currently in the index as of September 2021.

Each of these companies has a specific weight to determine how much that individual company affects the overall performance on the index.

These weights are generally adjusted based on performance on a quarterly basis.

Sorted by Alphabetical Order (Source)

Important Facts About the DOW 30 Stock Market Index

A lot of investors consider the Dow Jones Industrial Index to be one of the most important metrics to evaluate when trying to measure the overall performance of the U.S. economy.

It has been around for more than 120 years and continues to represent several important sectors and industries of the economy.

It is one of the oldest stock indexes to date and sits alongside two of the other major stock indexes that are measured by U.S. economists on a daily basis.

Million of investors gain exposure to the DOW 30 by investing in ETFs and Index Funds.

FAQs about the DOW Jones Industrial Average (DOW 30)

Investors have a lot of questions about the Dow 30.

Here are some answers to some of the most common questions relating to the Dow Jones Industrial Average in 2021.

Is the Dow 30 considered to be a risky investment?

The Dow has been around for more than a century and has reliably been one of the best long-term investments.

Over the last ten years, the Dow Jones Industrial Average has returned investors an average of 15%.

No stock index is completely immune from the possibility of experiencing tough times.

With that being said, the Dow 30 has consistently recovered and outpaced many of the other major stock indexes within the United States.

How often does the portfolio composition change in the DOW 30?

The Dow 30 periodically swaps companies in and out to rebalance the portfolio of the fund.

Just recently in August of 2021, three companies were replaced by Salesforce, Honeywell, and Amgen.

The three companies that were removed from the fund were Pfizer, Raytheon, and Exxon-Mobil.

What’s the average annual return for the DOW 30 over the last ten years?

The average annual return for the DOW 30 is 15% over the last decade.

This metric is slightly better than the S&P 500 over the same time period.

Final Thoughts

It’s hard to completely avoid a stock market index that has been around for as long as the Dow Jones Industrial Average.

With more than 120 years of existence, millions of investors continue to look at the Dow 30 as one of the best metrics for evaluating the American economy.

With consistent growth over the last ten years, the Dow 30 continues to be an excellent investment for the future.

This stock index provides investors with an excellent opportunity to invest their funds in a diverse collection of 30 of America’s best companies across the industrial sector of the economy.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.