Contents

- Blue Chip Companies

- High Dividends

- Check The Trend

- Low Beta

- ETFs

- Real Estate

- What About BioTech Stocks?

- FAQ

- Conclusion

Last time, we explained how the wheel strategy works with some examples. Today, we will give you the best stocks for wheel strategy trades.

Blue chips companies, high dividend stocks, REITs, and low beta ETFs work well when employing the wheel strategy.

Blue Chip Companies

These are large, often multi-national companies that have been in business for years and have large market capitalization.

Think companies like Cola Cola.

Cola Cola (KO) Annual dividend per share (yield): 1.67 (3.11%) 5-yr beta: 0.68

They are stable and reliable, which is great for the wheel strategy.

High Dividends

We like to pick stocks with high dividends (around 3% to 4% annual yield) because if we end up being assigned on our short put, we may need to hold the stock for a while, waiting for it to recover.

It is nice to be able to collect a dividend during that time.

Verizon (VZ) Annual dividend per share (yield): 2.52 (4.91%) 5-yr beta: 0.48

Lockheed Martin (LMT) Annual dividend per share (yield): 10.4 (3.12%) 5-yr beta: 0.82

Because the price of Verizon is around $50 per share and the price of Lockheed is $300 per share, it is better to look at the percentage dividend yield, which is the annual dividend per share divided by the share price of the stock.

That way, we can better compare using apples to apples.

These numbers can be obtained on most trading platforms.

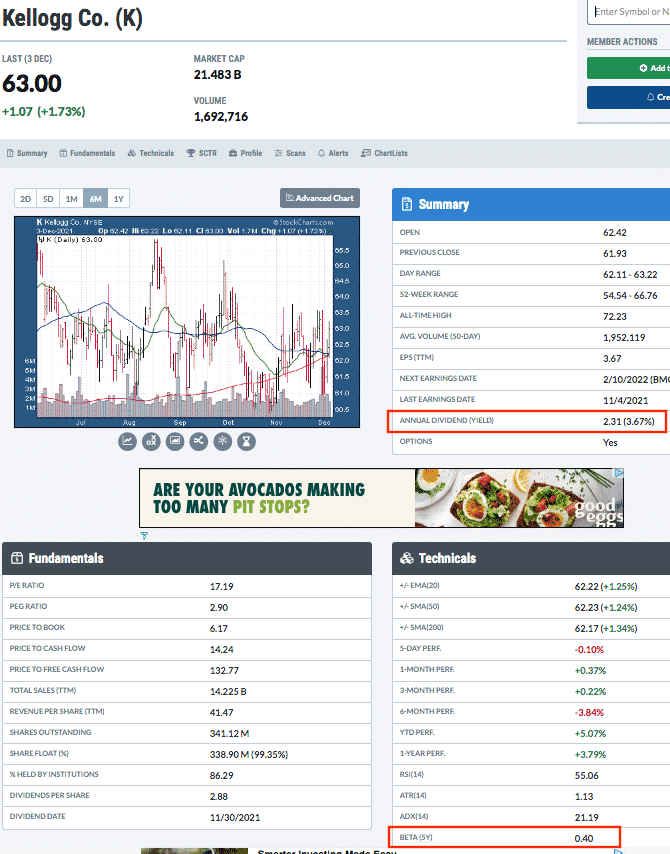

Here is Kellogg Company data from StockCharts.com

Kellogg Company (K) Annual dividend per share (yield): 2.31 (3.67%) 5-yr beta: 0.4

Check The Trend

If a stock has a high dividend yield (greater than 5%), you need to check the chart and the fundamentals.

Because the yield is a percentage of the stock price, a high dividend yield can mean that price has dropped.

Generally, we want stocks that are in an uptrend.

Brookfield Infrastructure Partners (BIP) Annual dividend per share (yield): 2.04 (3.62%) 5-yr beta: 0.97

source: stockcharts.com

We are also fine if stock is in a neutral trend.

Kimberly-Clark (KMB) Annual dividend per share (yield): 4.49 (3.32%) 5-yr beta: 0.49

It also works if you want to apply the wheel strategy to a stock that is part of the Dow Index. Here is an example.

3M Company (MMM) Annual dividend per share (yield): 5.92 (3.43%) 5-yr beta: 0.86

These stocks are not going to go bankrupt anytime soon.

They will get de-listed first.

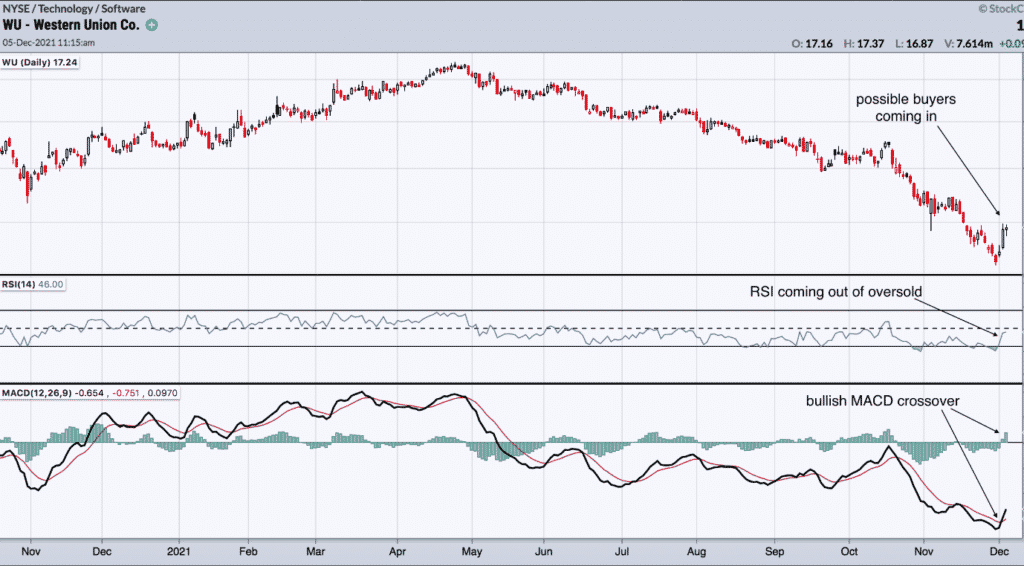

If stock is in a downtrend and you think it is recovering, it may be worth considering if we are collecting a 5.39% annual dividend along the way, as is the case for Western Union.

Western Union (WU) Annual dividend per share (yield): 0.93 (5.39%) 5-yr beta: 0.8

source: stockcharts.com

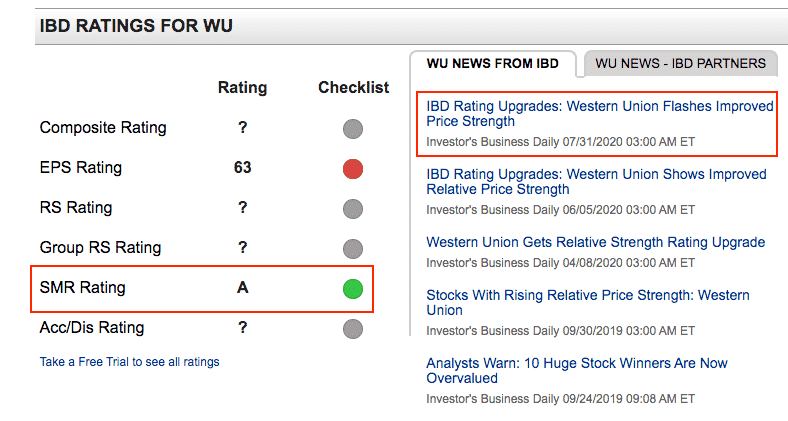

Of course, you will want to check your own fundamental metrics (be it sales/revenue growth or earnings per share or PE ratio, etc.) on all these companies to see if it is a company that you want to own.

As a quick check, you can look at the SMR rating in Investor Business Daily.

source: investors.com

If you are a member of investors.com, you can look at the Composite Rating.

All of the best stocks for the wheel strategy listed in this article have an SMR rating of “A” or “B” (or “not available”) at the time of this writing in the 4th quarter of 2021.

Low Beta

We also want stocks and ETFs with low beta (less than 1.0).

A beta of greater than 1 means that a stock is more volatile than the general market.

A beta of less than 1 means that a stock tends to move less (up or down) than the general market.

The reason low beta is important is that we don’t want a stock to make a huge move down to get assigned on our short put.

And then, when we try to sell a covered call on it, it shoots straight up past our call strike.

Newmont mining company has a beta of only 0.32.

Newmont Company (NEM) Annual dividend per share (yield): 3.05 (3.75%) 5-yr beta: 0.32

ETFs

Because ETFs consist of many stocks, they have less individual stock risk. Consider the EFTs with low beta.

Utilities Sector Fund (XLU) Annual dividend per share (yield): 1.98 (2.93%) 5-yr beta: 0.70

Health Care Sector Fund (XLV) Annual dividend per share (yield): 1.81 (1.39%) 5-yr beta: 0.81

Consumer Staples Sector Fund (XLP) Annual dividend per share (yield): 1.74 (2.43%) 5-yr beta: 0.65

Real Estate

Real estate is a category that has good stability and low volatility in the long term.

As the population increases, real estate will always be in demand.

Real estate can be cyclical, which can work well with the wheel strategy.

They can be in a hot market for some time until it cools off, and then it becomes hot again.

Two well-known REITs (Real Estate Investment Trusts) are IYR and VNQ:

iShares US Real Estate ETF (IYR) Annual dividend per share (yield): 1.86 (1.72%) 5-yr beta: 0.9

Vanguard Real Estate ETF (VNQ) Annual dividend per share (yield): 2.69 (2.49%) 5-yr beta: 0.92

Besides these two, there are many other REITs.

Some of which may not be liquid enough to trade options on.

So you should check the bid/ask spread and use limit orders to try to get the best fills.

A few that may be liquid enough to consider are.

Realty Income Corp (O) Annual dividend per share (yield): 2.69 (3.87%) 5-yr beta: 1.0

Iron Mountain (IRM) Annual dividend per share (yield): 2.47 (5.25%) 5-yr beta: 0.82

National Retail Properties (NNN) Annual dividend per share (yield): 2.10 (4.78%) 5-yr beta: 0.99

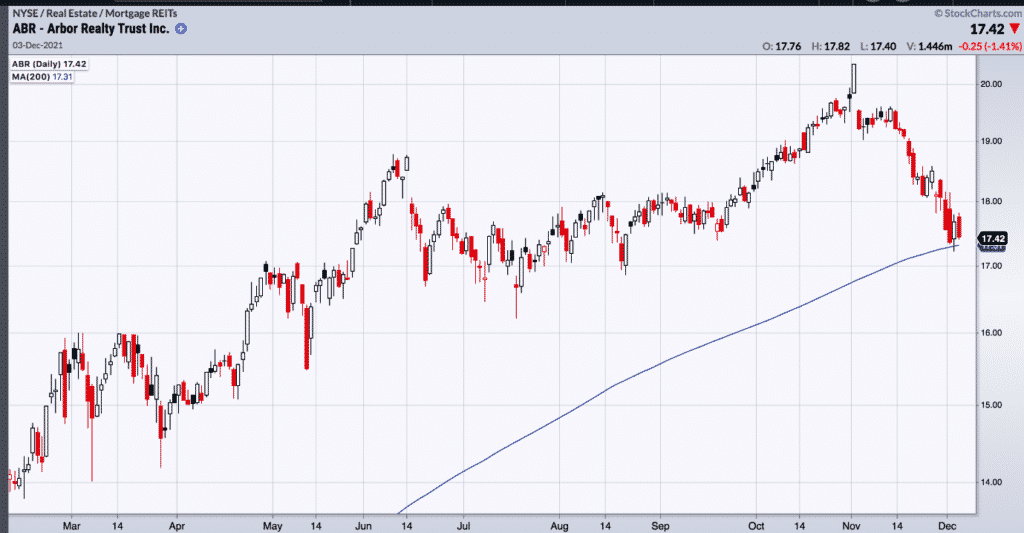

Arbor Realty Trust has a surprisingly high dividend of nearly 8%.

Arbor Realty Trust (ABR) Annual dividend per share (yield): 1.38 (7.92%) 5-yr beta: 1.05

Yet the chart still looks decent.

And the SMR rating of “A” indicates that this might be something to consider.

What About BioTech Stocks?

For wheel trades, we want stocks that can recover whenever their price falls, and we get assigned on them.

For example, the biotech company AbbVie fell sharply in September.

However, it made a quick recovery and is in an overall bullish trend, as noted by its price being above an upward-sloping 200-day moving average.

AbbVie (ABBV) Annual dividend per share (yield): 4.96 (4.17%) 5-yr beta: 0.8 SMR: A

In general, biotech/pharmaceutical stocks can be volatile and make big moves when they announce drug trial results.

For this reason, many investors do not like to trade them in the wheel strategy.

But other investors may be willing to take the risk as long as they are the larger well-known companies with beta still less than 1.0 and the SMR rating of an “A.”

Some to consider are.

Gilead (GILD) Annual dividend per share (yield): 2.81 (4.04%) 5-yr beta: 0.6 SMR: A

Amgen (AMGN) Annual dividend per share (yield): 6.88 (3.40%) 5-yr beta: 0.79 SMR: A

Bristol-Myers Squibb (BMY) Annual dividend per share (yield): 1.96 (3.48%) 5-yr beta: 0.64 SMR: A

FAQ

What is the Wheel Strategy?

The Wheel Strategy is an options trading strategy that involves selling cash-secured puts and covered calls on a stock to generate income and potentially acquire shares of the stock at a lower cost basis.

What are the best stocks for the Wheel Strategy?

The best stocks for the Wheel Strategy are typically stable, blue-chip companies with consistent dividends and strong fundamentals.

Some examples include Apple, Microsoft, and Johnson & Johnson

How do I select stocks for the Wheel Strategy?

When selecting stocks for the Wheel Strategy, it’s important to consider factors such as the stock’s volatility, dividend yield, and overall financial health. It’s also a good idea to diversify your portfolio by investing in stocks from different sectors.

What are the risks of the Wheel Strategy?

The risks of the Wheel Strategy include potential losses if the stock price falls significantly, as well as the possibility of missing out on gains if the stock price rises above the strike price of your covered call.

It’s important to manage risk by selecting appropriate strike prices and maintaining a diversified portfolio.

Can the Wheel Strategy be used for other types of securities besides stocks?

Yes, the Wheel Strategy can be used for other types of securities such as ETFs and indices.

However, it’s important to be familiar with the characteristics and risks of the security you’re trading before implementing the strategy.

Conclusion

You may be wondering why AAPL, MSFT, and TSLA are not on this list.

Today, our focus was to look for other stocks and ETFs that have high dividends and low beta.

While both AAPL and MSFT have dividends, they are not in the 3% levels like the ones that we have found for you.

TSLA is fine if you can accept the volatility of a beta of 1.4.

In truth, if these are companies that you like to own, then certainly using the wheel strategy on them would be fine.

Each investor will have their own favorite stock to use.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Gavin-

I have benefited from your trading guides. Personally I prefer trading strangles, yet I am refining my strategy to trade the short put closer to the strike price on stocks suitable for this stratagy. What metrics do you suggest in choosing the short put, delta, premium to BPR ratio?

In choosing the underlying you suggest low beta, but that also means low IVR and lower premium. What IVR and premium to BPR ratio would you suggest?

Kind regards (and happy trading)

Brian

Hi Brian, glad our guides have helped you. Each to their own really. Low beta stocks are going to move a lot slower, so it depends on your risk tolerance. High beta stocks are ok if you are prepared for the big fluctuations in P&L.

I don’t have any strict rules around premium to BPR ratio.

Thanks for these Gavin. I have been using the Wheel strategy for almost a year and like it quite a bit. I have been using F, AXP and MMM quite a bit. One factor I don’t see you address is account size. If you are going to use LMT or MSFT or particularly TSLA you need a decent chunk of capital if you end up being assigned even 200 shares.

Yes, that’s very true. Good comment. I should have mentioned that.

Insightful article, with excellent background logic. I would add that you do want to diversify across several sectors to avoid a sector winter.

Biggest win is to avoid a big losses with a significant position. You can trade through any small to midsize losses.

Security selection is an excellent skill for this and it trumps fat premiums.

100% agree.