One of the most seemingly complex but remarkably simple products that has changed the face of the global economy are futures contracts. This article will give an illustrative example explaining the basics of futures trading.

Then we will discuss why futures contracts are so important to our global economy.

This article is designed as an introduction.

Subsequent articles will delve into the intricacies and strategies around futures and futures options.

Let’s get started.

Contents

- What is a Futures Contract?

- Margin Requirements

- Advantages of Futures Trading

- A Fixed Contract with Flexible Benefits

- Why Should I Care?

- How can I use Futures in my Portfolio?

- Concluding Remarks

What is a Futures Contract?

A futures contract is an agreement to buy or sell a certain asset at a time in the future for a predetermined price.

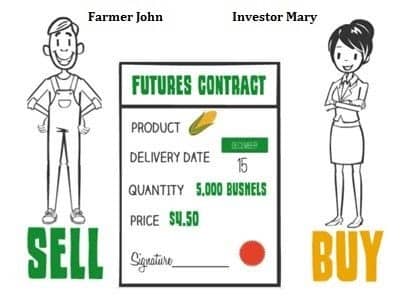

Let’s look at the example below.

Source: https://grainphd.com/education/how-do-i-use-the-futures-market/

Here we have two individuals.

Farmer John and Investor Mary.

Farmer John is a corn farmer.

He plants his corn crops early in hopes of having a great harvest and being able to sell his corn at a high price.

John has all his money tied up in his farm. Everything from tractors, trailers to fertilizer and utilities are invested in producing corn.

Investor Mary is an advisor for a high net worth client.

She is worried about macroeconomic inflation and is specifically bullish on the price of corn.

So John and Mary enter into an agreement.

Mary will buy 5,000 bushels of corn from John on December 18th. She will pay $4.50 for every bushel.

Leaving her cost at $4.50 times 5,000 = $22,500 on December 15th.

Margin Requirements

What is key here is that Mary is not required to buy the bushels of corn now, nor is John required to provide them.

In reality each party is only required to provide a few thousand dollars initially.

This money is posted as margin and required by the clearinghouse.

The clearinghouse is the intermediary making sure that both the seller, Farmer John and the buyer, Investor Mary, can meet their obligations for the contract.

Advantages of Futures Trading

Both Farmer John and Investor Mary benefit from this arrangement.

For Farmer John this futures contract is a godsend. If the price of corn got cut in half he would not only lose money but could lose his farm and his business.

Before the existence of futures contracts this would happen to farmers frequently.

If the price of the commodity that they produced crashed they would lose all they had.

Most likely fighting through starvation with their families to survive until the price of the commodity recovered.

Now by selling the corn futures contract John has hedged his exposure to corn prices.

If the price of corn halves he would lose a significant amount on the corn he sells after harvest.

Yet he already agreed to sell the corn at $4.50 so he had hedged himself against this adverse move.

For Investor Mary, she wants to speculate that the price of corn will increase.

Yet she cannot buy five thousand bushels of corn now.

First off she doesn’t have access to corn silos.

She lives in Manhattan. Additionally even if she could find storage for the corn, she cannot simply store it for months on end as the product will waste.

Buying the corn future gives her the exposure to the price increase she wants, without the hassle she can live without.

A Fixed Contract with Flexible Benefits

At first glance we would think that this agreement is quite restricting. We have a set date, set price and set amount.

Perhaps we imagine Investor Mary trudging through an Iowa cornfield.

A suitcase full of cash with her black stilettos in hand. “Oh Farmer John..?” This couldn’t be further from the truth.

In reality Investor Mary will never leave her centrally heated Manhattan apartment and John will never actually sell his corn to Mary.

Oh the conspiracy! The reason this will not happen is that their contract is traded electronically on the secondary market in real time.

As the price of corn fluctuates, the price of that futures contract also moves.

Before the contract expires the parties will simply close the contract for a gain or loss or roll the contract to a future date if they want to maintain their exposures.

It may be easy to think of Investor Mary as the one taking advantage of Farmer John.

After all she is the speculator. John also needs this contract more than Mary.

This is untrue.

When Farmer John sells his futures contract, he sells it to the best bid.

This is whoever provides the highest price to buy it.

Electronic Contracts

As this contract is traded electronically, we have thousands of investors from all around the world all competing for the same contract.

Then furthermore there are also hedgers who benefit from a lower price of corn. Imagine a company such as Kellogs.

If the price of corn skyrockets, their cereals cost more to make and they will lose money.

By buying corn futures they hedge themselves against this price increase.

All of these people are buying and selling the same contract. Additionally, we have speculators thinking the price will go down.

All these individuals from around the world buying and selling this contract makes the market a lot more efficient.

Now the world is a better place!

Why Should I Care?

“I am not a farmer, I have no idea how much corn should cost. Why do futures matter to me?”

The reality is that this is an illustrative example of one small kernel of the massive futures market.

There are futures on all commodities from Corn, Oil, Orange Juice, Lumber and even Cacao.

Then we have equity index futures, interest rate futures. We even have weather futures!

These markets make everything else pale in comparison.

For example all the world’s stock markets combined have a market capitalization of about 90 Trillion.

The derivatives market (which includes futures) is estimated at 1 Quadrillion!

How can I use Futures in my Portfolio?

In subsequent articles we will explore the many different ways to use futures and derivatives in a portfolio.

Though a simple example would be selling index futures as a way of removing macroeconomic risk from your portfolio.

If you have an opinion that your stocks will outperform the market but not that the market will do well, simply buying the stocks does not make sense.

By selling the futures you express your view correctly in that your portfolio will outperform the market.

Concluding Remarks

Futures contracts are contracts to buy or sell a certain asset in the future.

While fixed they offer an incredible amount of flexibility for both hedgers and speculators alike.

The futures market is a vast and essential part to our global economy.

Thus being aware of futures contracts and understanding how to trade them is paramount to being a successful investor.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.