Contents

In this article, we will go over some advanced techniques with collars.

But first, let’s review.

A standard collar using options is when investors own 100 shares of a stock.

They then buy a put option to provide downside protection.

Then, they sell a covered call to receive a credit to help partially pay for the put option.

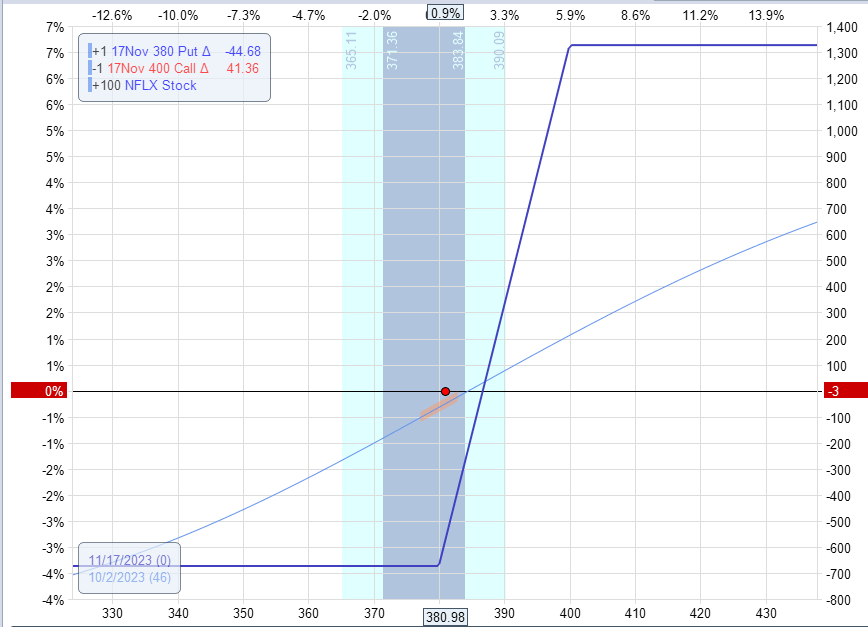

Here is an example:

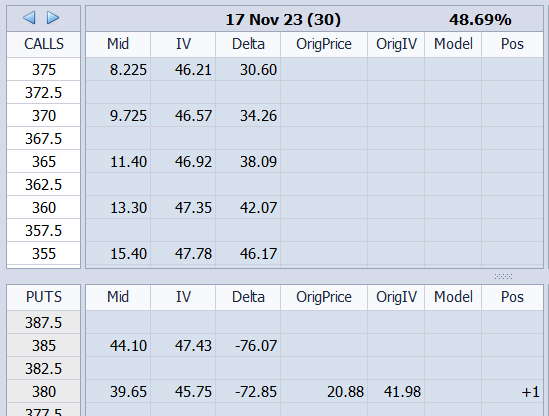

Date: October 2, 2023

Price: NFLX @ $381

Buy 100 shares of NFLX @ $381

Buy one November 17 NFLX $380 put @ $20.88

Sell one November 17 NFLX $400 call @ $15.20

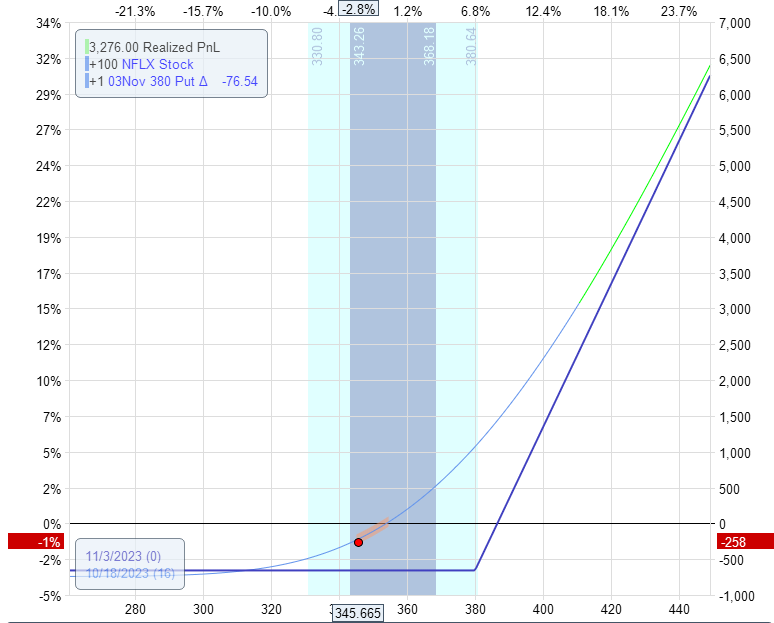

In this case, the put option was purchased at the money, and the call option was sold slightly out-of-money to give us a payoff graph that would look like this 46 days later at expiration.

If we hold to expiration, not looking at what the price of NFLX is doing, then the maximum potential loss in the trade would be $673, and the maximum potential gain would be $1326.

This would not be a bad trade with a reward-to-risk of roughly 2 to 1.

And we can just let it be as long as the investor is still bullish on NFLX.

In fact, NFLX closed at $465.91 on expiration day, November 17.

So we would profit about $1300 on the trade.

Dynamic Collars

However, some investors are not satisfied just sitting and waiting until expiration.

We call them “active investors” or traders.

They are always eager to trade and squeeze more profit out.

So they might buy the same put protection but sell a shorter-term call.

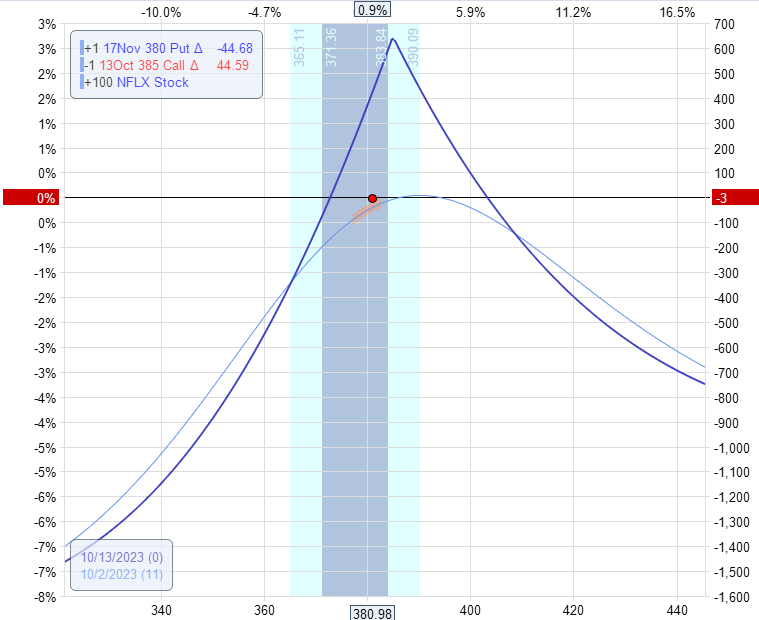

Date: October 2, 2023

Price: NFLX @ $381

Buy 100 shares of NetFlix (NFLX) @ $381

Buy one November 17 NFLX $380 put @ $20.88

Sell one October 18 NFLX $385 call @ $6.80

Net Debit: -39,508

If we sell short-term call options and repeat the selling when each one expires, we can potentially receive more premium from the combined sales.

The payoff diagram at the short call expiration will look more like a diagonal, so they are sometimes called “diagonal collars.”

In addition, these traders monitor the prices of the call and put options.

If we see that the call option has dropped 80% of its value, we will say it is good enough to take profit, close the call, and sell another one.

So we set a good-till-cancel order to close out the call by buying it back at $136 (which is 20% of $680).

This happened on October 11, when the price of NFLX fell to $368, and our call option was closed by paying $136.

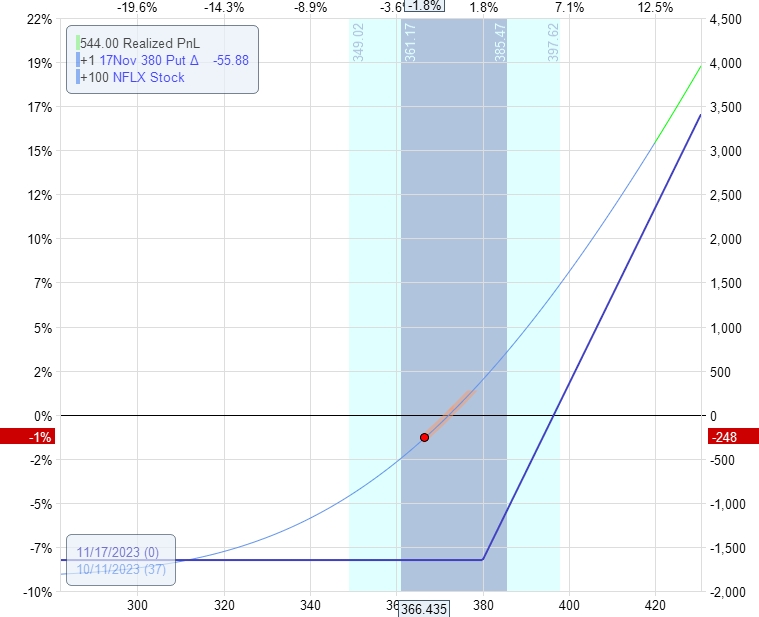

Without the call option, our graph looks like this:

We are at a loss because the NFLX price is dropping, and collars are bullish strategies.

In any case, we sell another call to collect more premium.

Date: October 11, 2023

Price: NFLX @ $366.44

Sell one October 20 NFLX $375 call @ $12.40

Now, have a near delta-neutral diagonal again:

Netflix reports earnings on October 18 after the market close.

One hour before the market closes on October 18, we see a high implied volatility (IV) on our put option (as would be expected).

When we purchased our put option, the IV of the option was at 41.98.

Currently, the IV has increased to 45.75.

We also see that we purchased our put option for $2088.

But now it is selling at $3965.

Our put option has gone up in value.

This is due to the increase in IV and the price drop of NFLX.

Our put option has 30 days till expiration.

We want to capture some of the gains we made in our put option, but we still want its protection.

After all, earnings are being announced in an hour.

We sell “half” of our put option. In other words, instead of a 30 DTE (days-till-expiration), put option with a strike at $380.

We will exchange it for a 16 DTE put option with a strike at $380.

Date: October 18, 2023

Price: NFLX @ $345.6

Sell to close one November 17 NFLX $380 put @ $39.65

Buy to open one November 3 NFLX $380 put @ $38.28

Net credit: $137.50

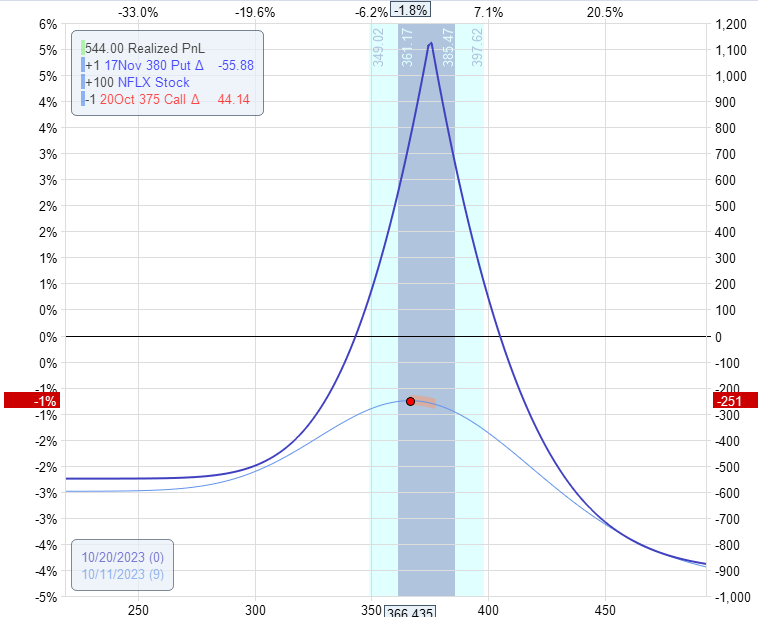

Next, we look at the price of our call option.

We sold it for $1240, and now we can buy it back at $385.

While this is not quite 20% of its original value, do we want a short call capping the potential reward of NFLX possibly gapping up on earnings?

We decided it was good enough to take profit on the short call and remove the upside cap.

So we bought it back and closed the short call.

Date: October 18, 2023

Price: NFLX @ $345.6

Buy to close one October 20 NFLX $375 call @ $3.85

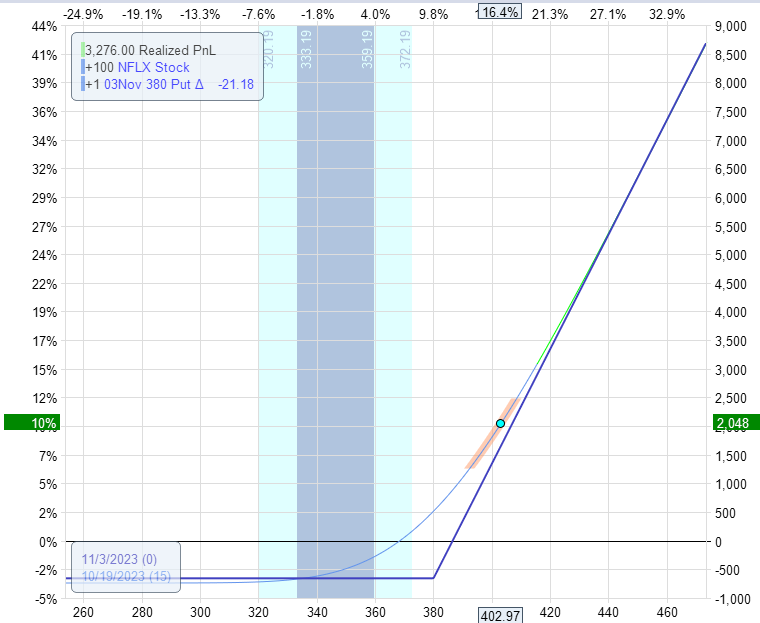

The resulting payoff graph looks like this just before the NFLX earnings announcement.

The next morning, NFLX prices jumped way up on earnings.

In a sense, we got lucky – profiting more than $2000.

We strategically gave ourselves the potential to capitalize on this luck by removing the upside cap while maintaining our downside risk control.

We don’t want to give back too much of our profit.

So, we removed the existing put option (which has now gone somewhat out-of-the-money).

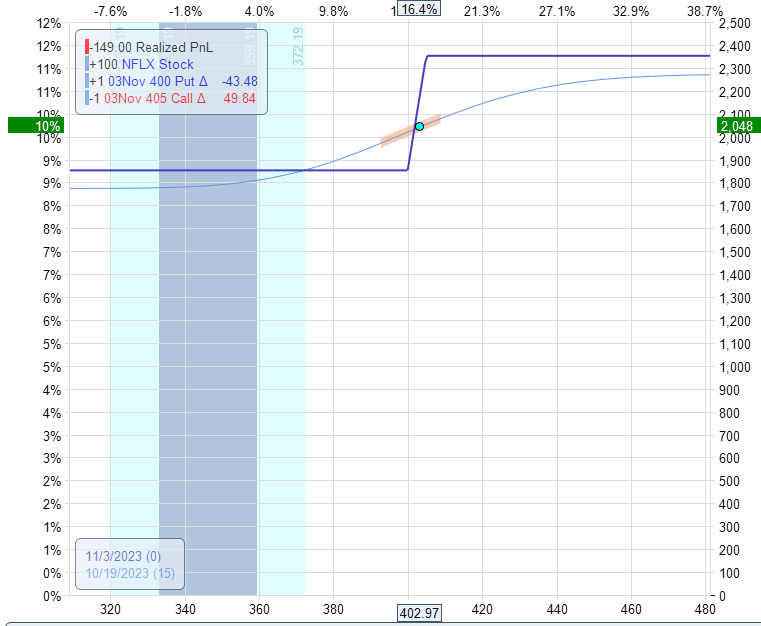

And re-collar our 100 shares of stock.

Date: October 19, 2023

NFLX @ $ 403

Sell to close one November 3 NFLX $380 put @ $4.03

Buy to open one November 3 NFLX $400 put @ $10.20

Sell to open one November 3 NFLX $405 call @ $11.27

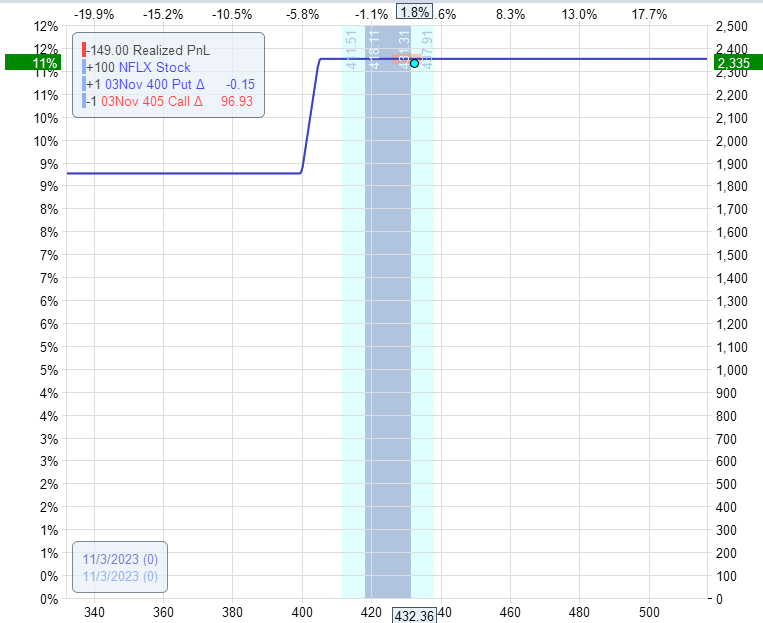

Our new risk graph shows our worst-case scenario would be that we make $1850 on the entire trade:

Our best case scenario would be that we make around $2350, which happened on November 3, when NFLX closed at $432.36.

Because our short call strike was $405, our 100 shares of stock were called away at $405 per share.

And our long put expires worthless.

Let’s Do The Math

OptionNet Explorer modeling software shows that we made $ 2,335 on the trade.

However, the numbers are not exact in this simulated trade due to the bid/ask spread fluctuations and rounding.

If we compute it manually, we get something close:

We could say that the dynamic collar would have made around $2300 in this trade.

A buy-and-hold investor of NFLX would have profited $2400 as NFLX went from $381 to $405.

But they would not have had the downside protection if NFLX dropped big on earnings.

Conclusion

In this example, we saw that the dynamic collar outperformed the traditional collar.

This may or may not be the case in every example.

It depends on how the trader would have adjusted the collar and whether they “got lucky” or not.

Active traders sometimes do this because they feel they can profit more by actively managing the trade, reading price action, and taking advantage of changes in IV.

But as you may realize, it will surely be a lot of work and moving parts to keep track of.

We hope you enjoyed this article on advanced dynamic collars.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.