Not all volatility is created equal. If I mention the words Contango, Backwardation and VIX Curve Structure, your eyes might glaze over.

When we get a volatility spike, not all options are affected equally.

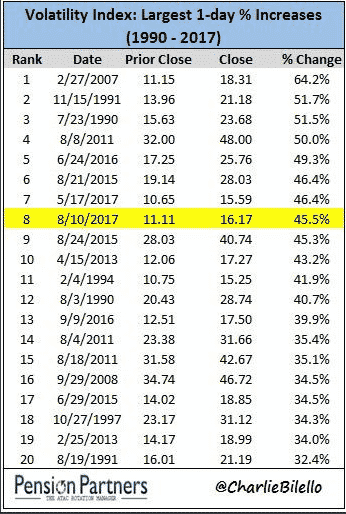

Let’s go back to last year when we saw a pretty decent volatility spike on August 10th, 2017. That day, the S&P 500 dropped 1.45% and VIX rose from 11.11 to 16.04, a gain of 44.37% which was one of the largest one-day gains on record.

However, just because VIX rose by 45%, doesn’t mean that the implied volatility of all options increase by 45%.

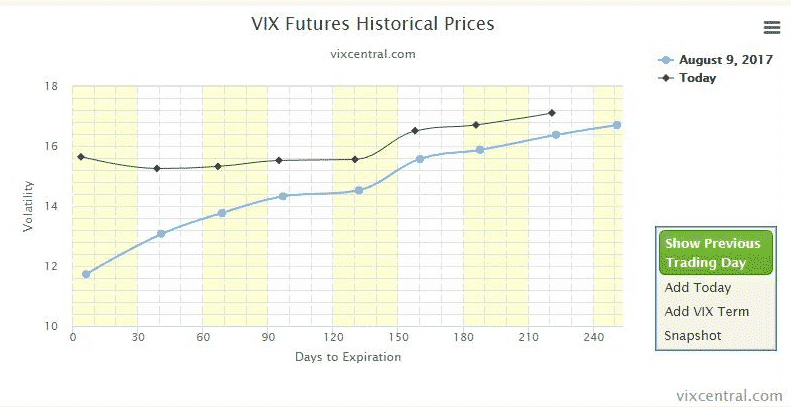

You can see in the chart below, that the near-term options were affected the most rising from below 12 to near 15.

The furthest dated options only rose from about 16 to 16.5%. So long term options were not impacted nearly as much as the short-term options.

This is why I never trade weekly Iron Condors.

In this 3-minute video below I explain a little bit more about this.

If you want to learn more about volatility you might enjoy these articles:

Gaining a thorough understanding of volatility is crucial if you want to be a successful options trader. I hope you enjoyed this quick lesson.

Notify Me When Coaching is Open Again

If you have any questions on this stuff, please drop me an email or leave a comment below.

Trade safe!