As a new options investor, I know that the topic of option assignment can be complex and scary.

But once you fully understand all the possible possibilities, that may alleviate some of the fears.

Contents

European Style Options

Before we get too deep, we need to know that there are two types of options: American-style and European-style options.

European-style options are options on the indices, such as SPX, RUT, VIX, NDX, DJX, and others.

Stocks and ETFs are American-style options.

The distinction is important because European-style options are assigned only at expiration.

There will not be any “early-assignment” scenarios for European-style options.

The assignment is cash-settled when the options are on indices where shares can not change hands.

American-style options can be assigned at expiration or any time before expiration (known as early assignment).

If stocks and ETF options are assigned, the holder of the short-call option must sell shares at the strike price.

Must sell 100 shares for each call contract.

If assigned, the holder of the short put option is obligated to buy shares at the strike price – 100 shares for each contract.

Because of the obligation, the broker will automatically perform the assignment in your account.

Terminology

When we say “short put,” that means that the investor has sold a put option.

A short call is when an investor has sold a call option.

ITM means “in the money“.

A short put is ITM when the stock price is below the option’s strike price.

A short call is ITM when the stock price is above the strike price.

Otherwise, they are OTM (out-of-the-money).

Only short options can be assigned.

Long options, an option that you bought, can not be assigned.

Long options can only be “exercised.”

If all is well, you are not obligated to exercise your long options.

However, if the long option is ITM at expiration, most brokers will auto-exercise the long options for you (if your account has sufficient funds to support this).

Brokers may also exercise your long option before expiration if you run into problems with your short options and account.

Short ITM Options

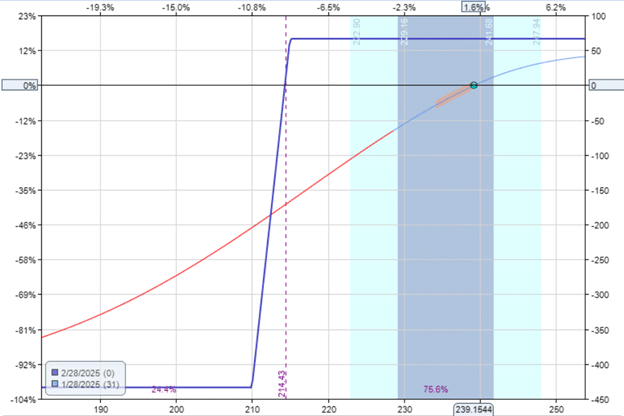

Now that we understand the technical terminology, here is an example of selling a short put on Amazon (AMZN).

On Jan 28, 2025, the investor sold the $215 put option AMZN with an expiration of Feb 28.

The investor collected a credit of $230 for the sale.

At expiration on Feb 28, AMZN closed at $212.28.

This is below the strike price of $215.

The short put option is in-the-money.

Since the investor is now obligated to buy 100 shares of AMZN at $215 per share, the broker will automatically assign the 100 shares and deduct $21,500 from the account.

If the investor wants to own Amazon (as in the Wheel strategy), then this is not a problem.

The problem occurs if the account does not have $21,500 of cash available.

This is why some types of accounts will only allow the sale of this put option if enough cash is set aside to cover $21,500.

This is known as selling a cash-secured put.

Suppose an account allows the sale of naked puts and the investor has sufficient margin.

In that case, the investor will borrow funds from the broker to cover the purchase (incurring interest charges).

If an account does not have enough margin, then it results in a margin call, and the investor must deposit money into the account or immediately sell the stock.

Or the broker may liquidate the stock at their discretion.

It is best to close the short ITM put prior to expiration or roll it out in time to avoid running into this situation.

Stock Can Be Assigned In Credit Spreads

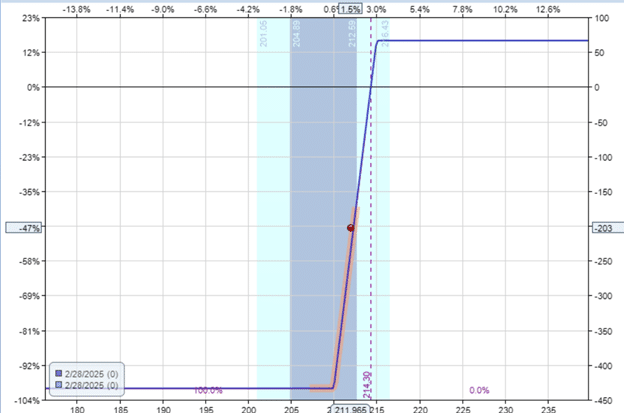

For smaller accounts, a bullish investor on Amazon might want to do a bull put credit spread instead.

Date: Jan 28, 2025

Price: AMZN @ $239

Sell one Feb 28 AMZN $215 put @ $2.33

Buy one Feb 28 AMZN $210 put @ $1.66

Credit: $66

The max risk on this trade can be calculated beforehand to be $434:

Width of spread minus credit received: $500 – $66 = $434

At expiration on Feb 28, the price of the AMZN falls in between the strikes of the spread.

AMZN closed at $212, and the investor is obligated to buy 100 shares of AMZN at $215 per share.

The broker automatically executes this order, and the investor will see that he now owns 100 shares of AMZN, and $21,500 was deducted from his account.

Remember that the long protective $210 put has now expired.

So, the AMZN stock position can have a weekend overnight gap risk in his favor or gap down against him on Monday morning.

If the investor doesn’t want those 100 shares, he should sell those 100 shares first thing Monday morning.

To avoid being in this situation, it is best to close the spread just before expiration or roll it out in time.

In this case, to close the spread 5 minutes before expiration would cost a debit of $270.

Hence, the net P&L in the trade would be -$203.

Credit to open: $66

Debit to close: -$270

Net P&L in trade: -$203

Conclusion

Take some time to learn the terminology and the basics of option assignment in this part 1.

So far, we have not talked about early assignments.

This brings a new set of more complex scenarios, which we will discuss in part 2.

We hope you enjoyed this article on option assignment.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.