What is known as the ARK funds, or ARK ETFs, are a set of exchange-traded funds managed by ARK Investment Management LLC, an American investment firm led and founded by Cathie Wood in 2014.

The acronym ARK stands for “Active Research Knowledge”.

The funds focus on investing in “disruptive innovation” such as AI, blockchain, and genomics.

Each of the ARK funds has slightly different specializations.

Here are a few of the family funds.

ARKK: This is perhaps the family’s most well-known ETF. The Innovation ETF invests in companies that the firm believes will benefit from disruptive innovation. As of early 2025, the fund’s primary holdings include Tesla (TSLA), Coinbase (COIN), Roku (ROKU), Palantir (PLTR), Roblox (RBLX), Robinhood (HOOD), and others.

ARKQ: This is the Autonomous Technology & Robotics ETF. While the ARKQ options may not be as liquid as one would like. Some of the companies in the holding do have liquid options.

The holdings include, but are not limited to, the following:

- Tesla (TSLA) for its autonomous driving.

- Kratos Defense (KTOS) for its unmanned systems and defense robotics.

- Teradyne (TER) for its automated test equipment.

- Palantir (PLTR) for its industrial automation solutions used to test semiconductors.

- Archer Aviation (ACHR) for its electric vertical takeoff and landing (eVTOL) aircraft with the eventual goal of having air-taxis.

- Iridium (IRDM) for its low Earth orbit (LEO) satellites.

ARKW: The ARK Next Generation Internet ETF. The options on this ETF are not yet liquid enough. But its top ten holdings are all well-known and liquid. They are Tesla (TSLA), Roku (ROKU), Robinhood (HOOD), Roblox (RBLX), Coinbase (COIN), Palantir (PLTR), Meta (META), Shopify (SHOP), Block (XYZ), and Crowdstrike (CRWD).

ARKG: The ARK Genomic Revolution ETF. The fund focuses on genomics, biotechnology, and healthcare innovation companies. Innovations that include DNA sequencing, gene editing, CRISPR technology, and precision medicine. CRISPR technology used in gene editing is based on the same method that bacteria use to recognize and cut viral DNA.

ARKF: The ARK Fintech Innovation ETF. These include companies that use AI in finance and companies involved in digital payments and blockchain. Blockchain is the underlying technology for cryptocurrencies.

ARKX: The ARK Space Exploration & Innovation ETF. ARK LLC likes the companies Rocket Lab (RKLB) and Trimble Navigation (TRMB). I am not saying that these are only two companies in this fund. Other companies in this fund include some of the previously mentioned. Some of the larger cap companies have research that spans multiple areas.

Final Thoughts

If you are looking for trade ideas in companies involved in innovation, then knowing these funds and their constituents can be a good place to start.

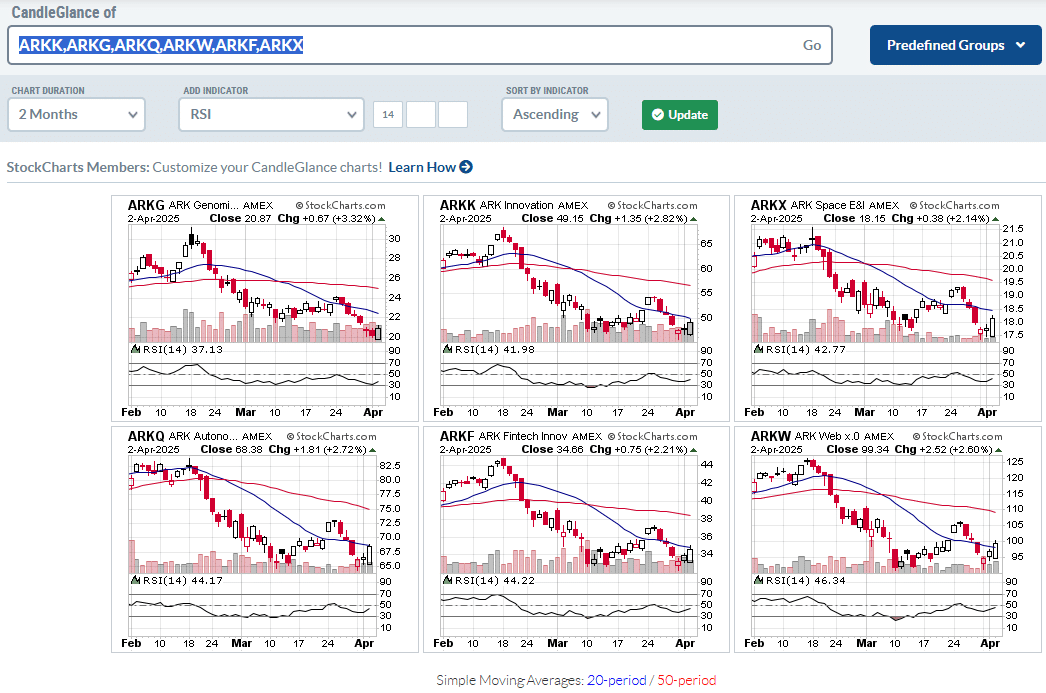

Using CandleGlance in StockCharts, I am sorting the six funds in descending RSI:

That way, it shows me the strong performers in the past two months:

In this case, the “F” fund for fintech was listed first, followed by the flagship “K” fund and the “G” genomics fund.

Or, if you are looking for value investing, you might look for a low RSI that is about to go back up.

The X fund for space and the ARKQ might fit that role.

Investors interested in FinTech might bring up the top constituents of the ARKF fund and get some trade ideas from there.

Have you memorized the symbols for the six funds yet?

The last letter representing the specialization is fairly intuitive to remember.

The two toughest ones to remember might be the ARKW, where “W” is for the Internet.

I guess you can think of “wired” for the Internet.

Remember that ARKQ is for autonomous and robotics.

We hope you enjoyed this article on the ARK ETFs.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.