On September 28th, I wrote an article about a MASSIVE bet made by a volatility trader, and I thought now would be a good time to provide an update.

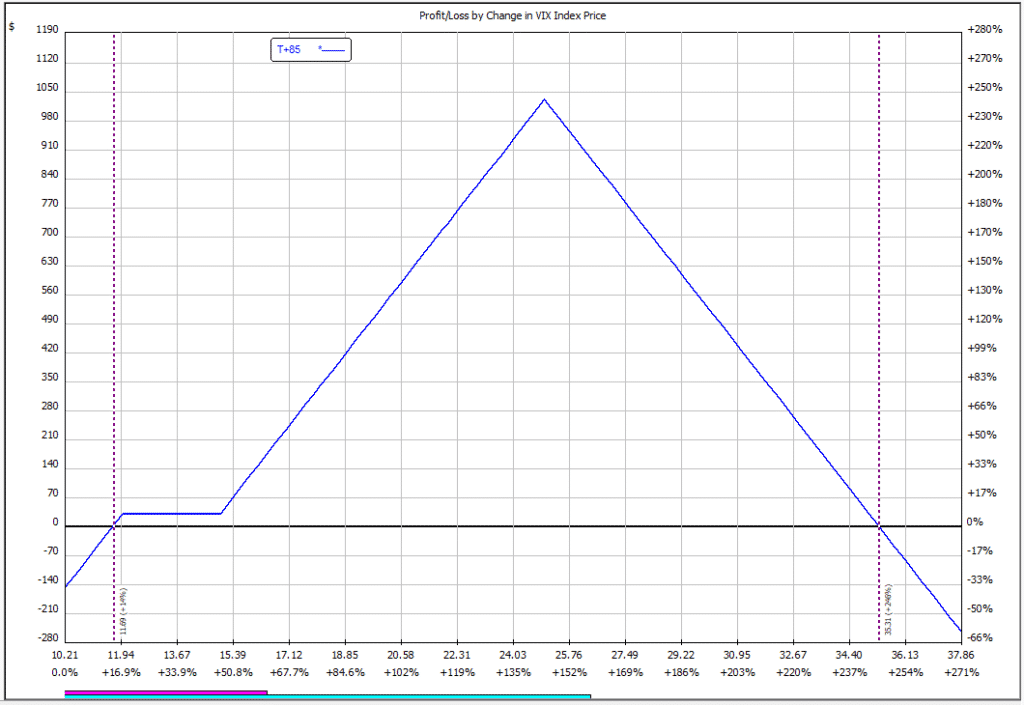

As a reminder, this is what the trade looked like. It’s basically a bet that volatility would be higher by December expiry with a settlement value of 25 being ideal. Any rise in VIX above 35 would be bad.

Most likely the trade was a hedge for a large portfolio or some other volatility related trades.

The trade had the potential to make as much as $263 million, but we kept it simple by just looking at a 1 lot trade:

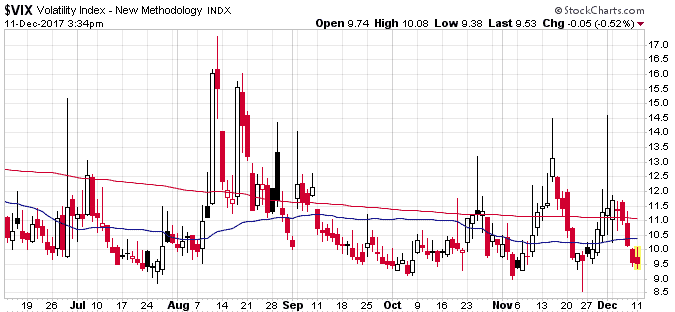

So far, other than very brief spikes in mid-November and early December, VIX has been relatively subdued and the trade has not really been working.

Register For 10x Your Options Trading

When VIX hit its low point on November 3rd at 9.00, the trade was down about $20. Not too bad really considering the trade wasn’t working.

On November 15th, when VIX hit an intra-day high of 14.43, the trade was basically flat.

On December 1st, VIX reached 14.50 and the trade was +$70.

As of today with VIX back at 9.29, the trade is -$170.

The closer we get to settlement, the more P&L starts to move around and with VIX well out of the profit zone for this trade, losses have started to pick up steam in the last week or so.

It has since been reported that the trader has rolled this exposure into January, so I’ll continue to follow along and provide an update in about a month.

Trade safe!