Using the CMLViz software has been a real eye opener for me and helped me find some fantastic trade ideas.

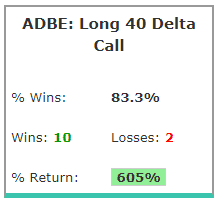

One trade idea that is on my radar is a bullish momentum pre-earnings trade in ADBE. The CMLViz software allows users to backtest strategies and one that has worked really well over the past few years is buying a 40 delta call 7 calendar days out from earnings and selling right before earnings.

ADBE has been such a bullish stock, and it has shown a propensity to rise ahead of earnings on optimism, or upward momentum, that sets in the one-week before an earnings date.

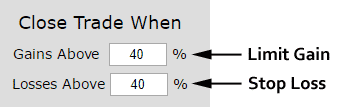

Here’s how we set up the parameters of the trade:

Just to confirm, this trade DOES NOT take on any earnings risk. ADBE reports earnings after the market close, so we simply close the long call at the end of the day before the announcement.

RISK MANAGEMENT

There is another layer of risk management to the trade by instituting and 40% stop loss and a 40% limit gain. Here is that setting:

Here are the results of the trade over the last 3 years.

SETTING EXPECTATIONS

While this strategy had an overall return of 605%, the trade details keep us in bounds with expectations:

The average percent return per trade was 36.8% for each 7-day period.

The average percent return per winning trade was 46.3% for each 7-day period.

The average percent return per losing trade was -10.9% for each 7-day period.

I’m going to be setting a reminder in my calendar 7 days out from ADBE’s earnings on Sept 13th.

More details on the CMLViz software here:

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.