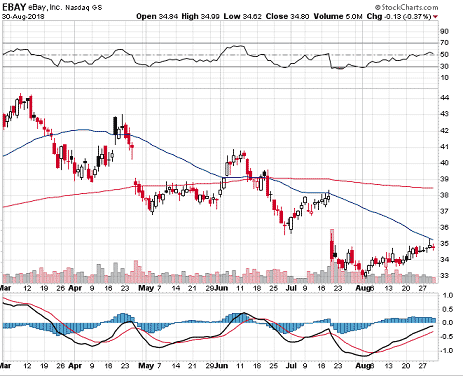

Back on July 20th, I wrote about how EBAY dropped 10% and looked at a couple of different trade ideas. EBAY closed that day at $34.11.

A month and a bit later, with EBAY trading at $34.80, let’s check in to see how the trades are doing with EBAY

BULL PUT SPREAD

The Bull Put Spread had an income potential of $140, risking $860. As of today, the trade is +$130 for basically a full profit.

PUT RATIO SPREAD

This trade created a large profit zone between $29 and $33 with risk on the upside limited to $40. With EBAY trading above the zone, the trade is down $30.

BEAR CALL SPREAD

This trade generated $200 in income on capital at risk of $800. Even though EBAY has rallied slightly, the trade is still +$95.

IRON CONDOR

With a $340 income potential on $660 capital at risk, the September 30-32-36-38 Iron Condor was well placed for some sideways action.

As of today, the trade is +$225.

I hope you enjoyed this update and you had some success trading EBAY. Let me know in the comments if you did.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.