The broken winged butterfly options strategy is a strategy similar to the butterfly strategy and was coined by Futures Magazine. Similar to the Butterfly strategy the Broken Winged Butterfly attempts to captures a certain range where a security will trade over a specific period of time. The main difference between the two strategies is the Broken Wing attempts to reduce the premium that is lost by creating a zero cost structure or even bringing in a small amount of income.

The broken winged butterfly strategy is geared to capturing the trading range of a specific security by simultaneously purchasing an out of the money puts spread, and selling a further out of the money put spread. For example, when XYZ stock is trading at $600 a trader would purchase a $580 put – sell 2 $550 puts and purchase a $500 put.

TECHNICAL INDICATORS

Typically I like to enter a broken wing butterfly when the market has made an extended move in one direction. For example, if I were to enter a bearish broken wing butterfly, I would wait until RSI hit 80. For a bullish broken wing butterfly, I would enter when RSI hits 20.

Be careful not to get the bullish and bearish broken wing butterflies confused. On a bearish broken wing butterfly, the profit zone is on the upside, but it is actually a bearish trade with negative delta.

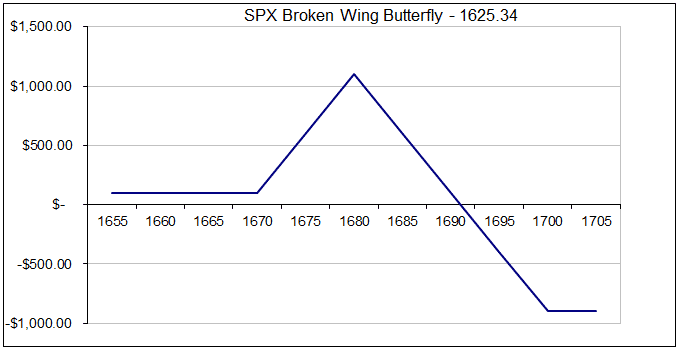

Bearish Broken Wing Butterfly

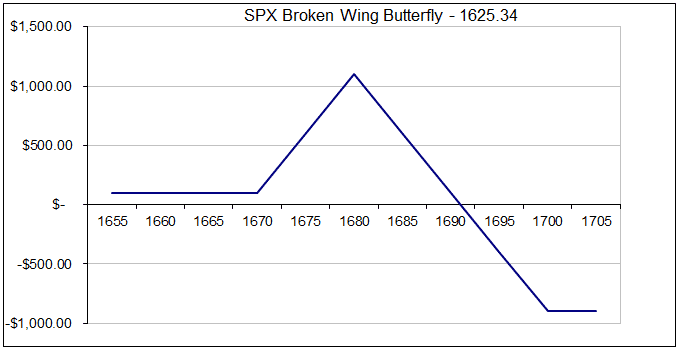

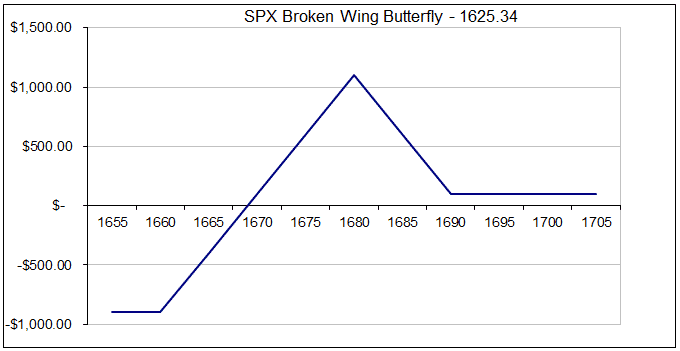

Bullish Broken Wing Butterfly

APPROPRIATE STOCKS

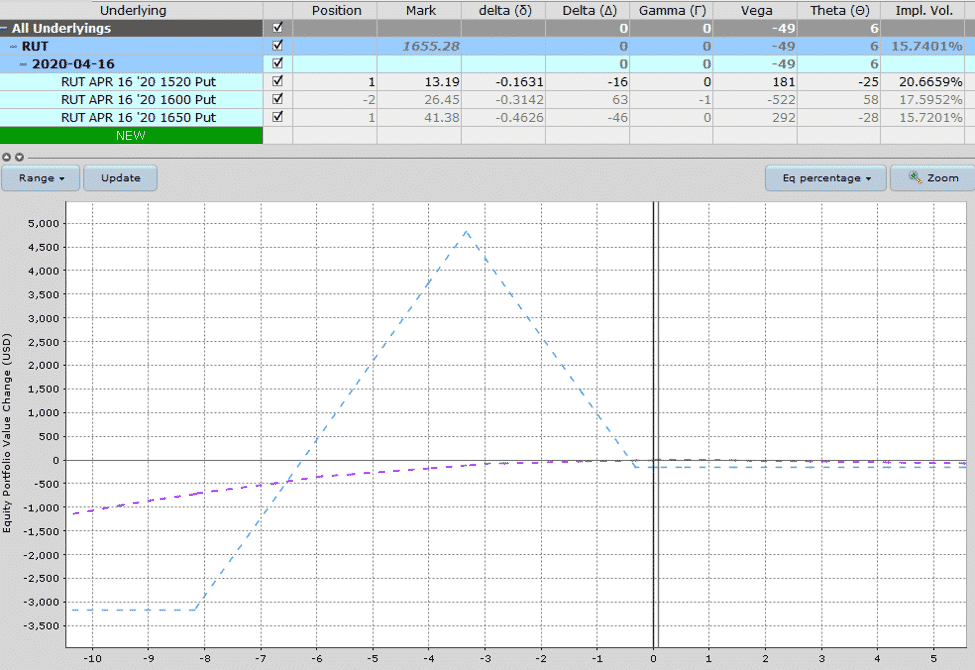

You can trade a broken wing butterfly on any stock or index. RUT is the instrument of choice for most traders, but there’s no reason why you couldn’t trade AAPL, GOOG, or any other blue chip stock. Just watch out for earnings announcements!

Indexes are perhaps a little better because there is no risk of early assignment.

STOP LOSS

In terms of a stop loss, you can take an acceptable percentage of the total capital at risk. If your capital at risk is $1,000 then a 20% stop loss or $200 might be appropriate.

HOLD TO EXPIRATION?

If the stock moves in the direction you want, it is very easy to just hold into expiration, let everything expire worthless and keep the premium you received upon entering the trade.

However, if the stock moves towards your profit zone, you are faced with a dilemma. Most novice traders will be enticed by the huge profit zone and start thinking “If RUT stay here for just a few more days, I’ll make $x. However, what they may not realize is that they are in a very risky position, because if the market keeps trending you could suffer a large loss.

If you stick to a 20% stop loss you might save yourself some sleep. Otherwise you might also want to think about closing the trade if it gets within 10 points of your short strikes.

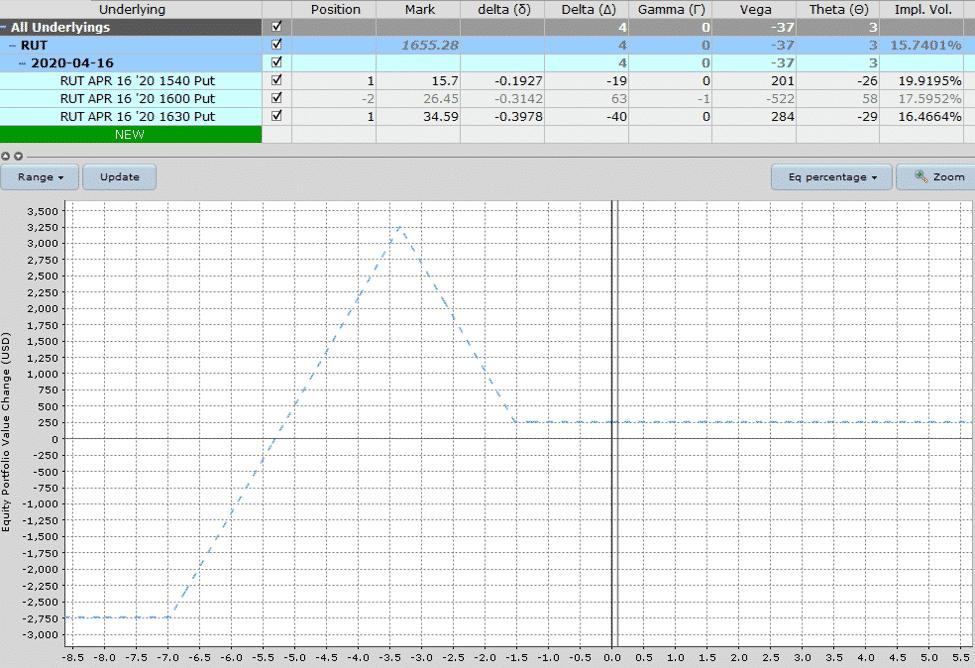

TYPICAL SET UP FOR A RUT BROKEN WING BUTTERFLY

When it comes to these types of trades, I like low maintenance low stress broken wing butterfly trades. Below you will find the standard set up that I would look at.

Days to Expiration: Between 60-90 days

Short Put Strike: Around the 30 delta

OTM Long Put Strike: Around 80 points below the short strike

ITM / ATM Long Put Strike: Whichever strike gets you to delta neutral. Usually close to the at-the-money strike

Initial Debit: Less than 5% of the capital at risk

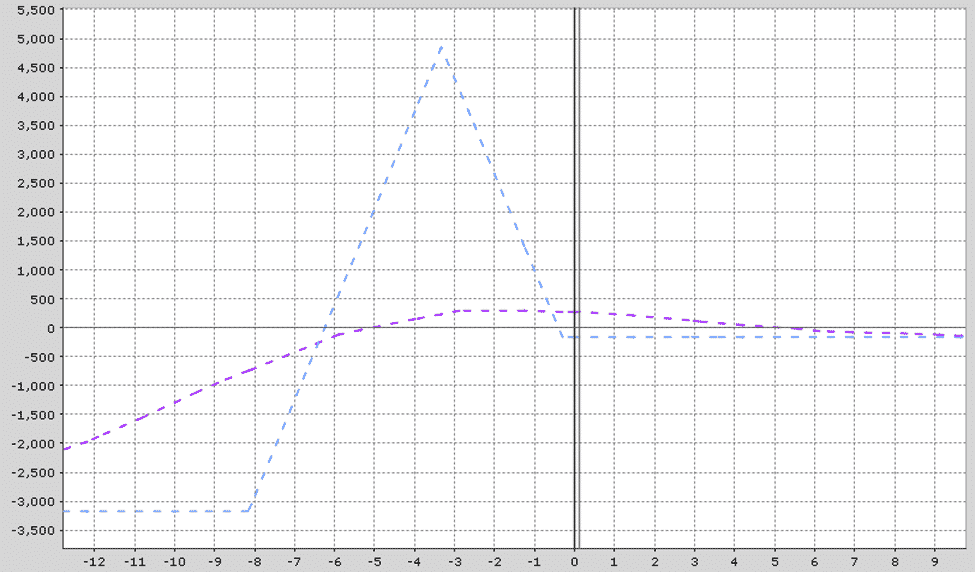

On the risk graph below, notice that the T+0 is line is very flat and losses only start to appear after about a 3% drop.

The T+30 line shows the profits starting to come in with a range of -5% to +5%.

BROKEN WING BUTTERFLY ADJUSTMENTS

Getting in to a broken wing butterfly is the easy part. What comes next is the hard part. So let’s looks at a couple of different adjustment techniques.

REVERSE HARVEY ADJUSTMENT FOR BROKEN WING BUTTERFLY’S

Dan Harvey was one of the early mentoring students of Dan Sheridan who went on to become a very good trader and educator in his own right. He is famous for the Reverse Harvey butterfly adjustment. Let’s dive in to how it works.

Assuming the market has rallied since placing the broken wing butterfly trade. We don’t want to leave the position as is, because the expiration line on the upper part of the risk graph is below the zero line.

We need to lift the right hand side of the graph so there is less upside risk and also some potential for profit.

To do the Reverse Harvey adjustment, we roll the long puts closer to the short strike. So, the lower put we roll up and the upper put we roll down.

Sell to Close the 1520 and 1650 puts.

Buy to open 1540 and 1630 puts.

By doing this, it significantly reduces the capital at risk on the downside and also lifts up the expiration graph to the right of the profit tent.

Another adjustment technique is to add a smaller call butterfly at or above the current stock price.

OVER TO YOU

What do you think? Do you like the look of broken wing butterflies?

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thanks, great advice as always. Could you elaborate a bit on the choice of strikes? Once you pick the closer long at 25 delta, how do you choose the body strike?

It depends on the underlying. Typically if I’m trading RUT I would use 10 points wide. So once you have the first long at 25 delta, just add 10 and that is the strike you sell and add another 20 and that is the strike you buy.

AAPL would be the same.

Generally if the first long is at 25 delta, the short strike will be around 20 delta.

Sounds good. Another question: how far out to the expiration do you go–a couple of weeks like you suggest in the book for directional butterflies, or longer? Thanks!

Anywhere from around 15-30 days is good.