Today, we are looking at some of the best trading quotes.

If you enjoy other quotes, then simply post them in the comment section and write about how they have helped you personally.

I would love to hear them.

Now without further ado let’s get started.

Introduction

There is a saying that a picture tells a thousand words.

If this is true, quotes tell a thousand experiences.

There are many valuable trading quotes online.

This list could easily have 50 entries, but I have kept it to ten of my favorite short quotes.

A shout out to Agustin Lebron for a lot of his ideas.

Some of these quotes are directly from his book “The Laws of Trading” which is highly recommended.

1. “Take Only the Risks you are Paid to Take, Hedge the Others”

Generating returns in the market is all about taking risk.

Not all risks are adequately compensated for.

If you are not being compensated for added risk in your portfolio, simply do not take it.

Hedge your risk or choose something less volatile.

Source: Laws of Trading

2. “Know Who’s Lunch you are Eating, Otherwise you just might Bite into a Rock”

For every buyer there is a seller.

This is important as you are trading with the opposite opinion as the person on the other side of your trade.

Understanding their motivations for a trade is just as important as understanding your own.

There is no free lunch in the stock market, if you think otherwise, you will be met with a surprise.

3. “Just Because Something Has Never Happened Doesn’t mean it can’t”

Using past prices and events to understand normal distributions makes sense.

Despite this there always needs to be an understanding that things will happen outside of what has happened in the past.

While it can sometimes be impossible to adequately prepare for a specific unforeseen event, being prepared in general for extreme events will help you survive these unexpected storms.

A few of the top unforeseen events so far of 2020/2021: COVID Crash, Negative Oil, Meme Stock Bubble.

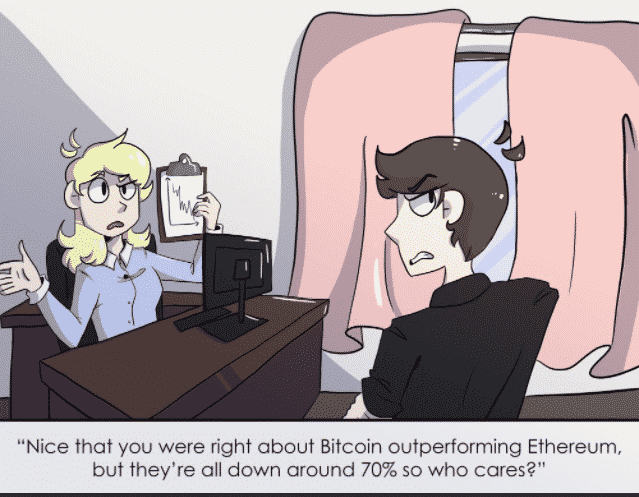

4. “The Market can Remain Irrational Longer than you can Remain Solvent”

The most dangerous trades are those that as they move against you become more attractive.

These become alluring to double down as the market becomes more and more irrational.

It also makes it extremely challenging to cut losses when you need to most.

This is because at some point you will probably be right, and the asset will move to its fair value.

In the meantime, it can easily squeeze you out of your trade at the worst possible moment.

Understand when logic doesn’t matter and cut the position before a headache becomes a migraine.

5. “It’s Okay to be wrong; It’s Unforgivable to stay Wrong”

Traders will always lose.

Become accustomed to it.

Without being honest with yourself and admitting you were wrong you will never learn.

Those who stay spiteful and married to wrong ideas will only harm themselves in the long term.

In contrast individuals who make frequent mistakes but learn from them will be incredibly successful over time.

6. “Sheer Will and Determination is no Substitute for Something that Actually Works.”

Sometimes we rely on hope and willpower while trading.

Yet a stock price doesn’t depend on your determination.

Trade what works. Be mechanical when you are right and wrong and leave the emotions out of trading.

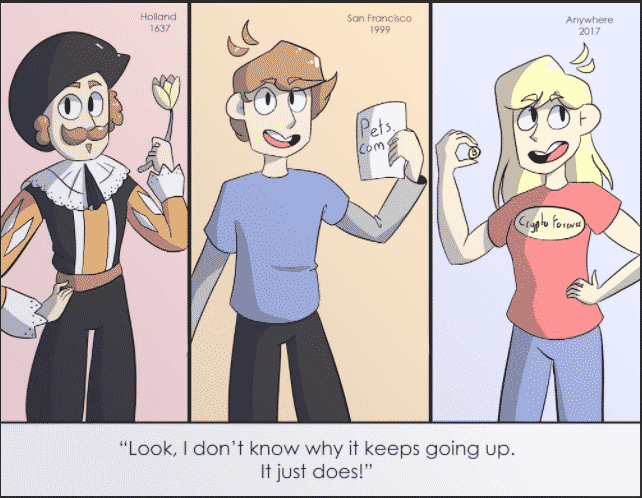

7. “Easy Come, Easy Go”

In the market the quickest way to make money is to trade against irrational greed.

The greater fool theory is the easiest way to make money in the markets.

It is also the easiest way to lose it.

If you trade this way don’t get left holding the bag of tulips at the end.

8. “If you Can’t Explain your Edge in 5 minutes you don’t have a very good one”

Sometimes people will overcomplicate ideas using fancy jargon and messy ideas.

Ironically, most of the best trading ideas are resoundingly simple.

For example, a HFT market maker has incredibly diverse and complex strategies, but their edge is simple.

They provide liquidity to those who want it now and seek to make a fraction of the bid-ask spread on every trade.

On the other side if you have no idea why the asset you are trading should appreciate you should not be trading either.

Source: The Laws of Trading

9. “Everything In Life is a Trade”

Everything in life is a trade-off. Should I buy insurance for my house?

Should I invite my crazy aunt over for dinner?

Everything is an exchange.

This could involve the conventional trade of money but also of time, social credit, and personal utility.

Understanding the trade-offs in your personal day to day life is important.

It also provides a strong mindset to understand trading in the stock market.

10. “Market Giveth, Market Taketh”

The stock market has given some of the best minds’ vast amounts of wealth while at the same time evaporating that same wealth away.

All with a single click of a button.

Even after doing all the research, you can, you will sometimes lose.

Understand and respect the organism that the market is. Never underestimate it.

Concluding Thoughts

I hope you enjoyed ten of the best trading quotes.

The amazing thing about quotes is that once you have found ones that are meaningful to you, they can provide a quick perspective which can change bad habits, motivate, and provide clarity in the times we need them the most.

Trading in the financial markets is not easy.

There is lots of competition from many smart people. Despite this with a strong set of rules, guidelines and morals success is just around the corner.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Amazon Associate Disclosure

Options Trading IQ is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com