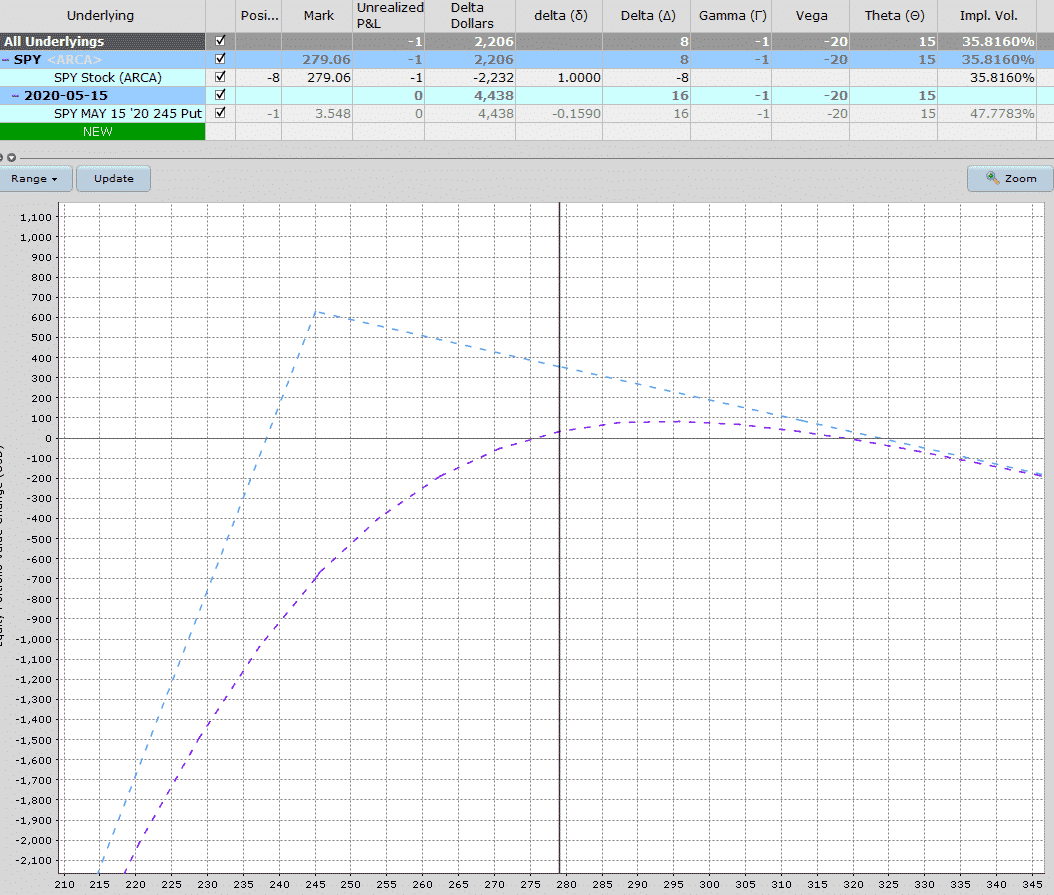

This trade is something I like to do sometimes to hedge the directional risk of sold puts.

Selling a put is a pretty standard trade, but what I’ve done is add a short stock position of -8 shares which is basically hedging half of the delta of the sold put.

What this does is reduces delta from 16 down to 8 but doesn’t cost us anything in the way of Theta or Vega.

We also get a slightly larger profit potential on the downside.

The drawback with the trade is that if SPY does rally, the profits will be a lot smaller than they would be if I didn’t sell the shares.

The profit zone for the trade is roughly between $237 and $322 so it’s a nice wide profit zone.

The trade is unlikely to see huge returns but should hopefully generate a little bit of a return over the next month.

If SPY does drop, I might sell some more SPY shares to keep delta relatively close to neutral.

Likewise if SPY rallies, I might buy back some of the shares and let the put expire.

Let’s see how this one goes.

After posting this article, I had some interesting questions from a reader:

- Do you always sell the put at delta 15?

- How does the position make money?

- What happens if SPY goes up?

Really great questions and here are my thoughts:

I like the 15 delta puts usually and yes half delta hedge is good depending on my market opinion. If I was more concerned that SPY would head lower, I would fully delta hedge.

I would buy back the 8 shares well before $322. Probably around $300. Also as time passes if SPY hasn’t dropped the delta of the put will slowly decline so I don’t need as many short SPY shares, so I might end up buying back 4 shares even if SPY is flat but time has passed.

So let’s assume SPY goes to $300 in the next week or so. We’ll lose $167 on SPY shares but at that point, it’s very unlikely SPY will head back down and break through $245, so I would buy back the 8 shares and let the put expire worthless.

The put was sold for $355 so the net profit on the trade is $188.

You can use stock to hedge any position. Credit spread, iron condor whatever. Stock is always delta 1.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.