Sometimes when a stock has had a really bad run, it can trade sideways or continue going lower. In cases like that, I us a Put Diagonal.

A Put Diagonal creates a profit zone below the market and has very little and sometimes zero risk on the upside. That way, if the oversold stock snaps back to the upside, there is no damage.

The majority of the risk is on the downside and while a small drop is ok, a big drop would be harmful to the trade.

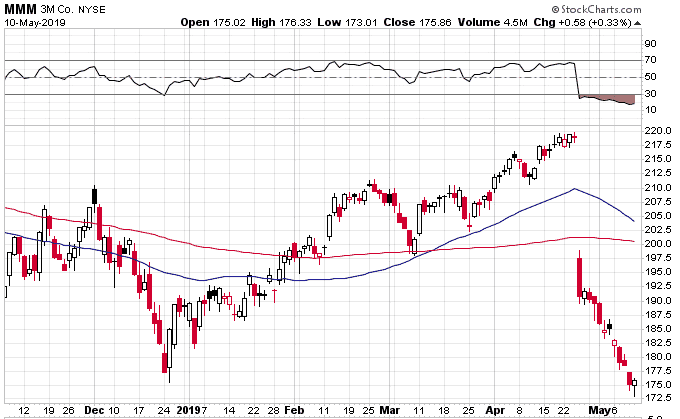

MMM is currently the most oversold stock in the Dow, so looks like a good candidate for this type of trade.

Selling the June 21st 160 put and buying the July 19th 155 put will cost $0.12. The most the trade will lose on the upside is $12 per contract.

Selling the June 21st 160 put and buying the July 19th 155 put will cost $0.12. The most the trade will lose on the upside is $12 per contract.

The maximum potential gain is $238 and the maximum loss is $512.

The trade should show a profit if MMM finished between about $156 and $176 at expiry.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.