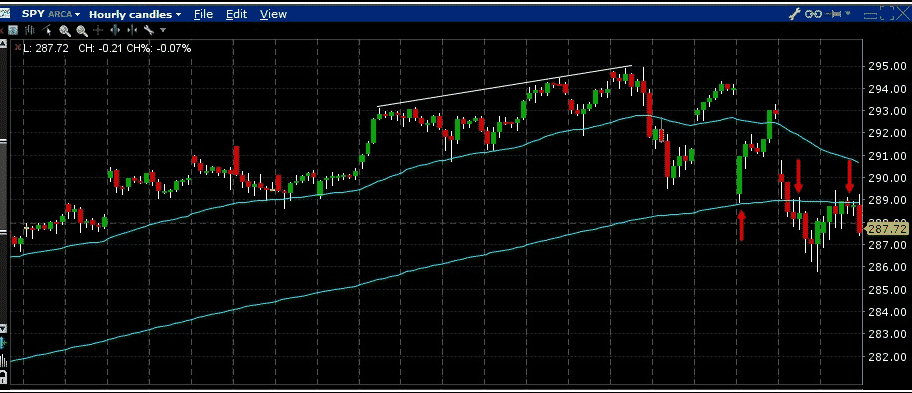

Yesterday I posted in the Facebook group this 1-hour chart of SPY showing the 200-hour moving average providing support and then resistance once it broke through.

Short-term this is bearish.

It’s not my style, because I prefer longer-term trades, but someone could sell a short-term Bear Call Spread and use the 200-hour line as a stop loss.

For example, at the end of the day yesterday, traders could sell a 294-296 May 17th Bear Call Spread for $0.52.

The 294 calls had a delta of 21 which is not a bad spot to sell.

The maximum risk on the trade would be $148 which gives the trade a 35.14% return potential.

This is a much higher risk trade than the previous example, because if that market rebounds sharply, losses would mount pretty quickly, so this trade would need a lot of attention. That can be hard for people working full-time.

Futures are down overnight with the S&P 500 currently down 0.70% so when the market opens this spread will already be trading for a lot less so probably too late to enter, but it will be interesting to follow this one and see how it performs.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.