Real Estate Investment Trusts are one of my favorite asset classes. You can read about that here and here.

However, since late December 2018, the major REIT’s have seen explosive growth and have been one of the best performing sectors this year.

IYR is the main ETF I use for trading options on REIT’s. This ETF is up over 28% since late December. Income investors have been flocking to REIT’s in droves as they search for yield as bond yields continue to plummet.

In my opinion, further upside for REIT’s is pretty limited for the remainder of this year.

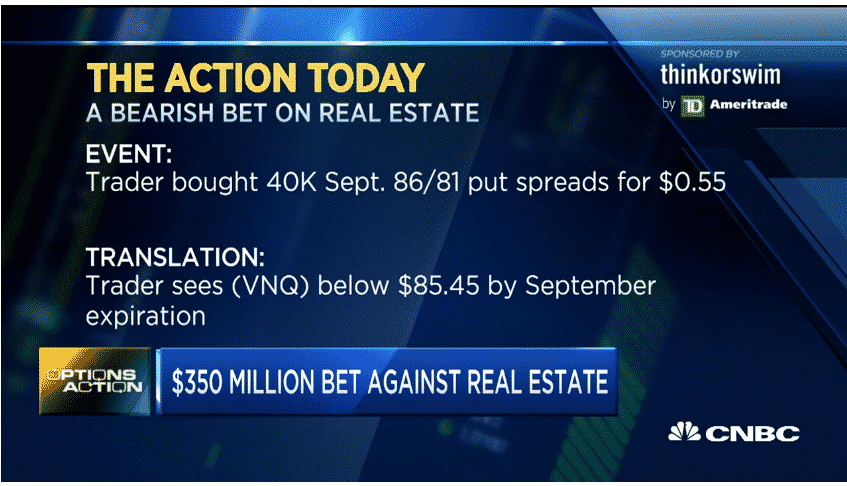

CNBC recently reported a massive $350 million bet against another REIT ETF – VNQ:

I recently sold a couple of IYR December 95-100 Bear Call Spreads for $0.85. If IYR does continue to rally of the next few weeks or months, I’ll look to roll these up and out and maybe also increase size. I’ll keep you posted on how the trade works out.

Other recent trades include bear call spread on WMT and NEM.

I share quite a few trade ideas like this in a free Facebook Group for option traders.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.