Wall Street sharks are well know for coming up with new and improved ways for you to blow your dough; and CFDs, or contracts for difference, are no exception. While CFD’s can and do serve a purpose, if you don’t know what you are doing you can do some serious damage to your account balance.

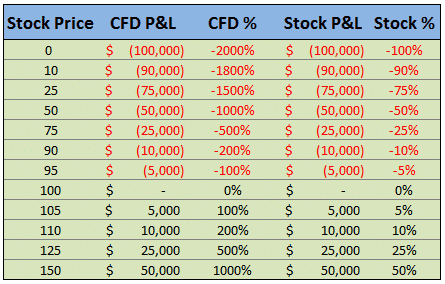

CFDs are not new, but they are based on the age old premise of “get rich quick”. Just check out the promotional material from one major CFD broker:

1:200 leverage, are you kidding me??

What Are CFDs?

Greg Medcraft, the Chairman of the Australian Securities and Investment Commission has called CFDs “a way to borrow to gamble”. No wonder Australian’s love them….

CFDs are exactly that, a way to gain massive leverage to gamble on the direction of a stock, commodity, index or currency. They are a derivative contract in that the value of the CFD is derived from something else, that being the underlying instrument upon which the CFD is based.

As with all derivatives, CFDs allow you to trade an underlying instrument without having to physically own it. They provide fantastic leverage, but do not offer the same kind of flexibility provided by options. With options, you can construct a position to profit in rising, falling or neutral markets. With CFDs, you can only take a bullish or bearish bet on the underlying instrument.

The advantage of CFDs is that they are a lot easier to understand than options.

Where Did CFDs Originate?

The invention of the CFD is widely credited to Brian Keelan and Jon Wood in the early 1990’s when they were working for UBS Warburg. They were initially utilized by hedge funds looking to hedge their exposure while also avoiding stamp duty. This was possible due to the fact that no physical shares were purchased or sold.

In the late 90’s, CFDs were unleashed on the unsuspecting public who were soon sucked in to the promise of untold riches due to the massive leverage available.

CFDs in Australia

CFDs were exported from the UK into Australia in July 2002 by IG Markets and CMC Markets and have since been introduced into a number of other countries. They are banned in the US by the SEC.

Initially there were 12 brokers providing CFDs, but by 2009, that number had dropped to 5.

From 2002 to 2007, CFDs were traded over the counter (OTC) until the ASX listed exchange-traded CFDs on the top 50 Australian stocks, 8 FX pairs, key global indices and some commodities. The ASX has since removed CFDs from their offerings.

How To Trade CFDs

In Australia, now that the ASX has discontinued exchange traded CFDs, the only way to trade CFDs is directly with a broker. The trade is an OTC contract between you and the broker. As with all OTC trades, the terms are not standardized and are basically determined by the broker. However, many of the brokers will have the same or similar terms.

One of the major differences between CFDs and options, is that the CFD has no expiry date. Assume you want to get long the ASX200, you would buy a CFD through your broker and that position would be open until you close it out by making the opposite trade with the broker. If your opening trade is a buy to open, you would need to enter a sell to close trade to close out the position.

Profits and losses are realised each day and are debited or credited to the traders account at the end of each trading day. This is know as “rolling over” the position.

Another thing to consider is the spread. Spreads on CFDs are typically higher than stocks, so if a CFD has a spread of $0.10, you will automatically be $0.10 in the hole as soon as you start the trade. You will also have to pay the spread when you exit the trade. Something to keep in mind.

CFDs and Margin

CFDs require what is known as an initial margin which is a deposit into your brokerage account and is typically only around 5% of the value of the underlying instrument you are trading. Here in lies the leverage, you put up only 5%, but you have exposure to 100%. You can see why retail investors can get sucked into this, but you need to realise that you still have the same exposure as if you were 100% invested. In other words, you need to be very, very careful with the size of the exposure you take. You can lose much more than the 5% margin you put in.

Margin levels of 5% are common, but they can range anywhere from 0.50% to 30.00%. Margin levels are based on the volatility of the underlying instrument and the perceived risk. For example, stock indices, foreign exchange and commodities have lower margin requirements (as low as 0.50%) than stocks (around 3.0% to 30.0%).

Margin levels can be changed at any time, such as after the September 11th attacks when margin levels were hiked due to the increased volatility and market risk.

There are two types of margin, the Initial Margin which is sometimes referred to as the deposit and is deducted from the traders account upon opening a trade and then deposited back once the trade is closed. The Variation Margin is calculated at the end of each day and is either added to or deducted from a traders account depending on if the trade went their way or not.

CFD Costs

There are a number of costs associated with trading CFDs, the most common of which would be the spread. Over the counter instruments such as CFDs have a larger bid-ask spread and you will have to pay this upon entering and exiting a trade. Unlike options, where you can generally get a fill somewhere near the mid-point of the spread, with CFDs you have to pay the offer price when buying and sell at the bid price. This can result in a fairly significant cost.

Some brokers will also charge commissions which can be as low as 0.01%. However, be sure to check the spreads offered by discount brokers as they might be compensating for a low commission rate by having a much wider bid-ask spread.

Interest is another cost to take into consideration. You are putting up only a small initial margin, and the broker is basically covering the rest. This is a form of loan and most brokers will add some kind of financing charge to your open positions. Be sure to check the fine print and know what your interest costs are going to be. If your account becomes overdrawn through a margin call not being met, you may also be charged deficit interest which can be as high as 15% to 20%. Ouchy!

Many brokers will also charge for market data. Usually this is not significant, but you should check to be sure.

CFD Examples

As with any financial product, your profits and losses are determined by the difference between what you bought and sold the product for. CFD’s are no different, but where it gets tricky is that you can either be a long or short trader. CFD’s allow great flexibility in that you can make money as the market falls, so if you can get your head around that you will be ahead of 90% of other retail traders. Let’s look at some examples and see if we can clear things up.

First, let’s take a bullish position in a CFD. XYZ stock is trading at $100 and you think the price will rise over the next few months. You decide that you want exposure to 1,000 shares of XYZ and buy a CFD for 1,000 units. If the margin rate on XYZ stock is 5%, you will be required to put up and initial margin of $5,000 ($100 x 1,000 shares x 5%).

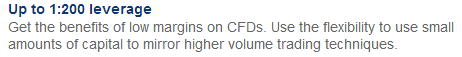

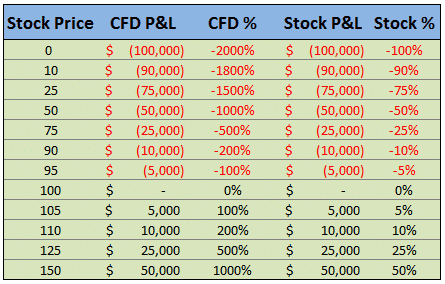

Remember that you can lose more than the $5,000. You are exposed to $100,000 worth of the stock, so that is your maximum theoretical loss.

After 2 weeks XYZ rises to $105. Your profit on the trade is $5,000. This is calculated by taking the gain in the stock price ($5) by the number of units of the CFD (1,000). So your return on investment is 100%. Compare this to someone who purchased 1,000 shares who would have had a return of 5% ($5,000 / $100,000). So the return percentage is much better for CFD’s, but remember that your potential loss was exactly the same as someone who bought 1,000 shares.

What would happen if the stock dropped though? Assume XYZ dropped to $95 and you decided to exit the trade. What would your loss be?

You would calculate your loss in the same manner. 1,000 units x $5 = $5,000 loss. So in this example, you have lost 100% of your investment compared to the stock trader who was only lost 5%. Here you can see where the risks of CFD’s lie. Make sure you have adequate capital to trade these things…

In the table below you can see the comparison between CFD’s and stock ownership. You can see that the dollar losses are exactly the same, it’s just the percentage that changes. You can make huge percentage gains, but you can also have huge percentage losses, including losing much more than your initial margin amount. Also notice, that when you put up a 5% margin, all it takes is a 5% drop for you to lose 100% of your investment.

CFD Broker Models

When opening an account with a CFD broker, it is important to know what type of model they are operating. There are three main types of models:

- Market Maker – In this model, the CFD provider comes up with their own price for the CFD to be traded. Buyer beware! Under this model, prices may vary significantly from the underlying asset.

- Direct Access – The CFD provider places your order into the market for the underlying asset. The price you pay will be determined by the underlying market. Under this model, investors are much more likely to get a better price on their trade.

- Exchange Traded – In this model, you are trading CFDs directly on the exchange.

In Australia, as the ASX is no longer offering exhange traded CFDs, the Market Maker and Direct Access model are the only ones available to investors. The Exchange Traded Model was unique to Australia, so that method of trading has gone the way of the Dodo.

Risks

The stakes are high with CFDs so it’s important to know the risks. Here’s a look at a few:

MARKET RISK – This is the big one. You are taking on massive leverage so a small movement in the price of the underlying can have a big impact on your profit or loss.

LIQUIDITY RISK – Spreads can be high in CFDs and can become higher as markets become more volatile. You also have the risk of a position being closed for you by the broker if you do not meet the variation margin.

COUNTERPARTY RISK – This is the risk that the broker you are transacting with fails to fulfil the obligations of the contract. There are a lot of reputable brokers out there but there are some shoddy ones as well.

Comparison With Options

For some people, CFD’s are much harder to understand than options, but really they are much simpler. Once you get your head around the margin requirements and making money as the market drops, there’s not much more too them. They are basically just a way to take on a massively leveraged exposure to a stock.

With options, you have to worry about the strike price, expiry date, implied volatility and the greeks to name a few things.

Hopefully this article has cleared things up for you regarding CFD’s, but let me know if you have any questions by leaving a comment below.

The following video provides a pretty good overview of CFD’s, although it seems like the guy is reading straight from a script and it’s a bit off putting that he’s not looking at the camera.

Gavin- in the above example of 1000 CFDs and a $100 stock with a 5% initial margin when we go long are we paying daily interest on the full $100k or on $95k?

I don’t believe so, unless there is a margin call, but it’s best to check with your broker. Personally, I’ve never traded CFD’s and don’t plan on it either.