Here are 7 things the charts are saying about the current market. Have a great trading day.

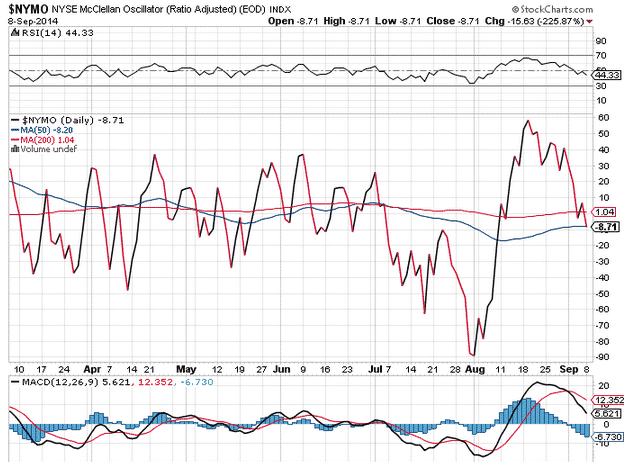

1. The McClellan Osciallator is in neutral territory having come down from the high 50’s.

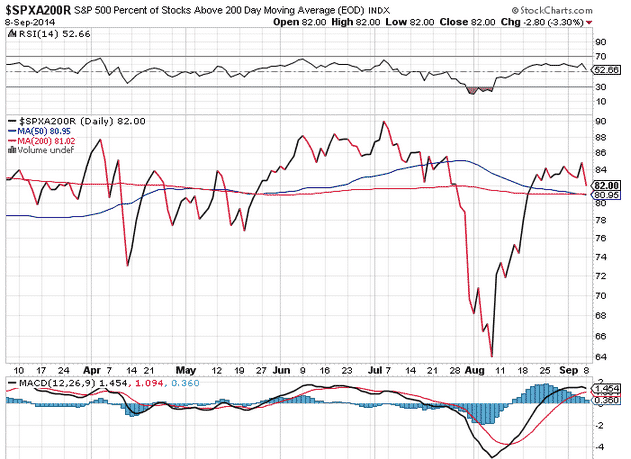

2. The current percentage of S&P 500 stocks above their 200 day moving average is 82%. This is below the high of 90% reached in July.

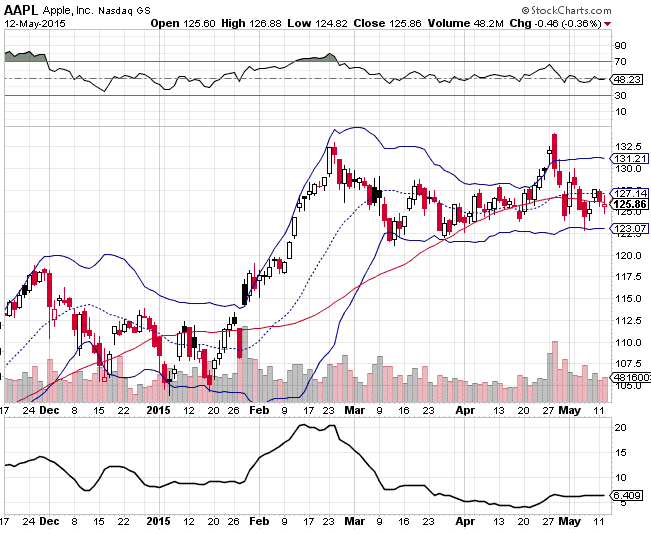

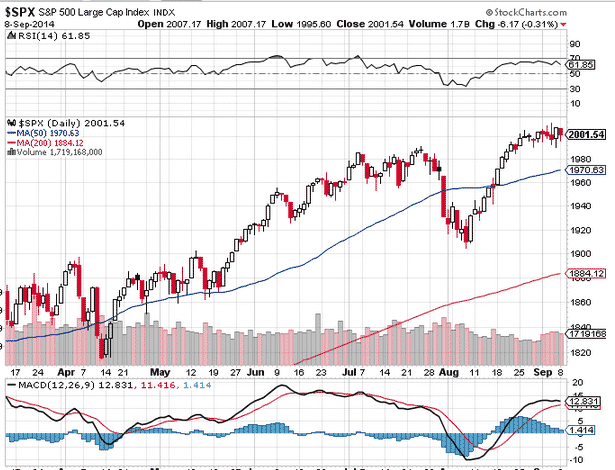

3. The RSI reading for the S&P 500 is 61.85. I would look to sell bear call spreads if that reading reaches 70.

4. The MACD indicator on the S&P500 is getting close to a bearish MACD cross.

5. SPX has traded within a range of 1991 and 2007 since August 2007. That range should break very soon.

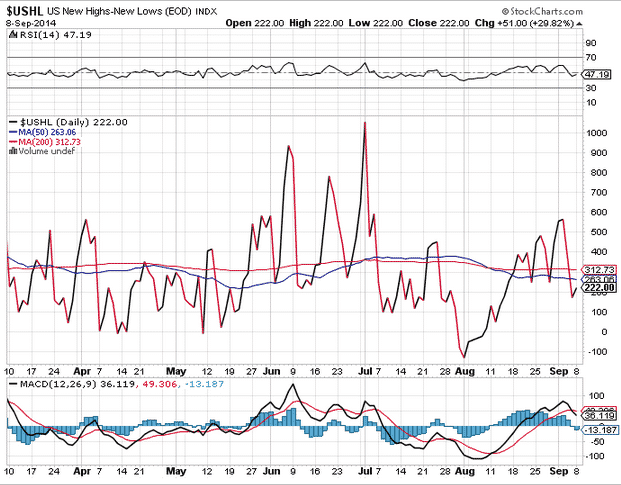

6. The New Highs – New Lows Index is at 222, well below the peaks reached in June and July.

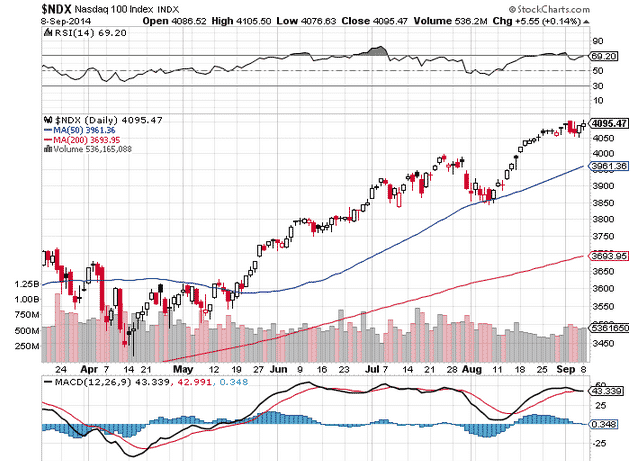

7. NDX has the highest RSI reading of the major indexes at 69.20

1.

2.

3 – 5.

6.

7.