I often get asked about the best way to enter iron condors. Particularly for newbies, this can be a bit daunting and confusing, so let’s discuss the best way to go about it.

In terms of setting up the actual orders, most brokers will allow you to open the position as 1 trade, or you can trade it via two credit spreads, or trade the four legs individually.

Before we look at the different methods, it’s important to have a good understanding of the role of market makers and the bid-ask spread.

Market makers set the bid and ask price for each option chain. For a typical RUT option, you’re looking at an average spread of around 0.20 for out-of-the-money options and 0.50-0.60 for in-the-money and at-the-money options.

< Learn the 6 keys to successfully adjusting iron condors >

Therefore, with a fairly large spread, it is absolutely crucial that we get a good fill price on our trades. Otherwise, you will be behind the 8-ball from day one and constantly playing catch-up.

We want to be entering our trades as close to the mid-point of the bid/ask spread as possible.

Often, you can just do this quickly in your head, but I’ve also created a spreadsheet that you may find helpful. The spreadsheet will also tell you the maximum potential gain and loss from the trade and also the percentage amount the stock would need to fall (rise) before hitting your short strike.

When you enter the bid and ask prices of each option chain into the spreadsheet, we then have our mid-points which equates to the initial price at which we will attempt to get filled.

In fact, I usually start my initial price entry a little bit BETTER than the mid-point. Occasionally, there will be a desperate buyer out there and you can get filled, but not always.

Once you have your mid-point, you can start entering your trade.

ENTERING AS 1 IRON CONDOR TRADE

With some brokers- Interactive Brokers, for example- you can enter all four legs of your Iron Condor as one trade. However, it is incredibly hard (I would say almost impossible) to get a good fill using this method.

The reason is that you need the market makers to give you a good fill on ALL FOUR of your option legs simultaneously. Generally, that’s not going to happen. They are trying to make money off you, so they are not likely to budge too much.

The advantage of using this method is that it’s a one and done deal. With the other methods you run the risk of the market moving against you when only half of the position is opened.

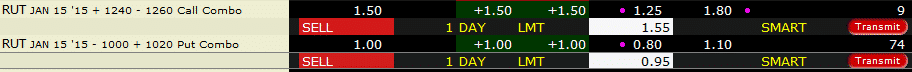

Here’s how a typical order would look using this method:

![]()

Notice that you’re buying it at a negative price. This may be confusing for you. Just remember that you want to buy low and sell high, so when entering a buy order, a lower price is better. Therefore -3.00 would be a better price than -2.20. Buying at the mid-point of -2.60 would see $260 deposited into your account.

If you don’t have any luck getting filled at a good price using this method, you have two other choices:

ENTERING 2 SPREAD ORDERS

I usually prefer to try this method first, as it is a little easier to enter only 2 trades, rather than 4. The downside is that it can take longer to get filled and the price may not be quite as good.

I first start by entering the two spread orders: a Bull Put Spread and a Bear Call Spread. I set the starting price above the mid-point and leave the trades in a pending status. Depending on how close to the mid-point I am, I sometimes leave the orders there for a few minutes, on the off-chance that they might get filled at a really nice price.

From here, I gradually start bringing my price down, until both the spread prices are right at the mid-point. I now leave these trades as they are for 5 minutes or so, to see if they will fill. If the markets are moving around a bit, I might update the price, to keep it in line with the mid-point. You don’t want to compromise too much on your price.

Occasionally, you won’t be able to get filled right at the mid-point. If this happens and you have had the pending trade open for an hour or so, you can move your price slightly below the mid-point, but no more than 0.05. Sometimes, it’s better to let a trade opportunity slip away rather than get into a trade at a bad price. Patience is key in this business, just remember, and there will ALWAYS be another trading opportunity. Don’t force your trades.

Once one spread has been filled, you want to try and get filled pretty quickly on the other spread. The issue here is that if you only get filled on the one side and the market moves against your open position, you may never get the chance to enter the other side of the spread. As a result, you may need to move your strike prices up (down) or compromise your price. So, it’s fairly imperative that once you get filled on the first side of the Iron Condor, you get filled on the other side pretty quickly. I would say within around 5 minutes or so, unless of course, you are planning to leg into you trades as I discussed earlier.

ENTERING 4 LEGS INDIVIDUALLY

A lot of the same principals discussed above also apply to this method of entering your Iron Condor trades. However, using this method takes a little more skill and experience, so I do not recommend it for beginners. The difficulty with this method is that you are trying to get filled on 4 legs, so the risk of the market moving against you when you only have 1, 2 or even 3 legs on is quite high. One thing I would recommend for all traders, no matter what method you use, is to avoid placing your trades within the first 30 minutes and the last 30 minutes of trading. During these times the markets are more volatile, so the risks are higher, particularly with the 4 individual legs method.

You want to start by setting up the 4 trades individually and leaving them in an open or pending status, with the price somewhere above the mid-point. From there, you gradually bring your prices down to the mid-point and then leave them there for 5 minutes or so.

Once you get filled on the first leg, you want to make sure you get filled pretty quickly on the other legs, to prevent the market running away from you. I would say you would want all legs filled within 5 minutes of the first leg getting filled. Sometimes, this might mean you have to compromise your price a little bit and go below the mid-point.

Another thing to keep in mind, particularly if you are trading a large position size, is that the market makers will know what you are up to and try to squeeze every last penny out of you. For example, if you have 4 option orders pending for the 4 legs of your Iron Condor, each for 20 contracts, the market makers will assume this is one person trying to place an Iron Condor. Once your first trade gets filled, they may be less inclined to take the other side of your 3 other trades at the mid-point of the bid/ask spread. They will know that you need to get your other trades filled quickly to limit your exposure and they will prey on that fact.

For what it’s worth, my preferred method is to enter the orders as two credit spread orders, a Bull Put Spread and a Bear Call Spread. Once the first spread is filled, I try to get filled as quickly as possible on the second spread, to minimize slippage.

The next time you’re opening an iron condor, try the different methods and see which one works the best for you.