This week Standard and Poor’s conducted their annual review of the year and their outlook for 2015. I was fortunate enough to be on the webinar and it is always great value.

Sam Stovall and his team did a great job as usual.

Unfortunately there was no Mark Arbeter this time as I always enjoy listening to his technical outlook for stocks and commodities.

Energy was obviously a big discussion point given the massive price drops we have seen recently. Interesting to note that previous times that energy has had such a large relative decline, the sector has subsequently outperformed to the tune of 16% over the next 2 years. BUT, you have to be patient. Within 1 year the performance is flat to slightly negative. So I think, set a reminder in your calendar about 4-5 months from now to start looking at some energy names again. Until then, just ignore the sector entirely.

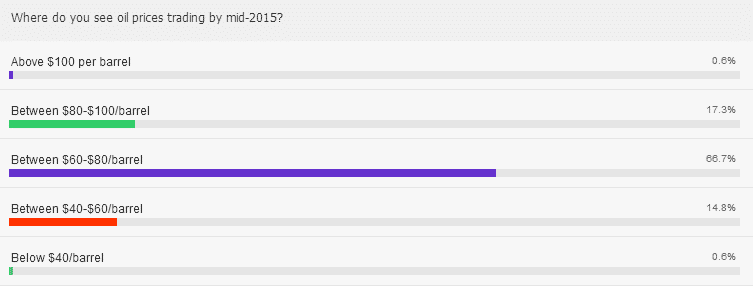

In a poll of the audience, 66% of respondents thought oil would be in the $60-80 range in mid-2015.

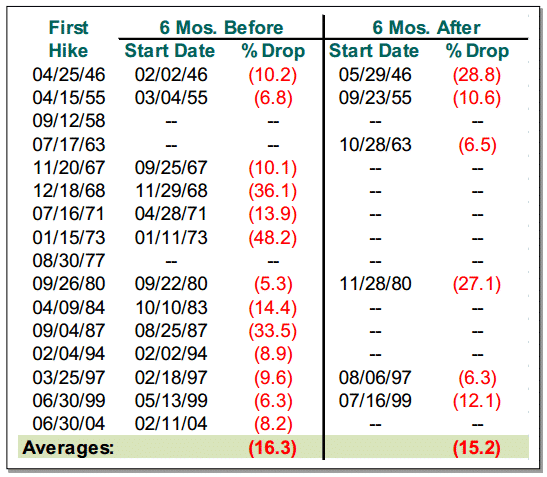

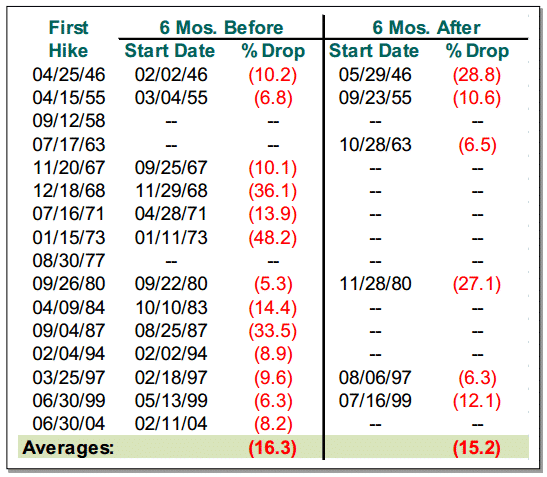

Some other data presented was the performance of the S&P 500 before and after the first rate hike of each cycle. Take a look at the results below:

Technically it was all bullish, with all major indices in uptrends with key support levels in tact. Until those levels are broken it should be full steam ahead.