TGT has just triggered an alert on CMLViz for a pre-earnings diagonal, so let’s take a look at this and see how it performs over the next few weeks.

LOGIC FOR THE TRADE

The logic behind the test is easy to understand — in a any market there can be a stock rise ahead of earnings on optimism, or upward momentum, that sets in the two-weeks before an earnings date.

We will examine the outcome of going long an at-the-money (strike price is set to the 50 delta) call option that has 14-days to expiry, and short an out-of-the-money (strike price set to the 30 delta) call option with 7-days to expiry.

The trade is opened 14 days before earnings and closed 1 day before earnings. As such, there is NO EARNINGS RISK.

The trade only triggers if TGT is above the 50-day moving average which it is currently.

TRADE SETUP

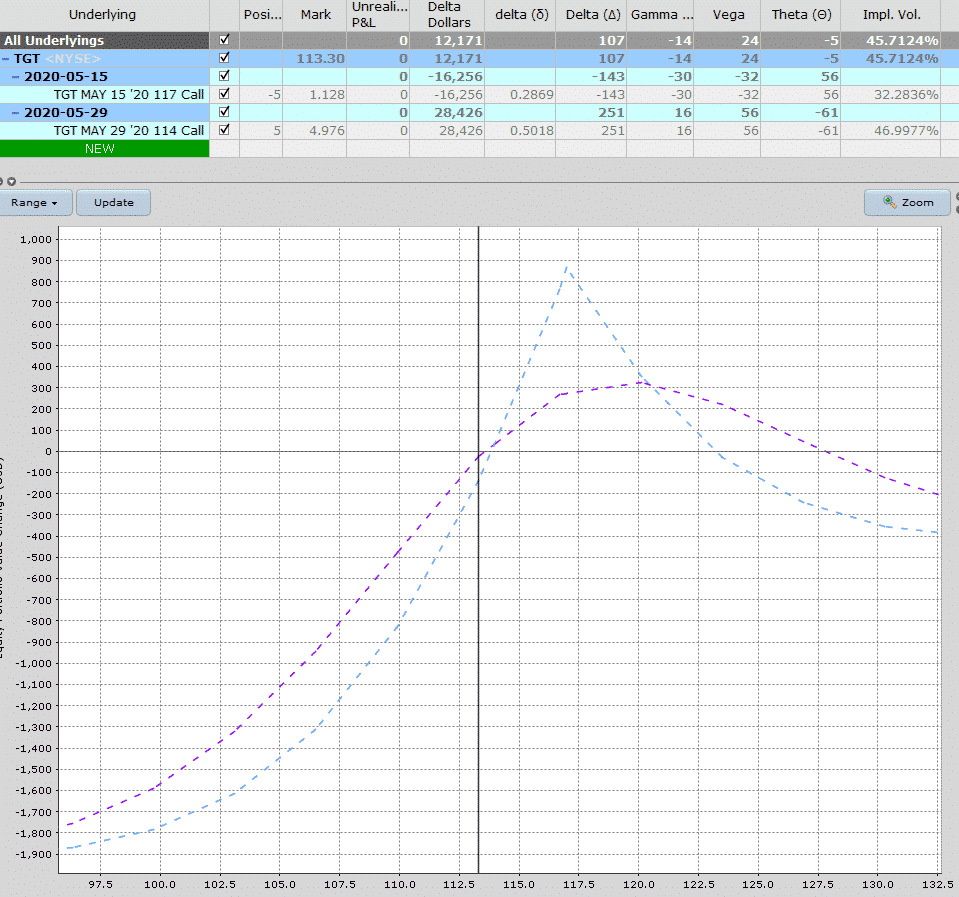

Here’s a typical set up for a trade like this:

Date: May 6th, 2020

Current Price: $113.3

Trade Set Up:

Sell 5 TGT May 15th, 117 calls @ $1.13

Buy 5 TGT May 29th, 113 calls @ $4.98

Premium: $1,925 Net Debit.

Breakeven: Approximately $113.80 and $123.20

Let see how this trade works out. Just a reminder to always do your own due diligence and consult your financial advisor before making any investment decisions.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.