TastyTrade brokerage accounts provide the TastyTrade desktop trading platform for options analytics.

Schwab brokerage accounts provide the ThinkOrSwim trading platform.

Contents

Introduction

While there are web-based versions of both, the desktop apps have more features and capabilities.

While there are mobile apps for both, the desktop apps are probably the tool of choice.

Obviously, there are other considerations for choosing a particular brokerage other than the quality of their trading platforms.

For today, we will look at the two desktop apps, TastyTrade and ThinkOrSwim.

To use TastyTrade or ThinkOrSwim, you need to open a brokerage account with TastyTrade or Schwab, respectively.

At Schwab, you can open an account with no minimum balance.

That means that once you sign up, you can download and use ThinkOrSwim without depositing any money.

Since you have no money in the account, you can not really trade with it.

However, you can pretend-trade with Schwab paper money accounts.

At TastyTrade, there is also no minimum balance to open.

However, there is a minimum balance requirement for using margin, which is necessary for options trading.

But TastyTrade has no paper money account.

Why Is A Paper Account Important

Some people are trading options with a brokerage that does not provide the options analytical ability to see the risk graph or the option Greeks.

For example, they may be on IRA accounts at Fidelity or Merrill Edge.

While they can set up a position in TastyTrade to see the option analytics, they can not save this position unless they execute that position live in a TastyTrade account.

This is not a practical solution for people who do not want to switch brokerage or add money to a second brokerage account.

However, with Schwab, they can open a zero-balance Schwab account and enter their positions into the ThinkOrSwim paper trading account, where they can submit and save all their positions without having real money.

They monitor their option Greeks and risk graphs there and go back to their brokerage to enter the orders.

TastyTrade Greeks

Let’s take a look at the interface of the two platforms.

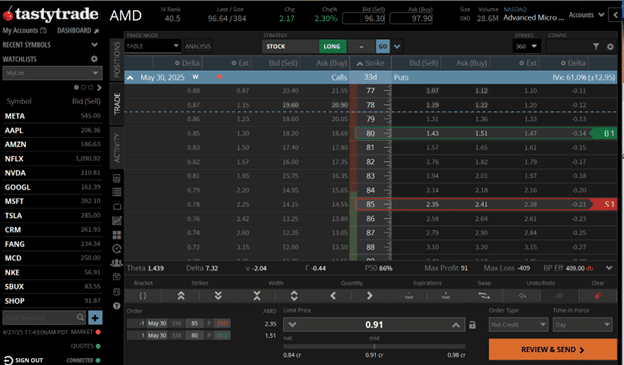

Starting with TastyTrade, we have entered a bull put credit spread on AMD, which is 33 days till expiration:

The short leg is shown in red; you can drag it and easily move it to different strikes.

The long leg is shown in green.

You can see from the column “Delta” that the short leg is at the 20-delta on the option chain.

The 80-strike put option is at the 14-delta.

The blue accordion header shows the expiration to be May 30, 2025, with “33d” till expiration.

It also shows the expected move to be “12.95”.

That means the AMD price is expected to move up or down about 13 points at expiration.

The IVx of 61% shown is the implied volatility for that expiration cycle.

The important metrics shown in the above screenshot are the option Greeks:

Delta: 7.32

Theta: 1.4

Vega -2.0

Gamma: -0.44

TastyTrade Risk Graph

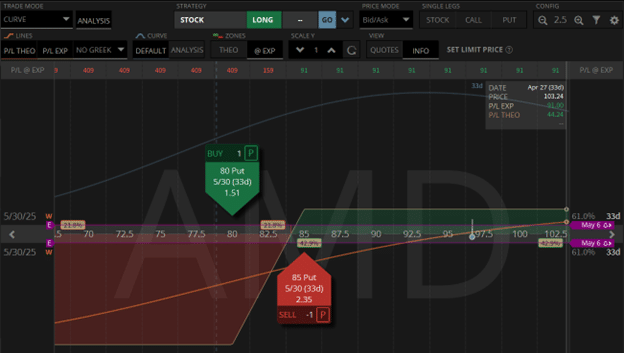

To see the typical bull put risk graph, you have to change the Trade Mode from “Table” to “Curve” and toggle on the “Analysis” tab:

The blue dot on the horizontal axis is the AMD current price.

The green shaded area is the profit at expiration.

The red is the loss at expiration.

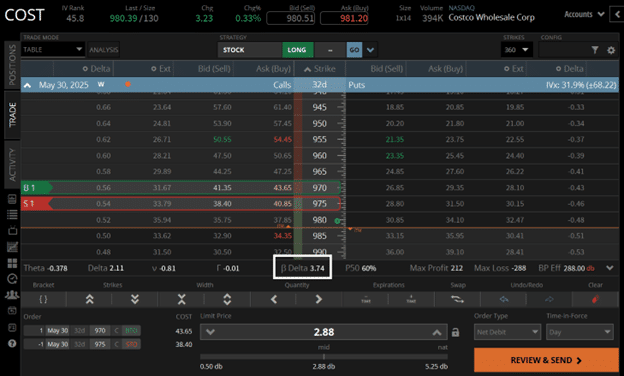

ThinkOrSwim Greeks And Risk Graph

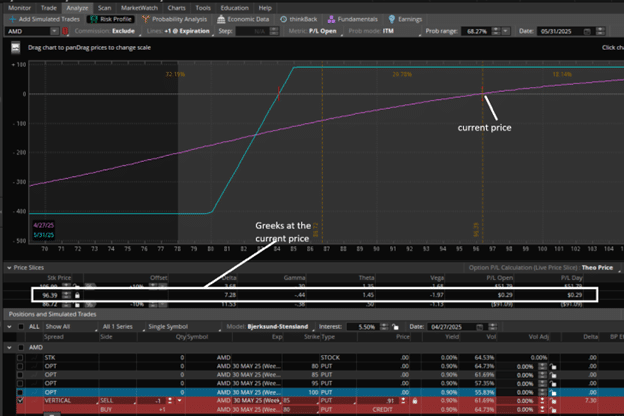

Let’s look at the same bull put credit spread position in ThinkOrSwim.

Here, we see the familiar risk graph:

The small vertical hash on the x-axis is where the current price is, and the price slice at the current price of 96.39 shows you the Greeks:

Delta: 7.28

Theta: 1.45

Vega: -1.97

Gamma: -0.44

You can see that they are comparable to what TastyTrade is showing.

Concluding Thoughts

While the modern drag-and-drop interface of TastyTrade is nifty, the options analytical ability of ThinkOrSwim is world-class and is difficult to surpass.

Because of the large number of features and a gazillion things to click in the user interface, it will require some time to learn.

Let me help get you started by answering a few basic questions.

FAQs

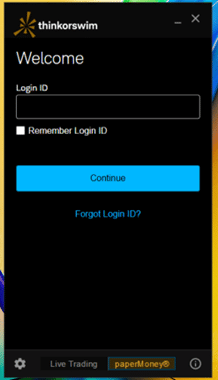

How do I get Into the Paper Trading Account in ThinkOrSwim?

By selecting paperMoney at the bottom of the login dialog:

Can I See Tom Sosnoff’s Trades in TastyTrade?

Yes, and for some other TastyTrade folks as well.

How do I Add Multiple Legs to an Options Position in ThinkOrSwim?

Click on the “ask” price in the option chain to buy. Click on the “bid” price to sell.

Once you have one leg in place, hold down the control key and click for the second leg.

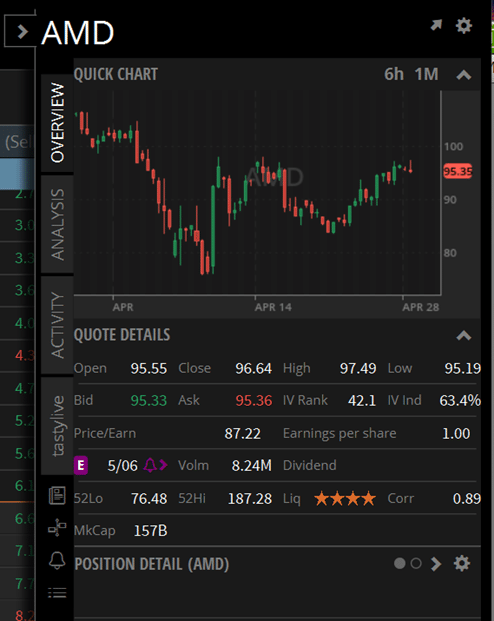

How Can I See the Liquidity of a Stock in TastyTrade?

Open the right-side panel, type in the ticker, option the quote details accordion:

The more stars you see in “Liq,” the more liquid the stock is.

Four stars is the best liquidity, and one star is the worst.

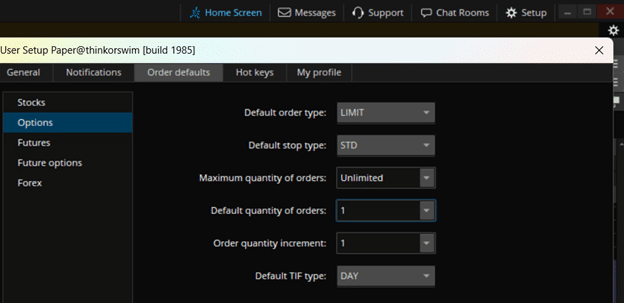

How Do I Set the Default Contract Size for My Options Position in ThinkOrSwim?

Click Setup -> Application Settings -> Order defaults -> Options -> Default quantity of orders:

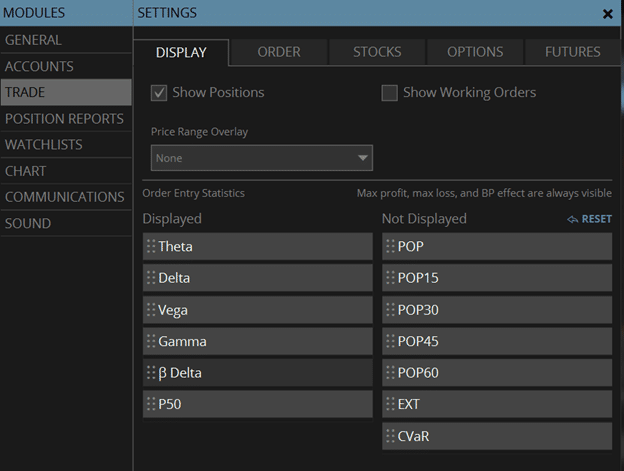

Can I see the Beta Weighted Deltas in TastyTrade?

Yes, it is beta-weighted to SPY.

To get it to show, you need to adjust the trade display settings here:

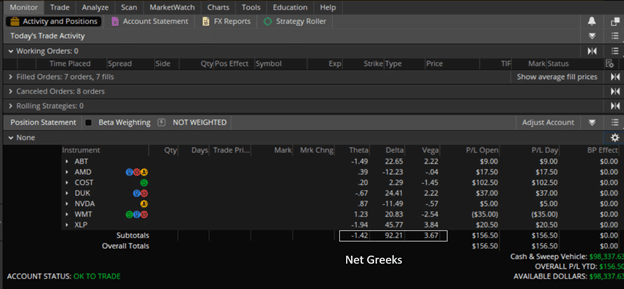

Can I See the Combined Portfolio Greeks for all my Positions in ThinkOrSwim?

Yes.

You can see the weighted Deltas to SPY or other assets if you check the beta weighting in your checkbox.

Finally:

I’m sure you have a whole lot more questions.

We have barely scratched the surface regarding the capabilities of these two options trading platforms.

Covering all the features plus the extensive customization flexibilities of these platforms would be like writing a book.

We hope you enjoyed this article on the TastyTrade and ThinkOrSwim platforms.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.