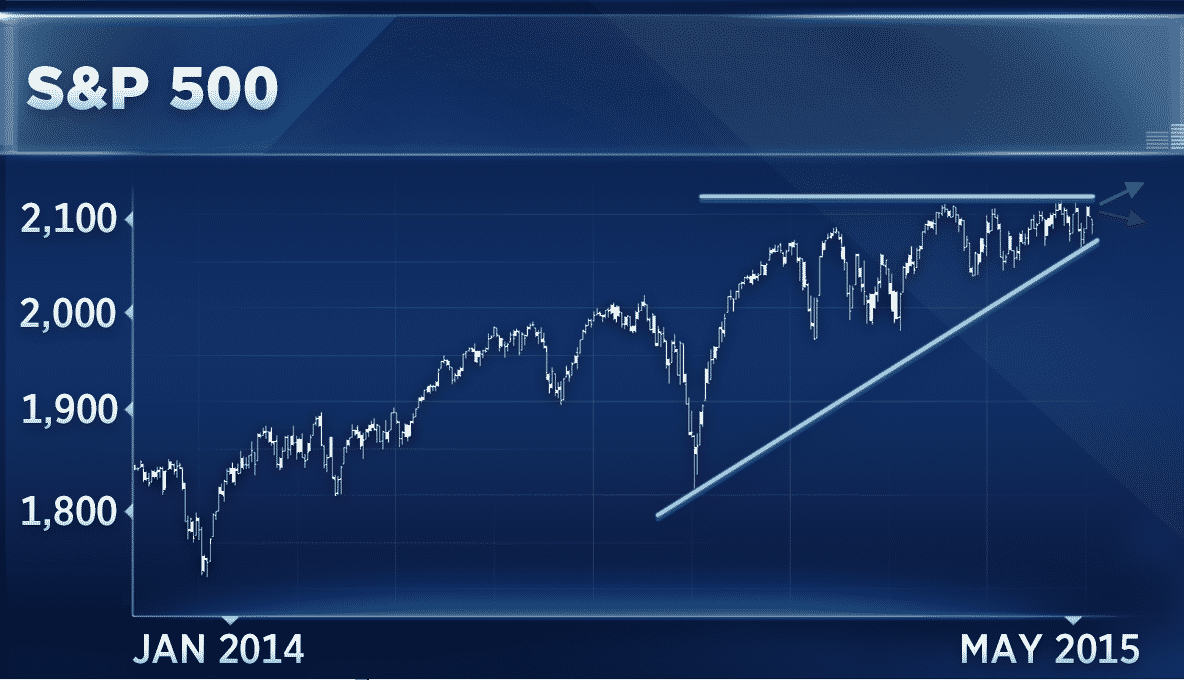

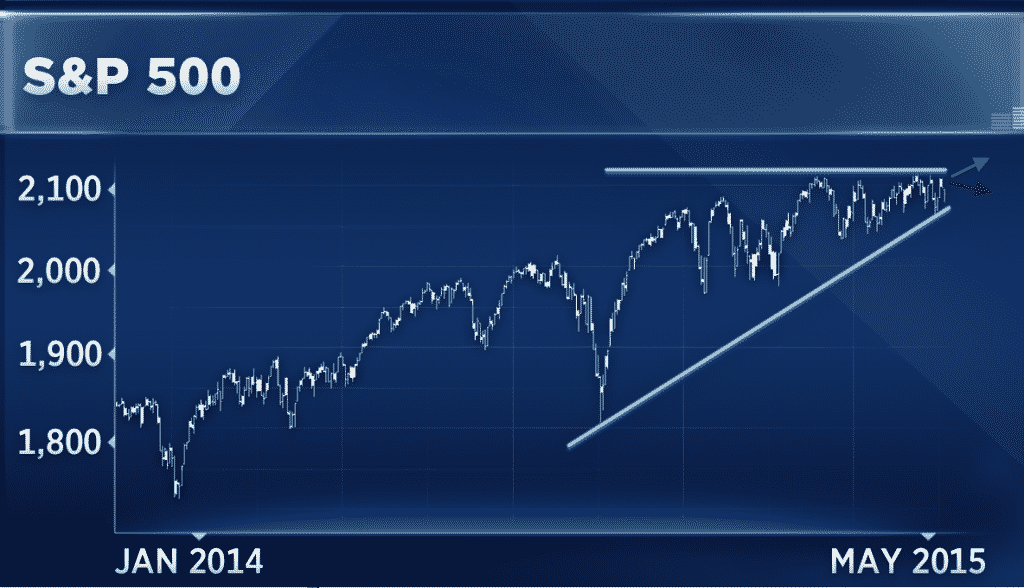

Stocks are wound up tight and are poised for a massive move in either direction. Last week I mentioned AAPL was set for a big move and I think that is also what is in store for the broader market. According to gun technician Carter Worth, “The S&P 500 is trading within its tightest range to start a year in almost a decade. It’s almost as if they closed the market.”

Worth shared the following chart on CNBC and it doesn’t take a genius to see the contraction in the range over the last few months. At some point, the S&P 500 will break out of that range, and that could signal the start of a bigger move.

Image Credit: CNBC

While it’s easy to argue that stocks could break down from here, you could just as easily argue that stocks could go on 1999 style run given the unprecedented stimulus being pumped out by central banks.

Jesse Felder paints a worrying picture and argues that we are experiencing a “Bubble in Everything“. If that’s the case, we could be in for a rather large move either way. Remember that before bubbles pop we usually see one final over exuberant rally before the bubble pops.

Either way, this market choppiness should be resolved very shortly.