Here are 5 charts I am currently watching. Have a great trading day.

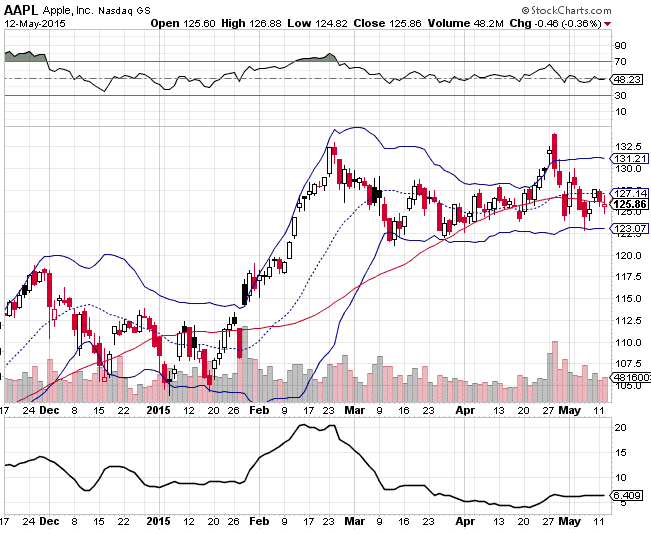

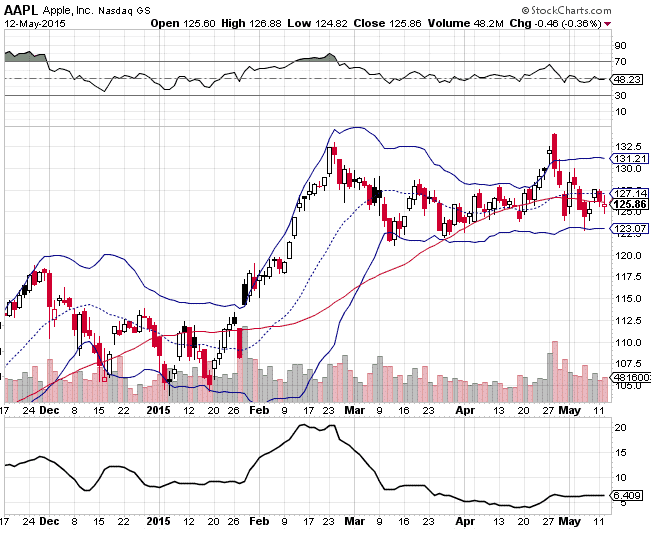

1. AAPL

- Has been more or less range bound for 3 months

- The Bollinger Band Width is near the lowest it has been in the last 6 months

- AAPL is in the middle of the Bollinger Bands

- I’m watching for a breakout either way.

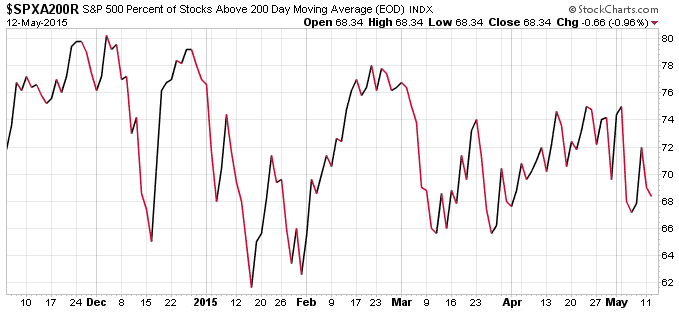

2. SPXA200R

- The percentage of S&P 500 stocks above their 200 Day Moving Average continues to flounder as the major indices struggle at the highs.

- Making successively lower highs

- Currently well below the peak set in December

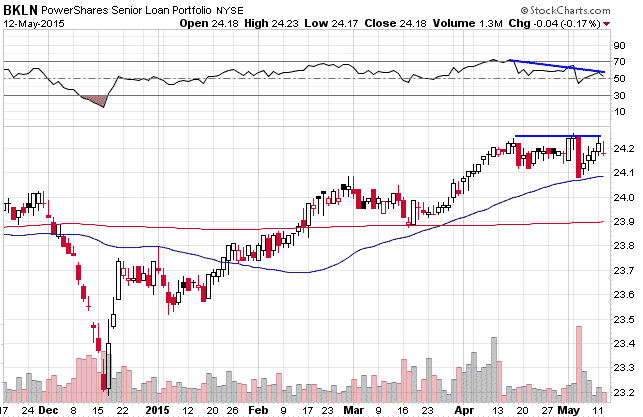

3. BKLN

- Showing RSI divergence at the highs.

- I’m watching this to see if it rolls over or breaks to new highs. Stocks could follow the lead.

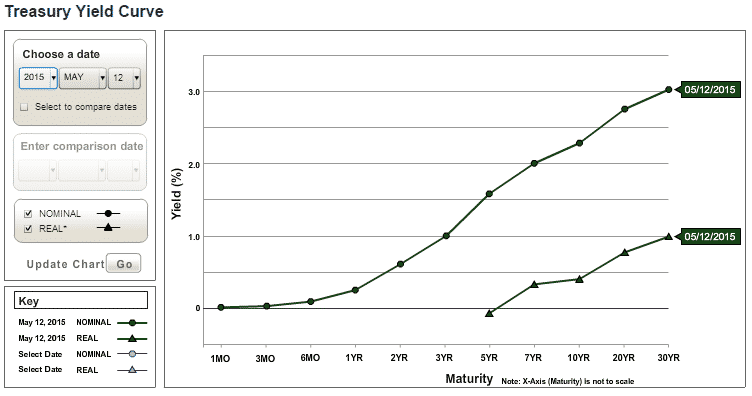

4. Yield Curve

- Negative yield curves are typically seen as a precursor to recession.

- No sign of a negative yield curve here

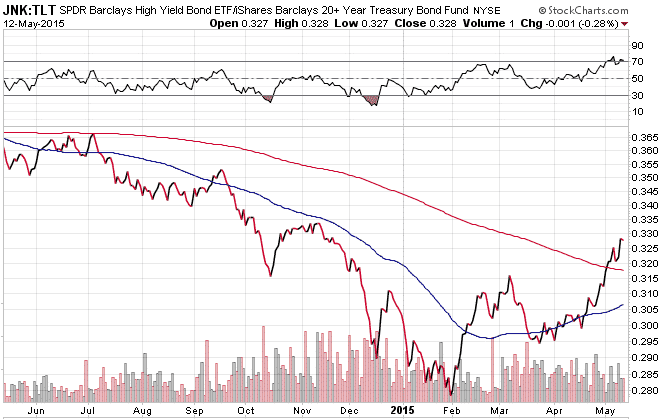

5. Junk Bonds

- Corporate defaults are another item that can cause the economy to falter.

- Right now, junk bonds look pretty strong

Click Here For My Top 5 Technical Indicators

Hi Gavin I would like to thank you for all your very good blog posts. I really learn a lot and could also benefit from some of your teachings. My favorite is selling a short strangle when Bollinger Band Width is at a multi week high. That were some of my biggest winners. Thank you keep up the good work. Andreas (Germany)

Thanks for your comment, always nice to get positive feedback.