In today’s example, we are looking at a squeeze trade on META.

We will be using the free built-in TTM Squeeze indicator on barchart.com.

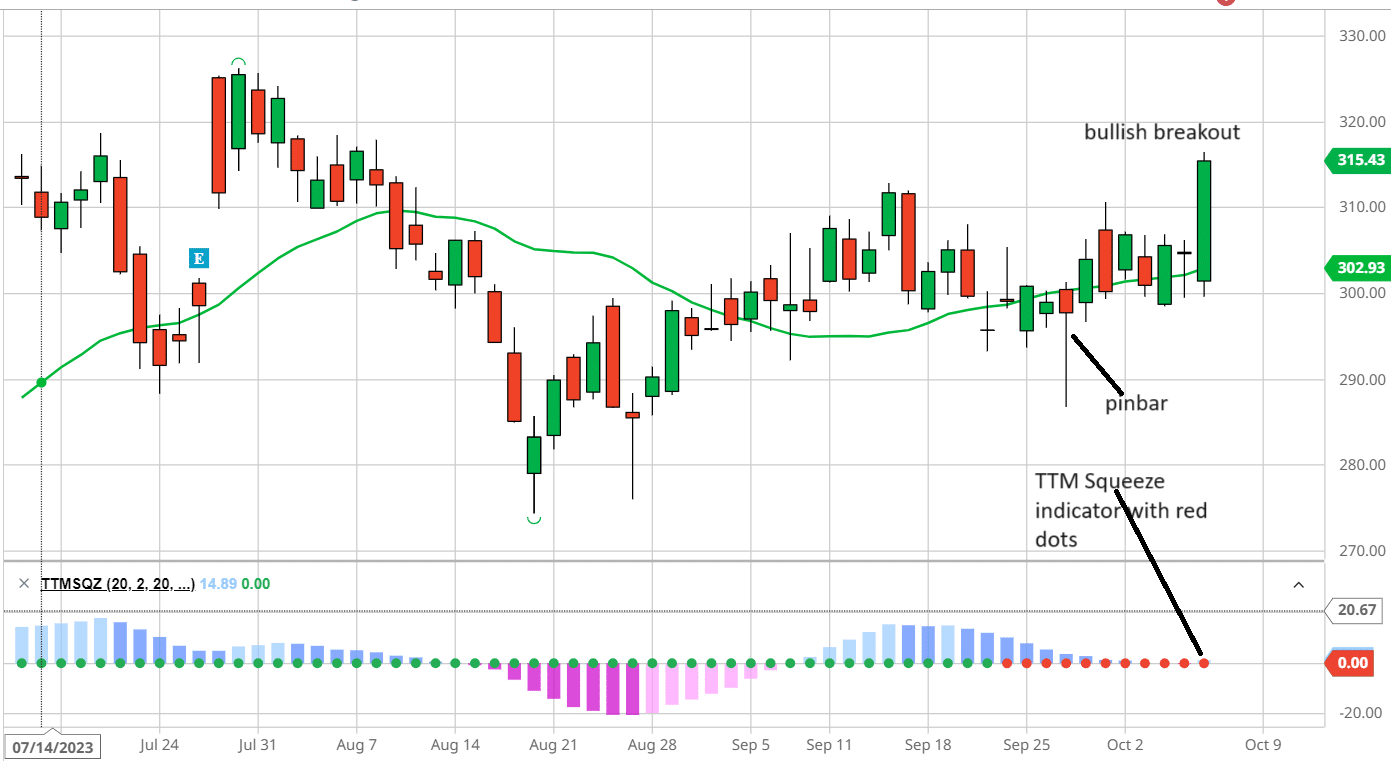

Early October 2023, Meta is moving in a side range consolidation.

It is in a “squeeze,” as indicated by the red dots of the “TTM Squeeze” indicator, which we had previously discussed.

This means that the stock is building up energy and is about to be released (which will be indicated by the red dots turning green).

However, many traders would like to get into position before the squeeze is fired to capture the move’s full potential.

Now, we have to decide which direction we think META is going.

Up or down?

On Oct 6, Meta closed with a bullish green breakout candle.

Previously, on Sept 27, a pin bar candle indicated that the price below $295 was being rejected.

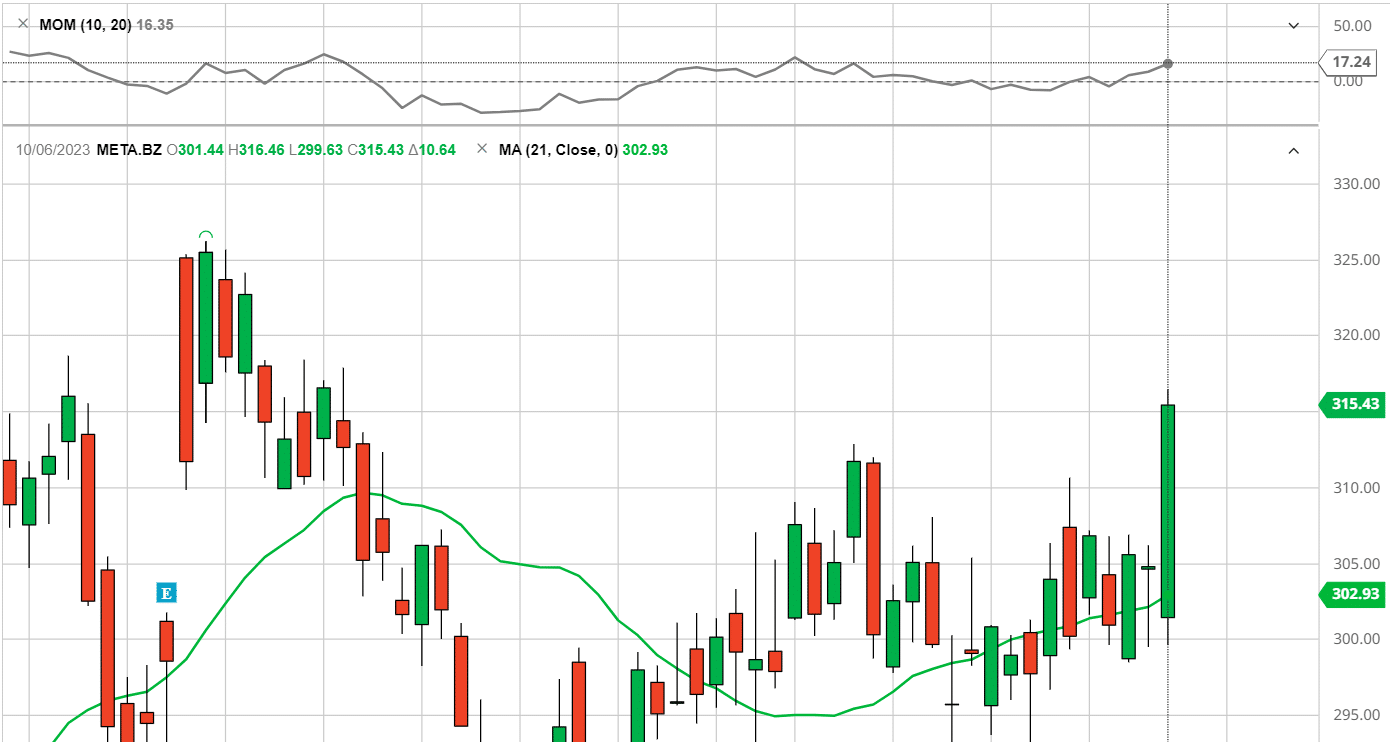

As added confirmation, we have positive momentum on the momentum indicator:

For some traders, this is good enough to put on a directional play for the upside move in Meta.

Suppose the trader thesis is that Meta will go up, but it would not likely go above $330, with $325 being its 52-week high.

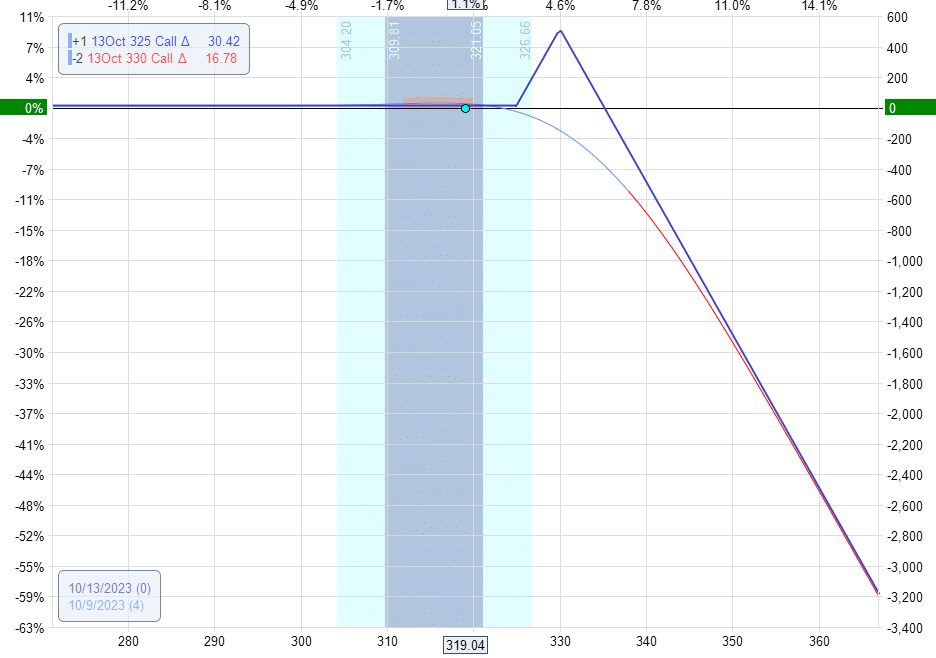

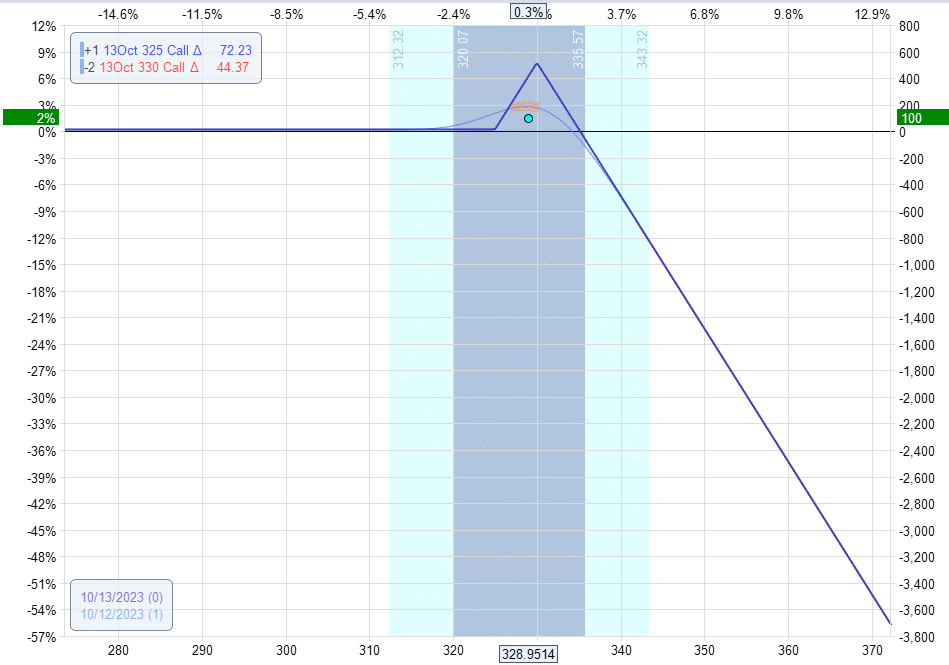

In that case, the trader might use a call ratio spread with the short calls at $330:

Date: Oct 9, 2023

Price: META at $319

Buy one Oct 13 META $325 call @ $2.85

Sell two Oct 13 META $330 call @ $1.49

Net credit: $13.50

This is a short-term trade with only four days till expiration.

The best scenario is if META goes up to $330 but not beyond it.

The drawback with this trade is that the graph does appear scary with unlimited loss if META goes to the moon.

That is why if we see Meta going past $330, we must start considering exiting the trade.

The disadvantage of this trade is that if we are wrong in our direction and META goes down instead, we don’t lose any money.

If META drops to zero, we still keep our credit of $13.50.

Let’s see what happens.

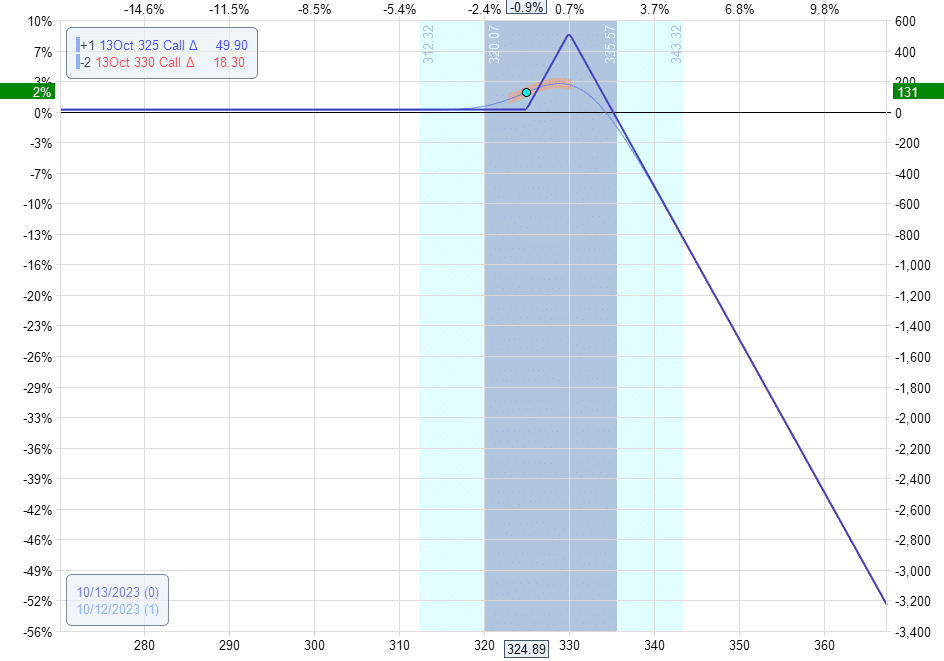

On Thursday morning or Oct 12, META went up to $329:

The trader could have exited at this time with about $100 of profits.

Then, the stock started to drop during the day.

By the end of the day, the price dropped to $325.

However, with the nice positive theta of the ratio spread, the profits increased to $131:

Another profitable opportunity.

At Expiration

He would have missed the boat if the trader had waited until expiration.

But would not have incurred any loss.

META would have dropped below the price when the trade started.

It would have gone in the opposite direction of our thesis.

Yet the trader would not have taken a loss but kept the profit of $13.

You can see this in the expiration graph when META closed at $314.69.

Frequently Asked Questions:

Why does my broker not allow this spread?

The spread contains a naked short call option and requires the highest level of option privileges, which not all accounts have.

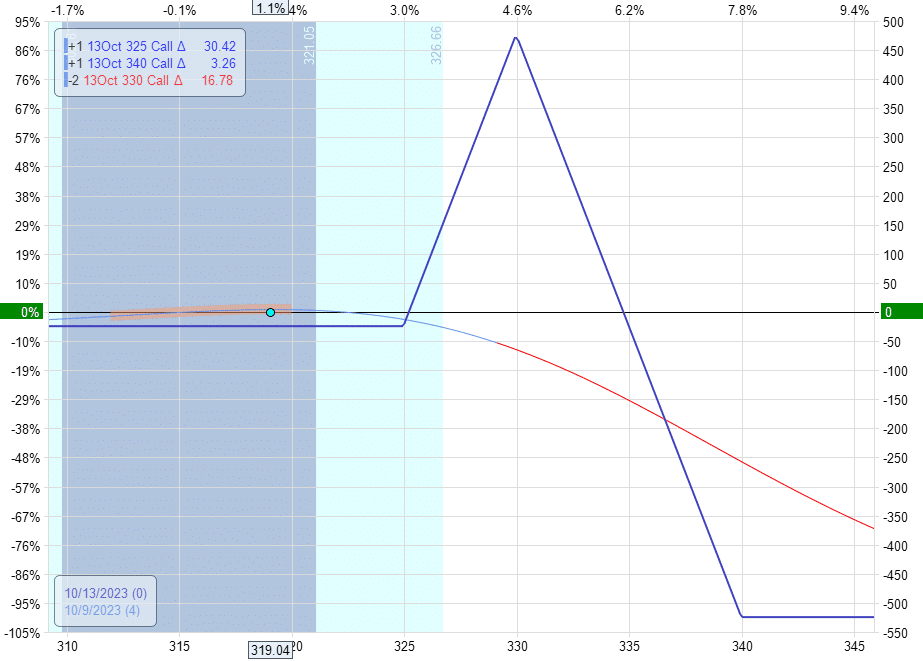

In that case, you can buy a far-out-of-the-money long call to turn this into a broken-wing butterfly.

For example, paying $38 for a $340 call like this:

The upside loss is capped at $525. And there would be a $24 loss if META is below $325 at expiration.

Will this make the same amount at the ratio spread?

No, because you had to spend $38 to buy the extra protection.

And the Greeks are slightly different.

You would have made $78 on Thursday morning and $95 on Thursday afternoon.

How far out of the money was the short call?

The $330 short calls were at the 17 delta on the option chain.

This implies that under normal conditions, based on the expected move, there is a 17% chance that META would close above $330 at expiration.

However, the squeeze indicates that META may likely move more than expected.

Conclusion

In this example, we saw a practical application of the ratio spread in making a directional play on a stock under “squeeze” conditions.

Even if the underlying price did not move, the trade would have made money because this is a positive theta trade, pushing the T+0 line up with each passing day.

We hope you enjoyed this squeeze trade on META.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.