Here are some interesting charts that I’ve been looking at over the weekend. Enjoy!

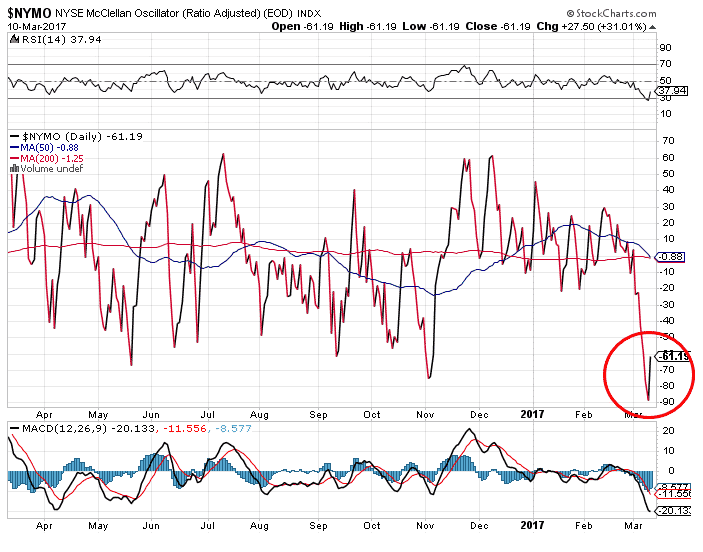

NYSE McClellan Oscillator

Rebounded from deeply oversold levels on Friday. It’s amazing that this indicator got so low considering stocks have not sold off significantly and are still near all-time highs.

NASDAQ McClellan Summation Index

Usually a pretty reliable indicator of tops and bottoms. Again, very interesting that this indicator is at oversold levels considering the Nasdaq is basically at an all-time high.

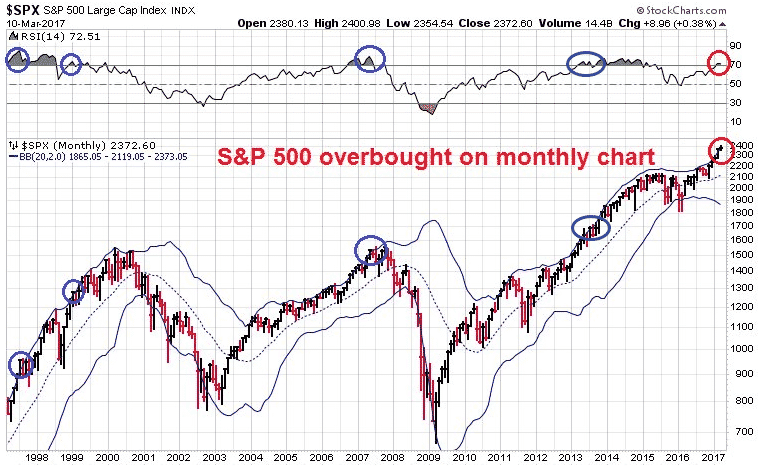

S&P 500 Monthly Chart

Starting to reach overbought levels on a monthly basis, BUT that does not necessarily indicate a top is imminent. See 1998, 1999 and 2013.

Click Here For My Top 5 Technical Indicators

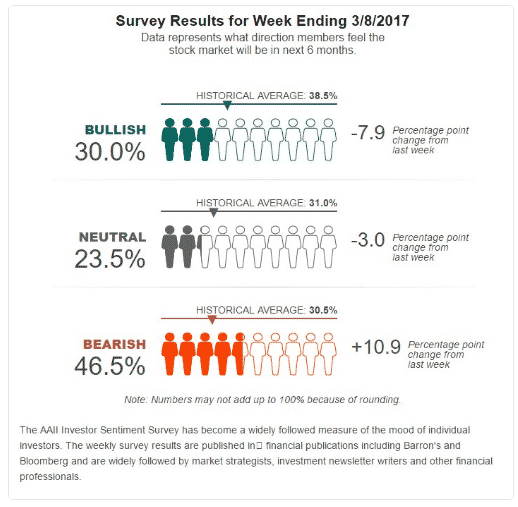

AAII Investor Sentiment Survey

Still a lot of bears out there…..

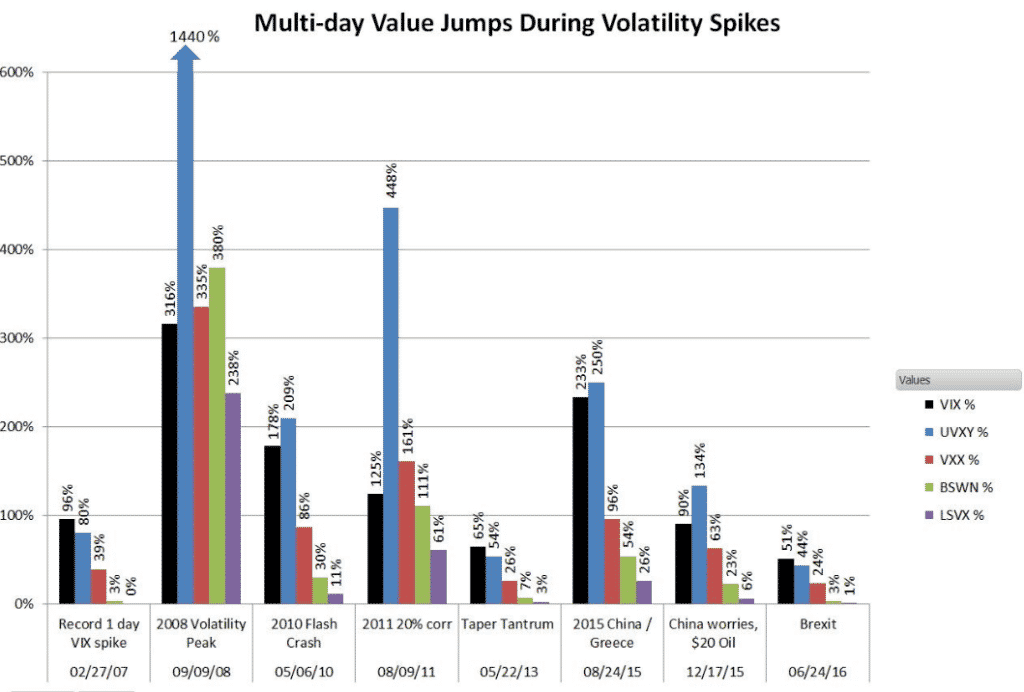

Performance During Volatility Spikes

Some interesting data here for those betting on continued declines in VXX and UVXY. Yes, they will naturally decay over time, but look at that performance during past volatility spikes.

Here is an excellent and succinct explanation of why these assets decay:

https://blog.tfscapital.com/the-hidden-83-9-tax-on-volatility-4e556cb1279e#.89ozvnpvh

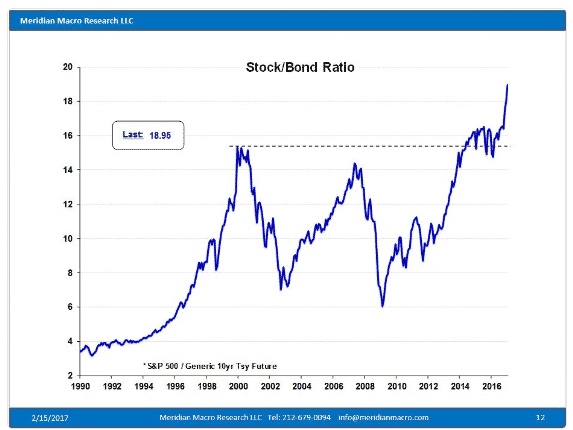

Stock / Bond Ratio

Higher than 2000 and 2008. Scary? Maybe.

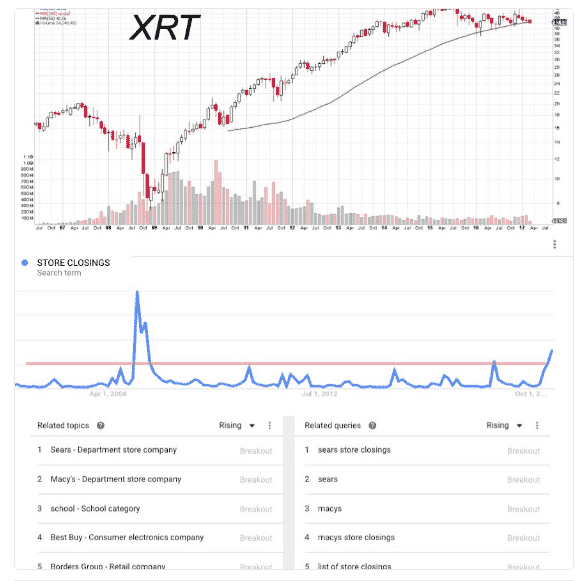

Retailers Rolling Over?

Retailers looking like they are about to roll over? The world is going online and companies like WMT, TGT, SHLD and M may get left behind.

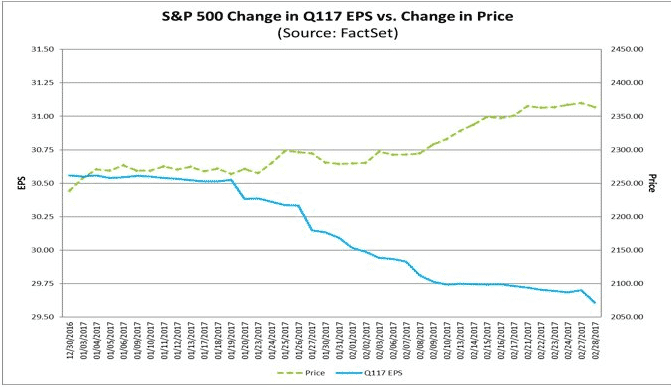

Where Are The Earnings?

S&P 500 continues to rally while earnings decline? Bulls better hope Trump delivers on his promises as they are fully baked in at this point.

Ultimate Guide to the Stock Repair Strategy

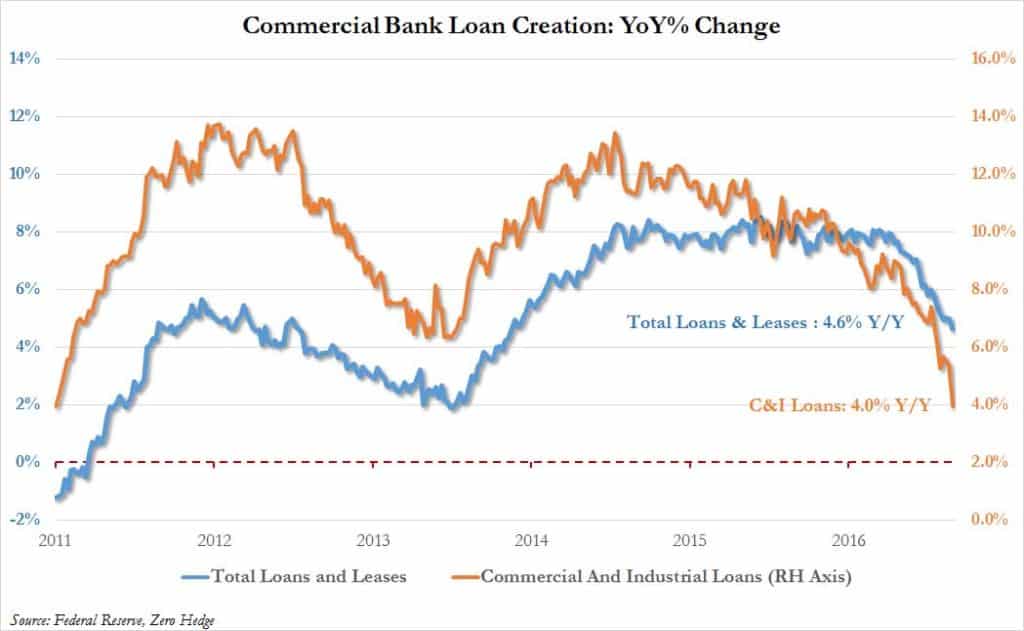

Commercial Loans Cliff Diving

Generally in an expanding economy, you would expect to see lending picking up steam…..

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.