Financial markets have been off to a flying start in 2017 with the BTFD mantra in full effect. The Dow Jones broke through the key 20,000 level and barely batted an eyelid before ramping up to 21,000. Not to be outdone, the S&P 500 is hovering around 2,400 and the Nasdaq is around 5,900.

Over the past 12 months, the Dow is +19.84% , the S&P 500 is +16.89% and the Nasdaq is +23.56%.

Why Are Equity Markets Rallying on Wall Street?

It’s interesting to think back to before the election, the general consensus was a Clinton victory would be good for the markets while a Trump victory would be bad.

Once it became obvious that Trump was going to win, the overnight futures were down as much as 5%. That seems like a long time ago now.

As we all know, that selloff reversed itself within the course of the day and finished in the green. It’s been full steam ahead since then with markets experiencing a rally of epic proportions.

The main reason behind the rally is increased confidence in the future.

Get Your Free Covered Call Calculator

This is due to Trump’s massive stimulus plans including tax cuts and huge expenditure to upgrade roads, infrastructure, railways, schools, the military etc. The figure being put forth is $54 billion, with another $30 billion if necessary.

So, just as the Fed looks to be turning off the money printing tap, the government is taking over with massive fiscal expenditure.

Naturally, markets have responded positively to this sentiment.

If we are entering the final stage of this bull market (there is an argument that this is the beginning of a new bull market after we had a stealth bear market in 2014), things can get pretty crazy. Valuation measures get thrown out the window as rampant optimism and greed take hold.

Remember markets can remain irrational longer than you can stay solvent.

However, markets don’t go in one direction forever and there will be pullbacks along the way.

How Will the Fed Funds Rate Impact the Market in 2017?

The federal funds rate, is the interest rates set by the Fed FOMC. Fed chair Janet Yellen and vice chair Stanley Fischer have alluded to several rate hikes in 2017, the first of which occurred this week. The move took the overnight funds rate to a target range of 0.75% – 1%.

“The market was bracing for a much more hawkish tone from the Fed. The early reaction looks to be one of relief, that the market’s worst fears were averted,” said Michael Arone, chief investment strategist at State Street Global Advisors.

There are expected to be two further rate hikes this year.

This should see the USD strengthen with resulting capital flows into the US. This could potentially be a positive for US stocks.

Register For 10x Your Options Trading

What Could Possibly Go Wrong?

At this stage, it seems like a lot of Trump’s plans are baked into the markets.

What happens if he can’t get some of his proposed reforms across the line?

There are also concerns that the US will again run into problems with the debt ceiling given the ambitious plans of the Trump government. After all, if they cut taxes and increase spending isn’t that less money coming in and more money going out? How are all the infrastructure projects going to be paid for with less tax revenue? More debt of course.

Remember that in 2011 the US had its debt downgraded by Standard and Poor’s and this saw markets tumble. I’m not saying that’s going to happen again, but it’s something to be aware of.

When Will We Get a Correction?

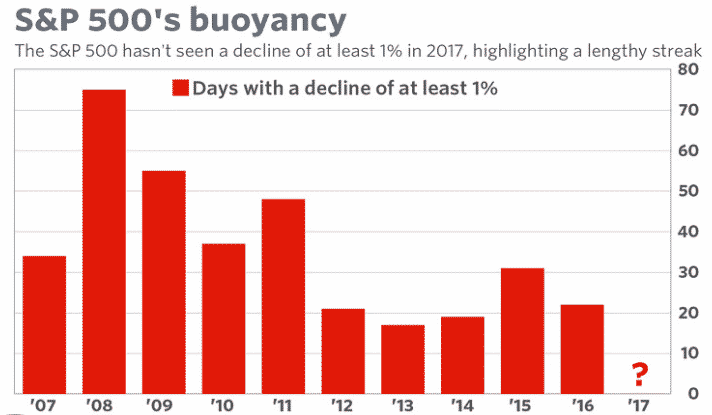

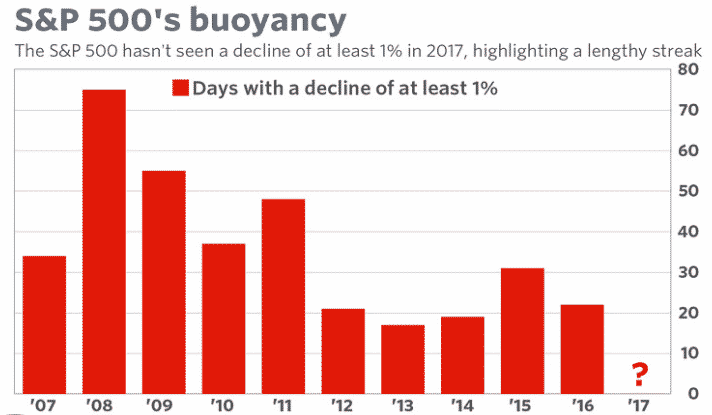

The S&P 500 has now had one of the longest streaks on record without a 1% daily decline.

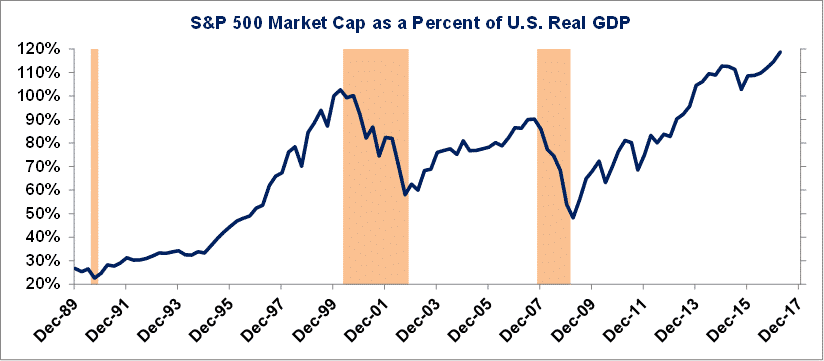

Sam Stovall recently pointed out that US stock market valuation as a percentage of GDP is at it’s highest level since the data has been tracked.

There really is no telling when the market will correct. Keep an eye on market breadth and momentum indicators for any signs of weakness.

For now the momentum is well and truly with the bulls.