It’s been a rough few months for buy and hold investors, and the “diamond hands” crowd has gone particularly quiet.

Thankfully, as option traders, we can make money in down markets and are not stuck, hoping the market goes up.

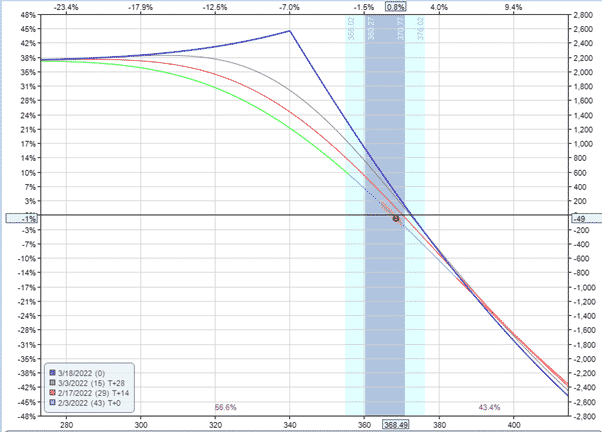

Here’s an example of a trade that worked well recently.

Date: February 2nd

Trade Details: Poor Man’s Covered Put

Buy December 1st QQQ 420 Put @ 64.30

Sell March 1st QQQ 340 Put @ 6.55

Six weeks later, we were able to close it out for a nice gain.

A poor man’s covered put is a bearish strategy that is the opposite of the poor man’s covered call.

We buy a long-term, in-the-money put and sell a short-term out-of-the-money put against it.

For the long put, we usually look at around the 70-80 delta and the short put is slightly out-of-the-money, or you could use around a 20 delta.

We hope your trading is going well and if you have any questions, feel free to reach out.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.