This options trading tutorial deal with credit spreads and how to effectively sell option premium ahead of expiration dates.

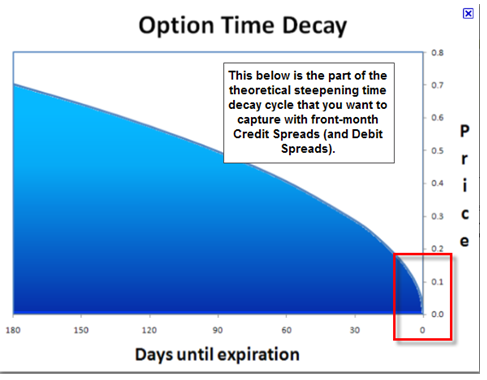

Some of you may know that all option values are made up of two components; intrinsic value and time value. Intrinsic value is the in-the-money portion of an option premium, and the remaining portion represents time value. However, you may not know that options lose two-thirds of their time value in the last one-third of their life. This is shown graphically below. As option traders, we can profit from this increasing time decay by selling credit spreads.

We now know that options lose the most time decay the closer they move to expiration. Therefore, it makes sense to be a seller of options with only a few weeks left until expiry. Selling “naked” options involves the risk of unlimited loss, but credit spreads will cap your maximum loss at the difference between strike prices less the option premium received. A credit spread trade means we are selling one option and buying another at a higher strike price (in the case of a call spread, lower for a put spread). A call credit spread is a bearish strategy whereas a put credit spread is a bullish strategy. However, the beauty of credit spreads, is that we don’t have to be 100% correct. We have a margin for error.

Let’s assume that we are slightly bearish on the current market. With the SPY currently trading at 129.39, we could sell a February call credit spread. Picking strike prices would depend on how much of a margin for error you wanted, how bearish you are and how much profit you require. As an example, we could sell the February 18, $134 calls for $0.37 and buy the February 18, $136 calls for $0.14 This would give us a net credit of $0.23, so $23 is the maximum profit per contract. Our maximum loss would be $177 per contract (13600 – 13400 – 23). That’s a 12.99% return on risk in 4 weeks. The margin required for this trade by most brokers is equal to the maximum loss.

At expiration, SPY could finish at $134.23 before we start to experience losses and $136 before we hit our maximum loss. That’s a 4.50% and 6.06% margin for error.

You should note that with this trading strategy, you are looking to make small monthly gains while trying to avoid large losses. As the maximum loss is 7.7 times greater than the maximum gain, you would need to have 7.7 winning trades for every 1 losing trade. That’s not a great ratio to have. For this reason it is especially important to set stop losses. Each investor should choose their own trading rules and stop loss levels based on their risk tolerance. Some options sellers use a 200% rule, meaning that if the sold spread increases in value by 200%, they are stopped out. In this example, that would be if the spread increased from $0.23 to $0.69. The investor would be stopped out with a loss of $46 per spread which is much less than the maximum potential loss of $177. By using this stop loss level you would reduce your required winning trade ratio from 7.7 to 2.

How did you arrive at 4.5% and 6.06% margin fo error in this exercise?

That’s just the distance from the current index price to the short strike

Dear Sir,

If the 200% rule is used for stop lose, how could it be possible the spread increased from $0.23 to $0.69?

Regards,

Stanley

Hi Stanley, $0.23 x 200% = $0.46. $0.46 + $0.23 = 0.69

Hope that helps.

At expiration, SPY could finish at $134.23 before we start to experience losses and $136.23 before we hit our maximum loss. That’s a 4.50% and 6.06% margin for error.

error : should be

At expiration, SPY could finish at $134.23 before we start to experience losses and $136 before we hit our maximum loss. That’s a 4.50% and 6.06% margin for error.

Thanks Ke Jia for pointing that out.