In part 1, we learned the basics of option assignment.

In this part 2, we will continue our learning journey into more complex scenarios of option assignment.

Contents

Early Assignment In Bear Call spread

Consider an investor selling a bear call spread on Costco (COST) with the short call at the 15-delta.

Date: January 10, 2025

Price: COST @ $927.50

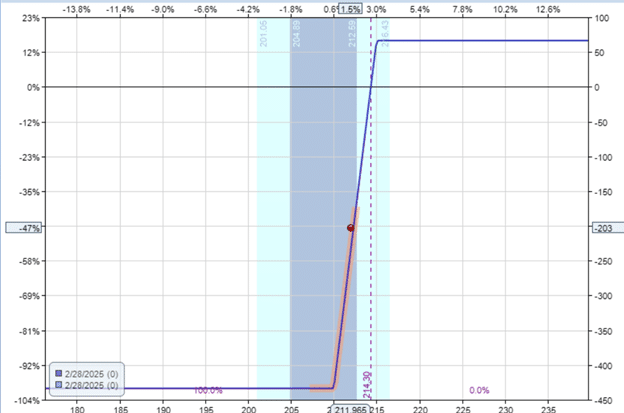

Sell one Feb 7th COST $980 call @ $4.95

Buy one Feb 7th COST $990 call @ $3.47

Credit: $148

Before placing the trade, the investor calculates the max potential loss to be $852:

$1000 – $148 = $852

Costco’s price went through an incredible rally and is up at $1032 on February 5 (two days before expiration).

The bear call spread is almost at its max loss.

As luck would have it, the short call with a strike of $980 is now assigned early.

The investor is forced to sell 100 shares of Costco at $980 per share.

If the account does not already have 100 shares to sell, the investor ends up in a short-stock position.

If the account is not allowed to short shares of stock or does not have the margin to support a short stock position of $98,000, the broker will need to exercise the long $990 call option to buy the 100 shares.

At least, that is better than buying at the market price of $1032 per share.

Effectively, the investor buys at $990 per share to sell the shares at $980.

That is a loss of $10 per share or a loss of $1000 for the 100 shares obligated by the one contract.

The net loss is only $852 if you account for the $148 initial credit for initiating the bear call spread.

This is the same max loss known at the start of the trade.

Why Does An Early Assignment Happen?

If a short call is assigned early, another party has exercised their long call before its expiration.

Why would the other party do that?

They are likelier to do that when their options have very little extrinsic value.

When they exercise their option, they lose that extrinsic value.

In our example, on February 5, the $980 call option (for which the other party is long) has a market value of $52.73 per share.

This call option is $52 in the money because $1032 – $980 = $52.

Therefore, the call option has only $0.73 per share of extrinsic value left.

By exercising their call option, the other party had given up the extra $73 to obtain the 100 shares of Costco now instead of waiting till expiration.

Underlyings With Upcoming Dividends

Costco has a dividend release coming up with an ex-dividend date of February 7.

That means that to receive the dividend, an investor must buy or own the Costco stock on February 6 or before.

The dividend amount is $1.16 per share or $116 for 100 shares.

So now we understand why it makes sense for the other party to exercise early, giving up $0.73 per share to be able to receive a dividend at $1.16 per share.

If they had waited till expiration, they would not have been able to receive the dividend.

Is It True That Only ITM Options Can Be Assigned?

While this is generally true nearly always, it is not 100% true.

No rule or regulation says that only ITM options can be assigned.

While it is extremely rare, OTM options can be assigned early.

Consider the case of a hypothetical investor who is short the Costco $1060-strike call option expiring on February 7, 2025.

On February 6, when Costco was trading at $1052, he was assigned to a short call that required him to sell 100 shares at $1060 per share.

He was assigned even though the call option was OTM (strike price higher than the current stock price).

Assuming that he already had 100 shares of Costco (such as in a covered call), this is good news for him.

He sold his 100 shares at $1060 per share when the market price was $1052– a gain of $8 per share.

This means a loss of $8 per share for the other party that exercised their long call.

Why did they exercise their long call option when doing so while the option is OTM, which results in a loss?

Perhaps the other party who owned the long call made a mistake.

Through a misunderstanding, they exercised their call option to buy at $1060 when they could buy the stock at the market for $1052.

More likely was that the other party saw the Costco stock price at $1062 per share at 10:15 am Eastern Standard Time.

This was when he called his broker to exercise his call option to buy at $1060 per share so he could own 100 shares before the ex-dividend date.

But after going through the automated phone prompts and reaching a live agent, it was ten minutes later, at 10:25 am, before the call option got exercised.

By then, Costco stock had dropped out-of-the-money to $1052 per share.

If you look at the intraday chart on February 7, it can be seen that this is a real possibility.

So, normally, OTM options are not exercised.

But in rare crazy scenarios, it can happen.

Put Options Can Be Assigned Early, Too.

Now, we understand that there is a dividend incentive for early assignment of call options.

Early assignment of put options can and does happen also.

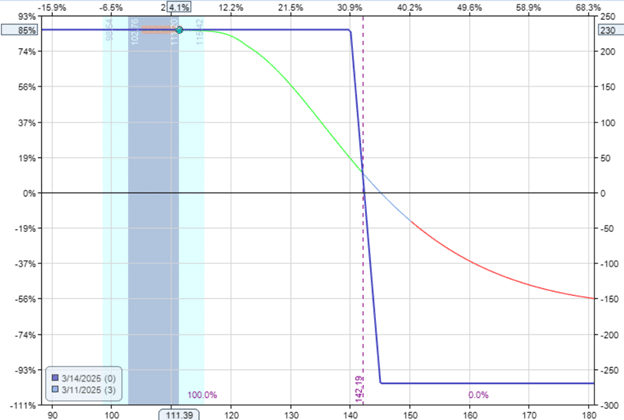

Here is an example of a bull put spread on American Express (AXP):

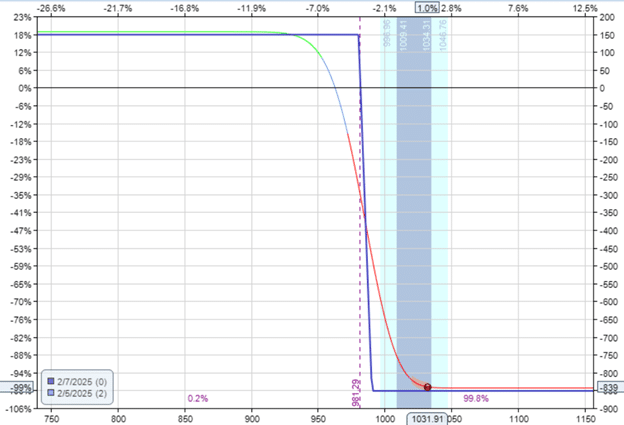

Date: February 21, 2025

Price: AXP @ $303

Sell one March 21st AXP $290 put @ $3.26

Buy one March 21st AXP $280 put @ $1.56

Credit: $170

The max risk on this bull put spread is $830.

The difference between the strike price and the premium received calculates this:

$1000 – $170 = $830

On the morning of March 15, with still one more week till expiration, the price of AXP is at $260. That’s quite a drop.

The bull put spread is ITM.

And the short put with a strike of $290 is deep in the money.

(For curious people, the delta on this short put is a 97-delta).

As luck would have it, this investor is assigned 100 shares of AXP stock.

This is an early assignment because it is still not yet expiring.

Deep ITM options have a higher chance of being assigned.

And the closer it gets to expiration, the chances increase.

Early assignment happens because another investor who holds the long $290 put decides to exercise his right to sell 100 shares of AXP at $290 per share.

Well, someone has to buy those shares from him.

That someone is holding a short $290 put with the same expiration.

There are many such people.

So, the Options Clearing Corporation (OCC) selects a brokerage, and the brokerage selects that someone.

This selection can be random, lottery, round-robin, first-in-first-out, or other fair process.

I said, “As luck would have it,” this investor got assigned.

Okay, now what?

The investor wakes up to see that he has 100 shares of AXP and $29,000 deducted from his account.

The max risk remains at $830 because he still has the long $280 protective put option (but only for one more week).

The 100 shares of AXP plus the long put represents a married put position that looks like this…

We can see from the expiration graph that the risk in this position is $830 – the same as the original put credit spread risk.

At this time, the investor can sell the 100 shares (at $260 per share), sell the long put (for credit of $2085), and take a net loss of $745 on the trade.

Credit for selling the bull put spread: $170

Purchase of 100 shares of AXP at $290: -$29000

Sell 100 shares of AXP at $260: $26000

Sell the long put: $2085

Net loss in trade: -$745

Or the investor can hold the position.

If AXP goes up, he can recover a little bit of the loss.

But holding the position ties up $29,000 worth of capital.

If the investor holds the position till expiration and if AXP can not go up above $280 per share, then the long put will auto-exercise, selling the 100 shares at $280 per share.

The resulting net loss in trade would be -$830, calculated as follows:

Credit for selling the bull put spread: $170

Purchase of 100 shares of AXP at $290: -$29000

Exercise long put to sell AXP at $280: $28000

Max loss in trade: -$830

If the account can not support the forced purchase of 100 shares of AXP, the broker will force the exercise of the long $280 put (even if it is not yet expiring).

The result is the same calculation, resulting in a max loss of $830.

Why Can Short Puts Be Assigned Early?

But why did the other party exercise their long put option early (which caused our investor to be assigned to the short put option)?

Theoretically, the other party has no financial advantage in exercising the put option early.

Let’s assume that the other party has 100 shares of AXP, which they want to sell at $290 per share or higher.

The other party holding the long $290 put should ideally hold the put option till expiration to see if the price of AXP goes above $290.

If it does, then the investment would exceed $29,000 (first possibility).

If it does not, then the long put is auto-exercised, giving the other party $29,000 for the 100 shares (second possibility).

By exercising early, the other party relinquished the first possibility and immediately accepted the second possibility.

This is a reasonable choice since the chances of the first possibility happening are low.

It is unlikely that AXP will go from $260 back to above $290 in the one week that is left.

The other party frees the capital locked in the stock by exercising the long put option to sell the shares.

The other party may have personal reasons for needing this extra cash immediately.

Can Debit Spread Be Assigned Stock?

Yes, they can – but only through early assignments.

If you think about the structure of the call debit spread and put debit spread, for the short option to be ITM, the long option must already be ITM.

Therefore, the long option can always be exercised to cover the short option at expiration.

If the short option is ITM at expiration, it means that the spread has made its max potential profit.

If the short option is ITM near expiration, it means that the spread has nearly made its max potential profit.

If early assignment happens, it is likely when the short option is ITM near expiration for the reasons explained earlier.

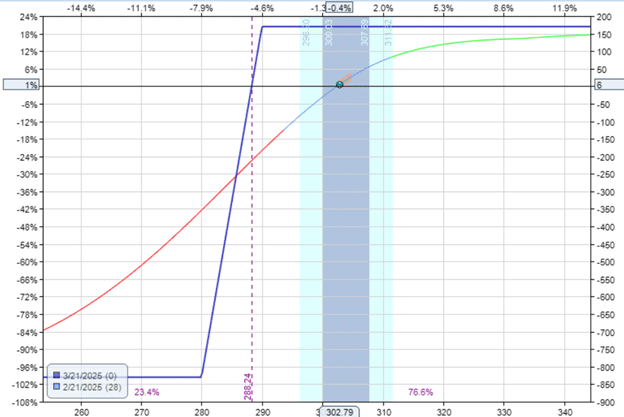

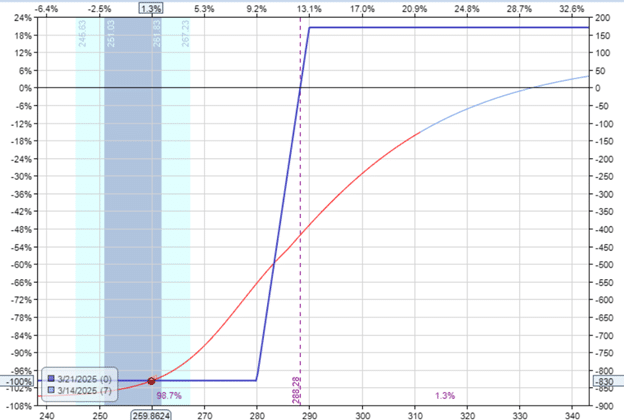

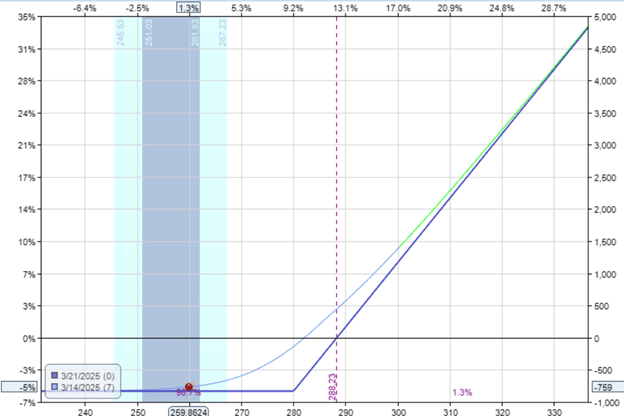

Consider the bear put debit spread on NVIDIA (NVDA).

Date: Feb 18, 2025

Price: NVDA at $140.83

Buy one Mar 14 NVDA $145 put @ $10.55

Sell one Mar 14 NVDA $140 put @ $7.85

Net debit: -$270

On March 11, three days before expiration:

The investor was assigned 100 shares of NVDA at $140 per share.

NVDA is trading at $111.39 per share at this time.

That may not sound good unless you realize that the investor can now immediately exercise the long $145 put option to sell his 100 shares at $145 per share.

This is a profit of $5 per share minus the debit paid for the spread, which is a profit of $230.

Alternatively, the investor can sell the 100 shares at the market price of $111.39 and sell the long put option, which is valued at $3367.

Debit paid for the spread: -$270

Assigned 100 shares at $140: -$14,000

Sell 100 shares at market: $11,139

Sell long put option at $3,367

Net profit: $236

That $6 of extra profit comes from the extra intrinsic value of the long put option.

However, you might lose as much from slippage trying to trade out of the stock and the put option.

Or the investor can hold the 100 shares until the expiration of the long put option.

If NVDA ends up below $145 at expiration, the long put will auto-exercise to sell those shares at $145, resulting in a net profit of $230.

If NVDA is above $145 at expiration, the investor can sell it at that higher price for an even greater profit.

Conclusion

Perhaps this is more than you needed or wanted to know about options assignments.

So don’t worry if you don’t understand everything right away.

Some of these complex scenarios require getting into the minds of the other party to understand why short options can be assigned early.

We hope you enjoyed this article on option assignment.

If you have any questions, send an email or leave a comment below.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.