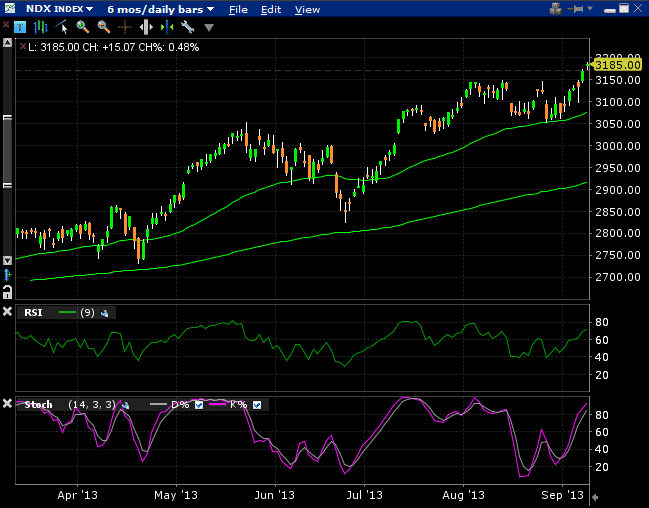

With stocks having a nice run up over the last 5 days, a period of consolidation seems in order. NDX in particular has moved up to 3185, having been at 3060 as recently as August 27th. That’s a gain of +4.08% in just 9 trading days.

If you look at the chart, NDX looks due for either some sideways action or a continuation of the slow, steady grind higher (such as we have seen many times already this year).

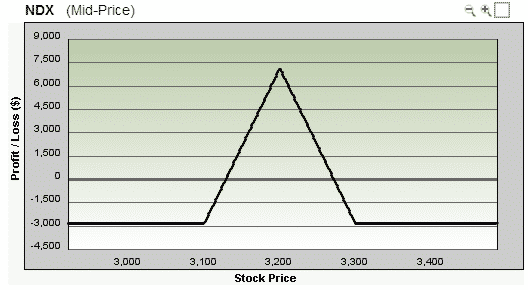

Here’s how you could play it using a butterfly spread. Assuming you have a slightly bullish view, centre the butterfly around the 3200 strike.

Date: September 10th 2013,

Current Price: $3185

Trade Details: NDX Bullish Butterfly

Buy 1 NDX Oct 19th $3100 call

Sell 2 NDX Oct 19th $3200 calls

Buy 1 NDX Oct 19th $3300 call

Premium: roughly $2,900 Net Debit

Max Loss: $2,900

Max Gain: $7,100

Breakeven Points: 3129 and 3271

Profit Target: 30% or $870

Stop Loss: 20% or $580

For this trade I would start with half position size and then add the rest of the position if NDX touches either of the breakeven points, while sticking to the original profit target and stop loss.

If you have a slight bearish bias, I would centre the butterfly around the 3150 strike.

To learn more about butterfly spreads, click the link below to register for a FREE 13 part Butterfly Course.