Last week, I suggested that NDX had made a decent run up over the preceding 5 trading days and was due to consolidate. The trade was a butterfly with a slightly bullish bias:

Date: September 10th 2013,

Current Price: $3185

Trade Details: NDX Bullish Butterfly

Buy 1 NDX Oct 19th $3100 call

Sell 2 NDX Oct 19th $3200 calls

Buy 1 NDX Oct 19th $3300 call

Premium: roughly $2,900 Net Debit

Max Loss: $2,900

Max Gain: $7,100

Breakeven Points: 3129 and 3271

Profit Target: 30% or $870

Stop Loss: 20% or $580

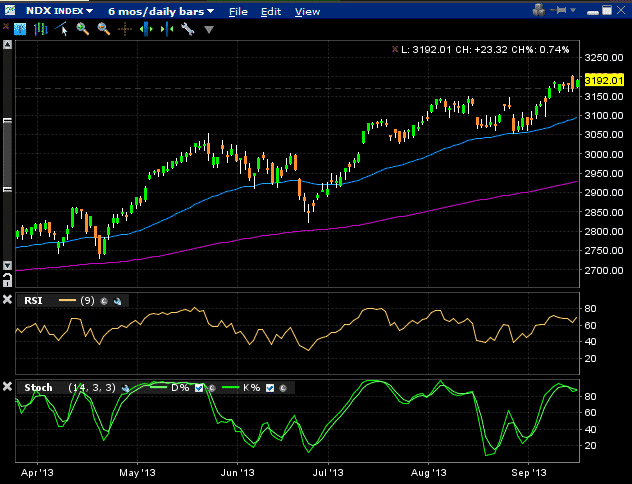

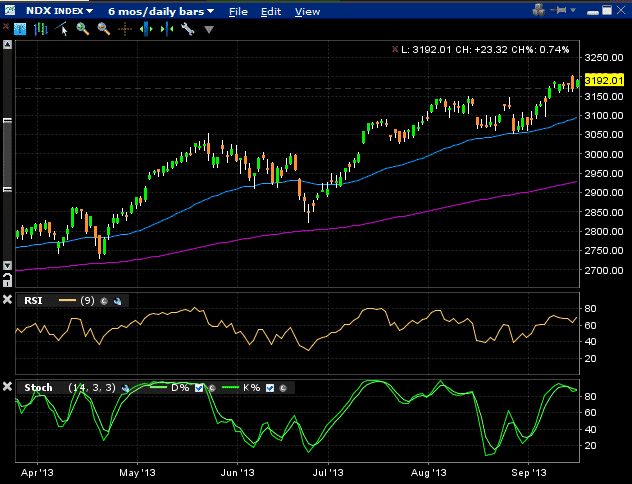

Looking at the chart, NDX has moved from 3185 to 3192 over 5 trading days. The butterfly is sitting on profits of around $350 or +12%.

The initial profit target was 30%, but 12% in 7 days is good, and I would be tempted to take profits here.

Incidentally, the slightly bearish version of this trade with the centre at 3150 would also be showing a profit. About $165 or 6.63% due to the passage of time, very little price movement and the drop in implied volatility.

To learn more about butterfly spreads, click the link below to register for a FREE 13 part Butterfly Course.