Since the lows in mid-June, we have been in the midst of the “Most Hated Rally”. The SPY is up almost 100 handles from the low and Oil has continued to come down as inflation fears and economic slowdowns loom. But it looks like after almost a 20% rally we are finally seeing it come to an end. Price action is finally starting to turn over, and more importantly in this instance there are some macro headwinds starting to appear.

Market Technicals

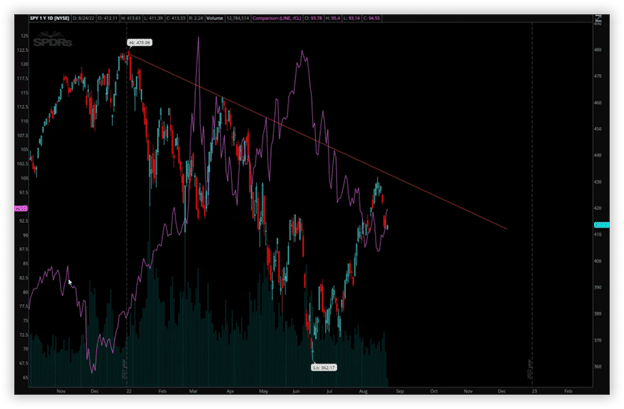

Price action has finally turned bearish again with a pretty large Gap down from Friday’s close to Monday’s open. Sellers were not bashful as they continued the raid into Tuesday. The other thing to note on the Price chart above is Oil (the purple line) has seemed to catch a bid again. Also on the recent rally look how heavily the volume sagged at the top. This is an indication that people started to lose interest in trading the higher it went.

Price could not take out the recent high at 462, heck we couldn’t even get to the trend line currently in place which confirms that we are still in an overall bearish environment. I can imagine that if the area around 409 gives way we could be back at the recent lows sooner rather than later.

Macro Forces

While the price action confirms that a bearish bias is still intact, there are some macro forces that are also confirming this bias.

Housing

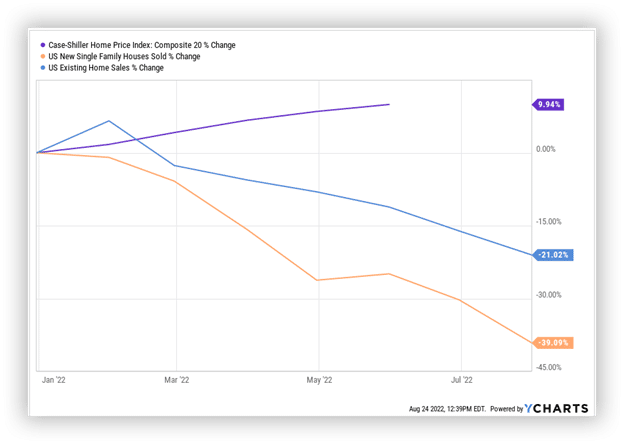

First, we have the housing situation. The US housing market is in an odd situation, there is a fundamental shortage of property related to the amount of buyers but less and less people feel confident enough to purchase. This is resulting in a rapidly cooling housing market with existing home sales off 20% Year to Date. Single Family homes are taking an even heavier beating with an almost 40% decline YTD. This is showing a sheepishness of people to make the large commitment in a rate hike environment and employment looking shaky.

Employment

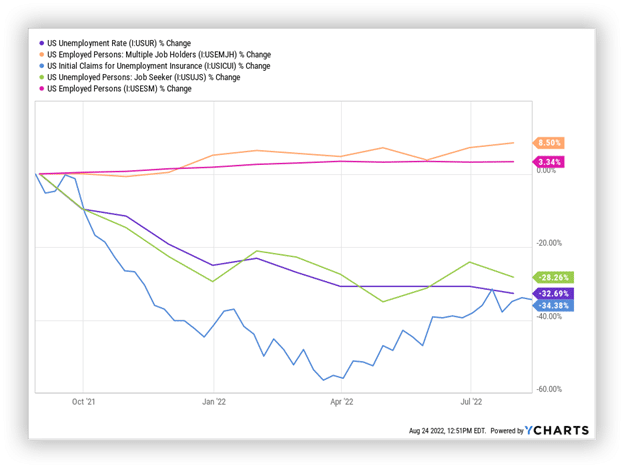

After housing we have employment. We are being told that we have fantastic employment numbers, but when you look under the hood things are not as rosy as they seem. While unemployment has dropped substantially from the Covid highs, the majority of the recent decrease appears to be going to multiple job holders. This does not speak well for consumer spending as people without a job are not likely to make any large purchases that are not 100% necessity. With the actual number of people unemployed staying mostly stagnant, this can provide a crunch on consumer spending and an overall headwind for the market earnings.

Inflation

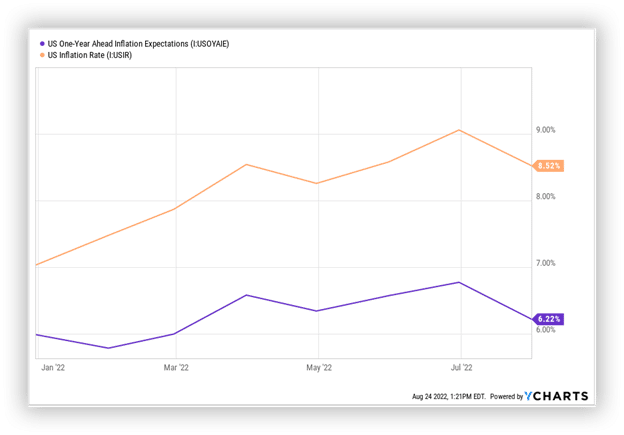

Dovetailing into the employment and housing is the 800 pound gorilla in the room: Inflation. Inflation is currently sitting at 8.52%, down from the high of just over 9% last month. While this is a move in the right direction the forward looking inflation numbers still have us over 6% this time next year. To make math easy, and for illustration purposes, I am going to average the two years to 7%/year. That is going to total a 14% decrease in purchasing power over the next two years.

This translates to a headwind for the market for two main reasons. First is the apparent one, if you are spending more on goods and services that means you have less discretionary to invest into stocks. This has the potential to lead to at the very least stalling prices, but more than likely a decrease in most of the hotly followed stocks like Telsa, Apple, Nvidia, and the meme stocks.

The second way this is a headwind for the market is on the consumption side. With rising pricing and wages near stagnant there will be a point where people need to purchase less as the staples like food and power will cost a higher portion of their weekly pay. This directly affects company earnings and will continue to lead to lower earnings and guidance in the coming quarters.

I think inflation has the potential to be a large factor in a continued market selloff. It is an insidious problem that no government seems to have a great handle on, particularly the US. Historically, as inflation starts to increase so does volatility so I would imagine that will play itself out as well.

Geo-Politics

The last thing that I believe is a relevant market force is the current geopolitical climate. China is posturing against both the US and Taiwan, the Russian-Ukraine conflict is still ongoing with no sign of stopping, and finally an energy crisis that is going to affect Europe in a huge way and to a lesser degree the US.

I personally think that the looming energy issues are perhaps the largest potential mover for the market going into the fall and winter. I am hearing rumors of a potential for 4 digit energy bills in Europe and that will almost certainly lead to some form of unrest. I think that coupled with the higher cost to move goods (moving goods takes a lot of energy) will have a downward force on the markets.

US Midterm Elections

The one wildcard in all of these pessimistic macro forces is the US midterm elections. The current administration does not have a lot in the Win column so going into the midterm elections I can foresee a huge push from the Fed to keep rates at least stable to help bolster prices going into the fall. It’s always easier to campaign when your assets are higher than where they started. It’s strictly window dressing, but sometimes that’s all that’s needed.

Tying it all together

While all of these things are pessimistic on the surface, with options you can position yourself to profit from any move that the market is preparing to make. I see some more potential downside and the US has entered a technical recession, but that doesn’t mean you can’t profit. Hedging against rising fuel prices through oil companies is a strategy I fully intend to employ. Stocks like XOM and USO will be a part of my portfolio as a hedge. Using Straddles and Strangles to play for the possibility of a continued downside move, or the complete possibility that I am reading all these signs wrong will also be a strong part of my portfolio. I think it’s important to pay attention to what the market is telling you, and all this economic data is saying that we are cooling off as a global economy, but that data is powerful if you know how to use the correct strategies to protect yourself in times of higher volatility.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.