The IVOL ETF is the Quadratic Interest Rate Volatility and Inflation Hedge.

That’s a mouthful.

Nancy Davis founded Quadratic Capital Management in 2013 after working at Goldman Sachs and Highbridge Capital Management.

Contents

Hedge Against Inflation

Quadratic Capital Management’s flagship product, IVOL, is a hedge against interest rate and inflation risk using combinations of fixed-income securities and options products.

IVOL invests in Treasury Inflation-Protected Securities (TIPS), designed to protect against inflation, as their principal value adjusts based on changes in the Consumer Price Index (CPI).

Rotation Of The Yield Curve

IVOL aims to profit from the rotation of the U.S. Treasury yield curve.

The yield curve plots the short-term rates in relation to the longer-term rates.

The yield is on the y-axis.

The Treasury terms are on the x-axis, with a one-month term on the left and a 30-year term on the right.

IVOL profits when this graph rotates counter-clockwise.

This is called the steepening of the yield curve. This can occur either because short-term rates are falling, or because long-term rates are rising, or both.

Diversification

Because of the uniqueness of this ETF, it has low correlations with other major assets.

Therefore, supplementing this ETF to a portfolio provides diversification, which reduces the portfolio’s overall risk.

The ETF fact sheet shows IVOL’s daily correlation to the S&P 500 is 0.04.

The correlation to DOW is 0.03.

The correlation to gold is 0.21.

The correlation to the VIX is 0.03.

The correlation of the Aggregate Bond Index is 0.40.

A correlation of 0 means no correlation. A correlation of 1 means highly correlated.

Why Is The Firm Named Quadratic Capital Management?

Both of the firm’s ETF products have “quadratic” as the first word in their names:

Quadratic Interest Rate Volatility and Inflation Hedge (IVOL)

and

Quadratic Deflation (BNDD)

What is the significance of the word quadratic?

A clue can be found in an interview with Nancy Davis on Fox Business.

She used the word “quadratic” to describe the asymmetric reward-to-risk characteristics of certain options and derivative products.

Do you remember drawing out a quadratic equation on graph paper in algebra class when you were young?

Okay, maybe not.

You had a scientific calculator to do that for you.

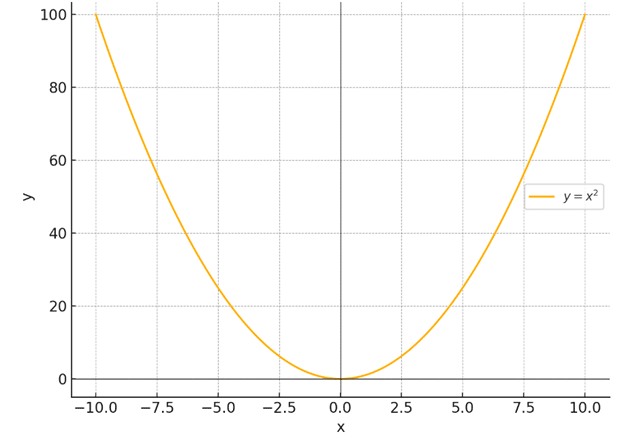

This is a graph of a quadratic equation y = x^2.

If the y-axis is the potential profit reward, what options structure could have a reward curve that is similar to this?

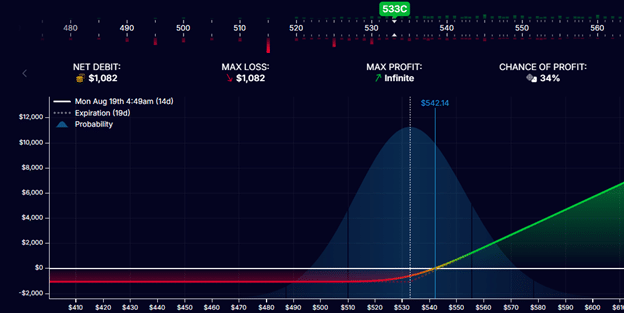

Here is the profit graph of a long call:

The max loss is the premium paid for the option, but its reward is theoretically unlimited.

OptionStrat says that its “max profit” is “infinite.”

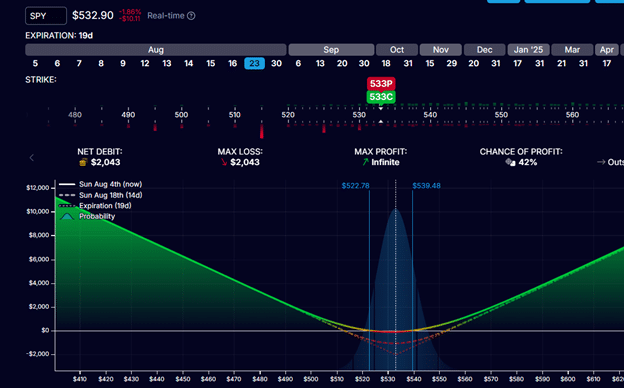

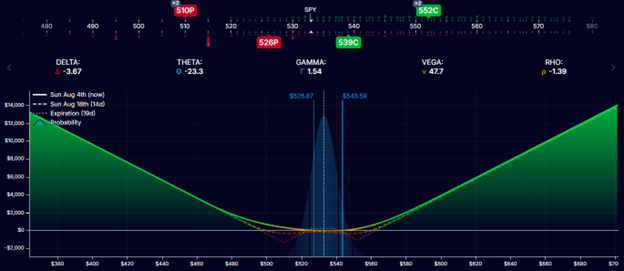

Below is the reward curve of a long straddle on SPY:

Infinite reward in either direction as SPY goes up or goes down.

The graph is looking more “quadratic”.

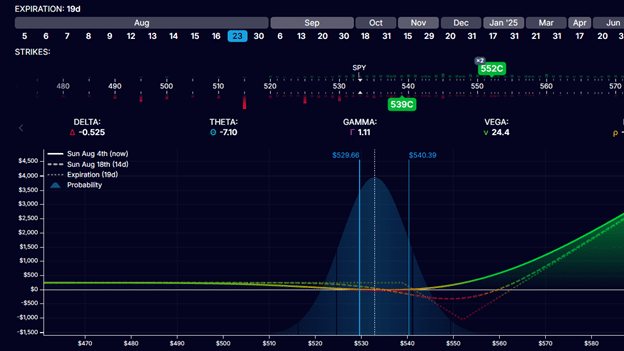

The next one is a graph of a call ratio spread where you sell one call option and buy two call options.

Here is a call ratio spread with a put ratio spread:

All these curves are constructed by being net long options.

When one has long options (or long premiums), one can make more than what one is risking.

The most you can lose is the net premium paid, but the rewards can be much more than the risk.

These examples are meant only to describe the word quadratic and do not indicate how the IVOL ETF works underneath the hood.

To do so, you have to look inside its fact sheet, which can be found on ivoletf.com.

Final Thoughts

Nancy Davis’ unique style of derivatives-based macro investing led to the creation of the IVOL fund, which won the “Best New U.S. Fixed Income ETF for 2019” award from ETF.com in the year of its launch.

We hope you enjoyed this article about the IVOL ETF.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.