The S&P 500 has bounced nearly 8% over the last 8 trading days giving many investors hope for better days ahead. A return to the BTFD days of 2013-2014?

Before going all in, it’s important to look at the broader market and not just the major indices as reported by CNBC.

The epic rally of recent years was driven by momentum stocks in the technology and biotech space. Companies like Go Pro, Biogen and Bluebird Bio. Those momentum darlings have not bounced to the same extent as the major indices.

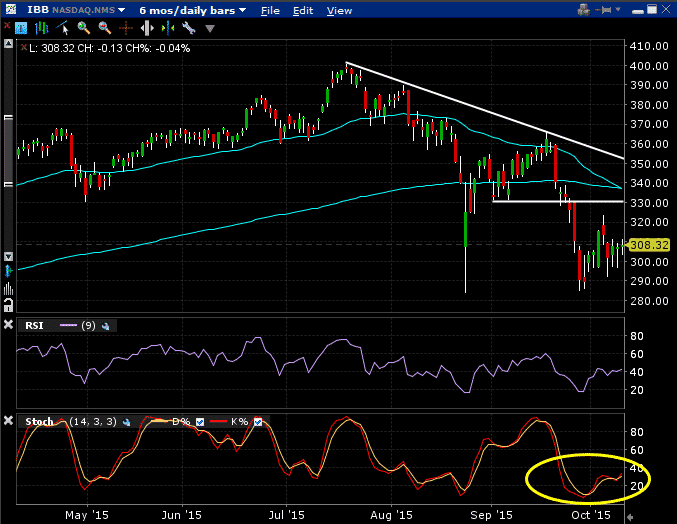

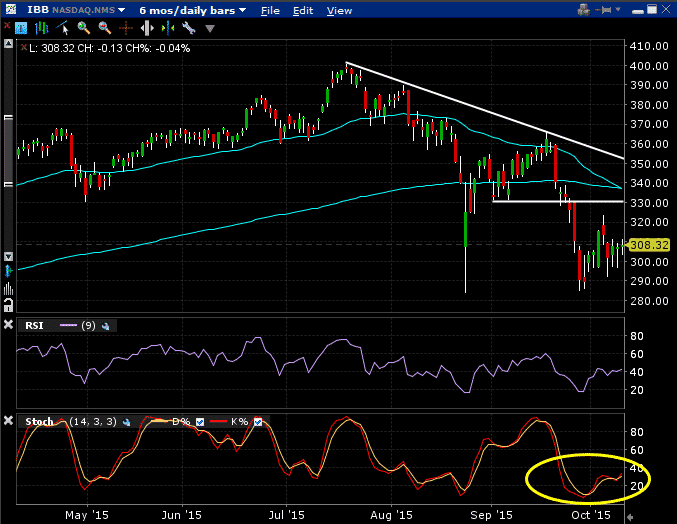

The biotech sector, as represented below by the ETF IBB has taken a serious beating lately and there is a lot of chart damage to be overcome before calling a resumption of the bull market. This chart needs to repair itself through time and price.

We’re currently seeing a death cross on the chart along with plenty of resistance at $330, $340 and $350.

Any further weakness in this sector could see the broader market follow suit.

Thanks for reading.

Click Here For My Top 5 Technical Indicators

This article originally appeared on See It Market.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.