I’ve been having some interesting chats with some trader friends over the last few weeks as you can imagine.

While it’s a very dangerous time in the market, there are also lots of opportunities to learn and also place high probability trades.

Last week I gave some ideas on how to trade the coronavirus selloff and those are still relevant. But today, I want to talk about a couple of other ideas.

Even if you’re not willing to risk live capital (which is totally understandable in this environment), there are huge opportunities to learn from this market situation.

LULU PUT DIAGONAL SPREAD

The first idea is a trade on LULU that a friend of mine brought to my attention.

With the market in severe backwardation at the moment, front week options have much higher volatility than back week or back month options.

As such, we want to be sellers of the near-term options (high vol) and buyers of the longer-dated options (lower vol). Just like with stocks, when it comes to volatility, we want to buy low and sell high, or sell high and buy low in as is the case in this example.

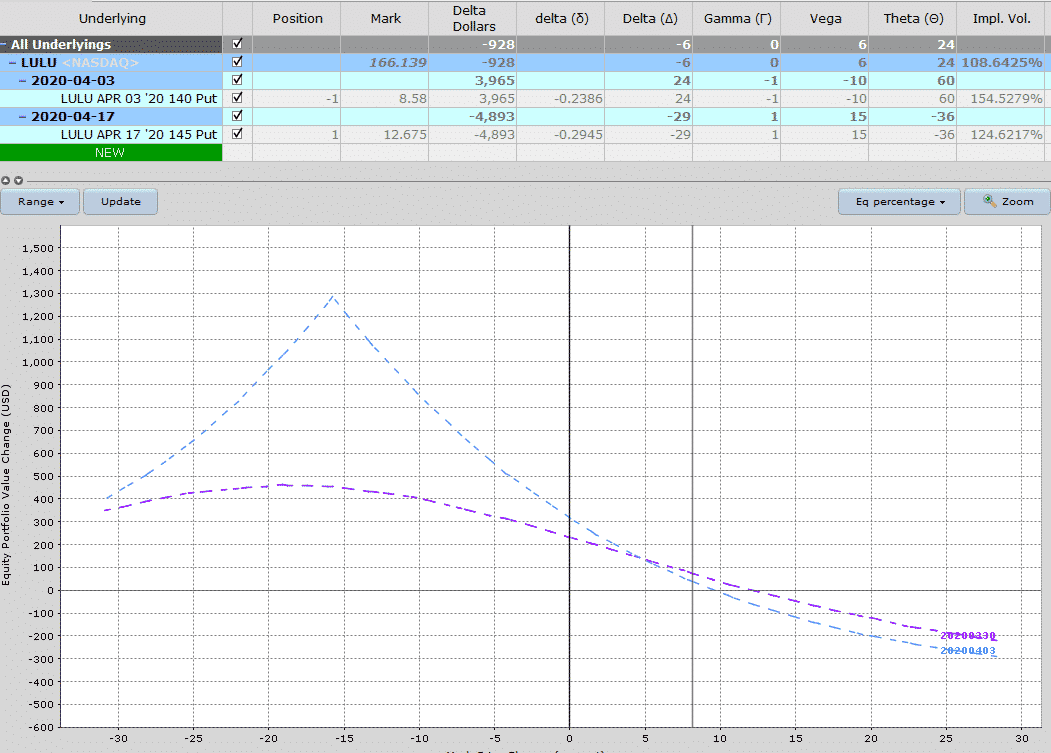

Date: March 23, 2020

Current Price: $164.96

Trade Set Up:

Sell 1 LULU April 3rd, 140 put @ $8.58

Buy 1 LULU April 17th, 145 put @ $12.68

Premium: $410 Net Debit

The nice thing about this trade compared to say an Iron Condor is the favourable risk/reward ratio. With this trade the maximum loss on the upside is limited to the debit paid which is $410. One the downside, the worst that can happen is a $90 gain.

This is calculated as the difference in the strike price times 100 less the premium paid. $5 x 100 – $410 = $90.

The maximum possible gain is around $1,300 but that is a bit of an unknown, because of changes in volatility. It could be more, it could be less. But even so, a return potential of $1,300 on risk of $410 is much better than an iron condor where you might have 20% gain potential and 80% loss potential.

Even if you don’t feel comfortable placing a trade like this, I would encourage you to follow along with the trade and watch how it performs in this market.

You could also try turning it into a Double Diagonal by trading the call side as well.

Calendar spreads are also another trade that takes advantage of selling near-term volatility and buying longer-dated volatility. You can place these at-the-money or do them as bullish / bearish bets if you have a strong directional opinion or needs some protection.

Markets are crazy right now and we need to be careful with trade selection. Trades like this that have limited risk are the way forward in my opinion at least until things settle down.

Trade Safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.