Suppose a trader has a portfolio (including option strategies) with a net Delta Dollars of $5000.

The portfolio is overall bullish. If the market crashes, money will be lost.

The trader wants to set up a trigger such that, at a certain point, it would automatically flatten the net position delta of the portfolio (or at least get somewhat approximately close to this).

For a portfolio containing multiple underlyings at various prices per share, it is important to use Delta Dollars instead of the option Greek delta.

This accounts for the various different position sizes of different underlying.

We need to initiate a trade that would give us $5000 in Delta Dollars to hedge the directional risk in this hypothetical portfolio.

Looking at the chart of SPY (the ETF that tracks the S&P 500 index).

It is currently trading at $473.65, and let’s say we want to trigger this hedge if the market drops to $465.

Shorting one share of SPY would provide -$465 of Delta Dollars.

Why? Shorting one share of SPY is -1 delta.

Multiplying that with the per share price of $465 gives us -$465 Delta Dollars.

Shorting ten shares of SPY would give us -$4650 Delta Dollars.

It is not a full hedge. But this is close enough to hedge off nearly all the positive $5000 of Delta Dollars in the portfolio.

So, to partially protect the portfolio, the trader can set a “Stop Market” order to sell ten shares of SPY with a stop price of $465.

FAQs

What is a Stop Market order?

A stop market order is an advanced order type that will trigger the order if the underlying asset reaches the “stop price.”

For a sell order (as in our example) with a stop price of $465, the order will trigger if SPY falls below $465.

When that happens, the broker will sell ten shares (as per our example) of SPY at market price.

The market price you may get filled at may not be exactly $465.

If the market is dropping fast, it may fill at a sale price of $464, for example.

Can I use a Stop Limit order?

If this is to be a hedge, as in this example, using the “Stop Limit” is not recommended because a “Stop Limit” will turn into a limit order when triggered.

In a fast-moving market, a limit order may not get filled and would defeat the purpose of having a hedge.

What if I don’t want to short?

If you are in an account that does not allow shorting or you simply don’t like shorting, you can buy the inverse ETF instead (such as the SH).

But the number of shares to buy would have to be recalculated as follows.

The SH is an ETF that tracks shorting the S&P 500 at a one-time multiplier.

It is currently trading at $13 per share:

Suppose we want the hedge to trigger if SH goes up to $13.2.

We would need to buy 379 shares because:

$5000/$13.2 = 378.78

The trader would set a “buy stop market” order with a stop price of $13.20 to buy 379 shares of SH.

Can we hedge by buying puts?

Yes, we can.

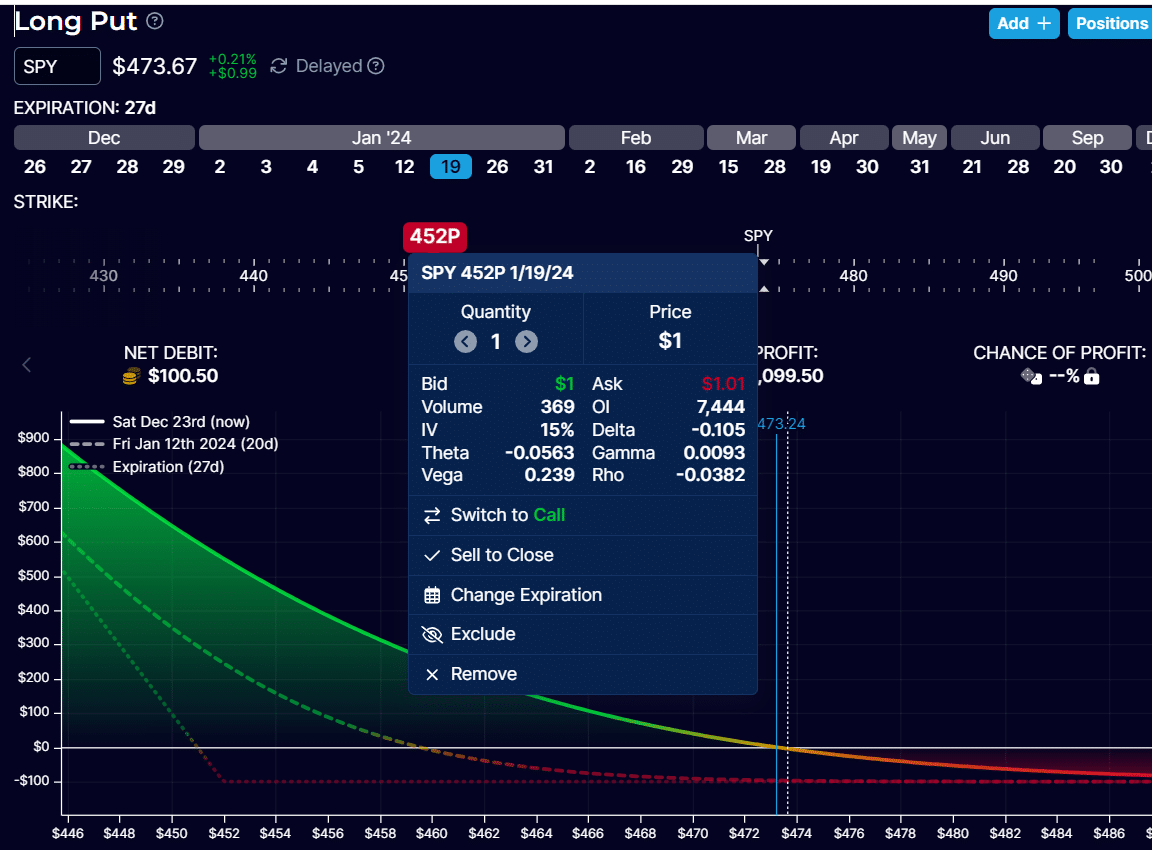

Buying a put option on the SPY with a strike price of 452 (with expiration 27 days away) would give us a -10.3 delta.

With a price of SPY at $473.6, this results in

-10.5 x $473.6 = -$4973 delta dollars

Source: OptionStrat.com

This put option would cost about $100.

The long put option has a negative theta, meaning it loses value each day.

However, the benefit is that if the market crashes and continues to go down, the put option goes to work and will get stronger as the price moves down.

If the market does not crash, the most you can lose on the put option is $100.

This is known as the “curvature” of options, as you can see from the curved T+0 line (shown above) for the long put.

The rewards can be much greater than the risk.

Conclusion

These hedges are going to roughly do the job as intended.

But don’t think of them as exact hedges.

The price of SPY or SH may differ from how the various positions in your portfolio may move.

Furthermore, the delta will change as the prices are moving.

The delta of each of your positions will change at different rates.

Nevertheless, something is better than nothing.

We hope you enjoyed this article on the hedging a market drop with ETFs.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.