Have you heard this famous market saying before? Well, it certainly proved to be the case last week.

The Russell broke out to a new high in late August, then pulled back to test that breakout in September. That is very bullish action if that support holds and the market can then push to new highs. But in late September, once those support levels broke, the market really tanked, with only a brief pause at the 200 day moving average.

So, where to from here?

Similar to the correction in Feb, I think we’re going to see some wild swings in both directions for the next few weeks. A move such as last week takes a while to play out, the market needs to time heal from a shock like that. Many indicators are flashing oversold and sentiment extremes so I’m expecting a bounce this week, but that bounce may be short-lived.

Interestingly, the stats are overwhelmingly positive when CNBC conducts a “Markets in Turmoil” special.

However, the below chart is the main concern for me. Have we seen the end of the bull run? Possibly.

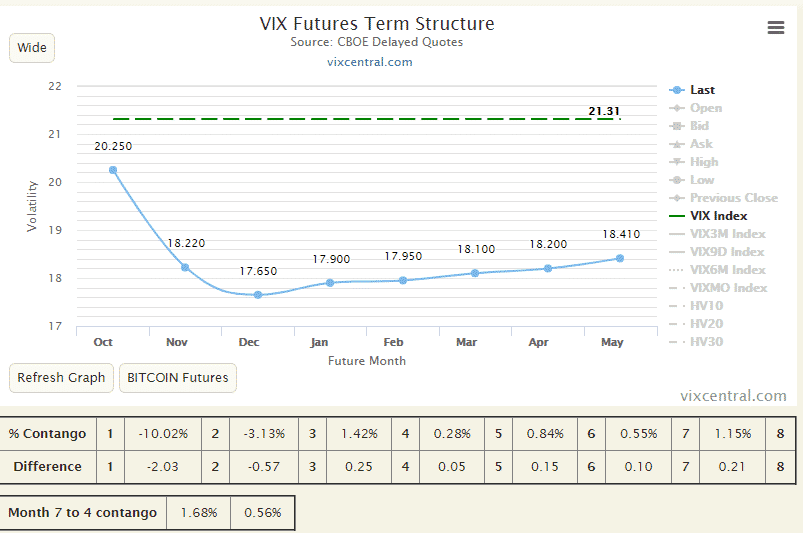

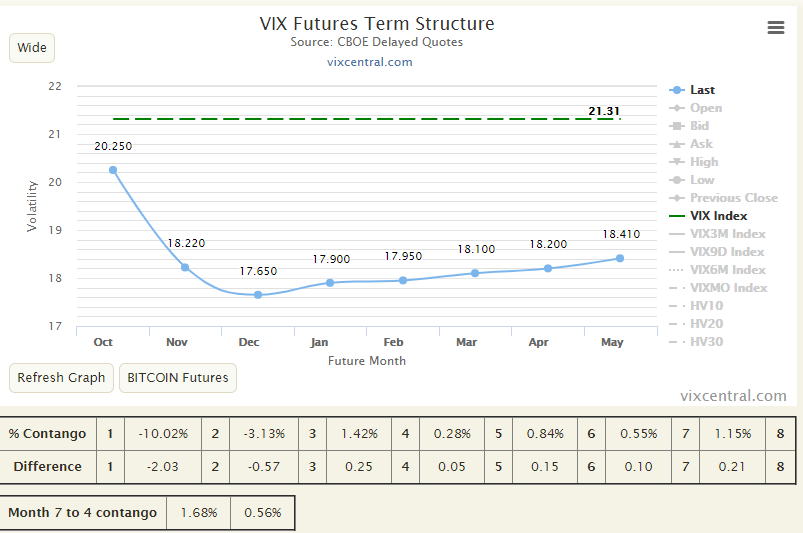

Despite the “recovery” on Friday, markets are still in panic mode with VIX futures firmly in Backwardation. Bad things can happen when the markets are in Backwardation so anyone tempted to play the long side should do so with caution. I’m going to be keeping exposure very minimal until we head back to Contango.

Access the Top 5 Tools for Option Traders

Remember that cash is a position and you can’t go broke being 100% in cash.

I’m expecting a relief rally to the 1600 level, maybe even up to the 200 day moving average at 1620, but then the selling will likely resume.

If you are trading, just remember the greeks are your best friend, don’t let your exposures get out of hand.

Hope you all have a great week and trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.