Volatility brings opportunity. We’ve certainly seen volatility in Facebook stock recently with the FTC’s investigation into the company’s privacy practices.

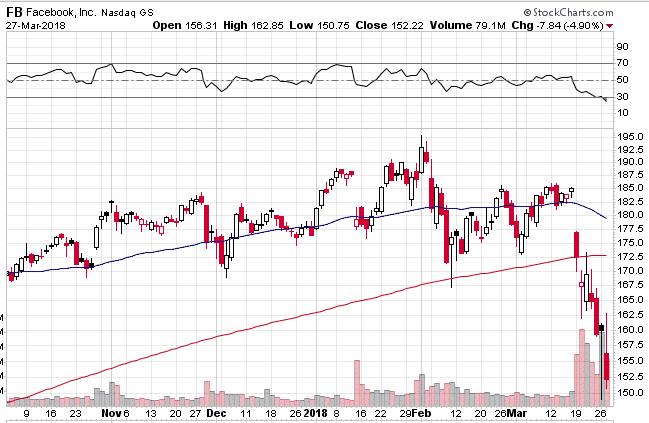

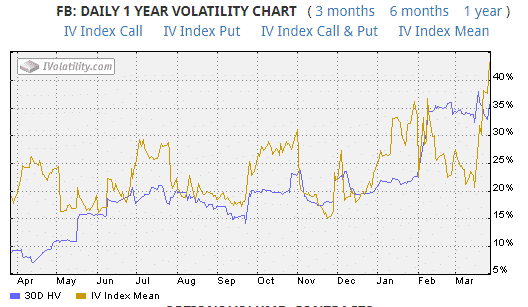

With the stock dropping from a high of $195.32 in February to a low of $149.02 recently, volatility has jumped from 15% to above 40%.

That means option premiums are significantly higher than they were a short time ago.

Of course, things could get worse for Facebook from here, but for those traders willing to take a view that things will settle down and the stock will recover, there is plenty of opportunity to be had.

Access the Top 5 Tools for Option Traders

Here’s three trade ideas for traders who think Facebook’s troubles will be short-lived.

Just a reminder that these are not trade recommendations and you should do your own due diligence and consult with a licensed financial advisor before making any investment decisions.

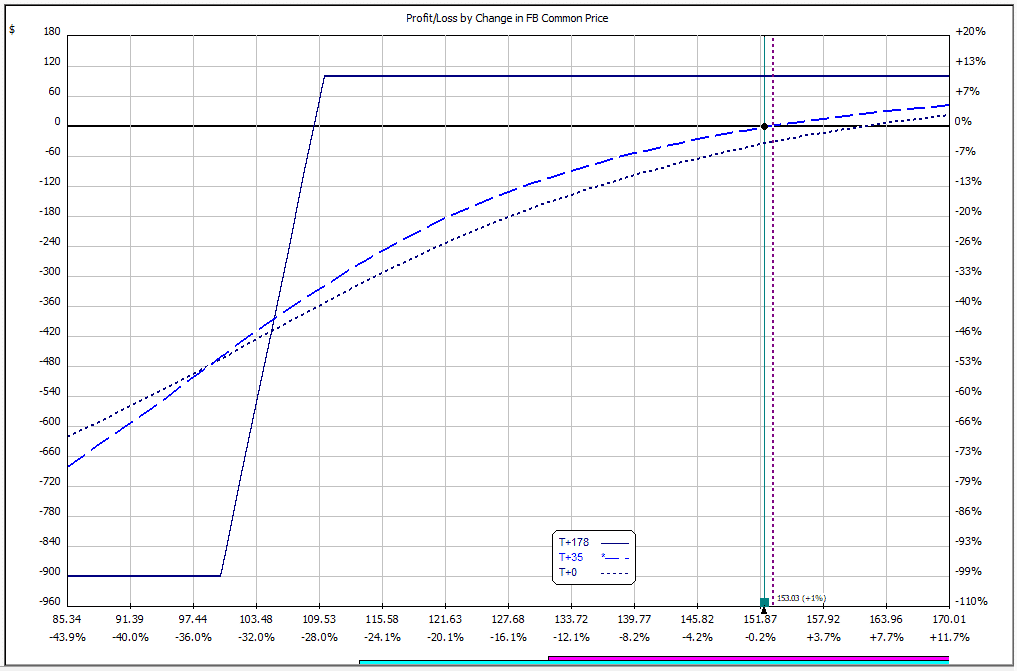

- BULL PUT SPREAD

As the name suggest, this is a bullish bet that will do well if FB stock recovers. The trade can also be set up with a large margin for error, by trading an out-of-the-money spread.

Going out to September and selling the $110-$100 put spread generates around $93 premium per contract on capital at risk of $907. Should the trade expire worthless, the trader would make a 10.25% return on just under 6 months.

There is also a 28% margin for error should Facebook trade lower over the next few months.

Traders wanting to achieve a similar return in a shorter timeframe would need to place the spread much closer to the current price. For example, to generate the same return from the May put spreads, the trader would need to use the $125-$115 strikes. Profits on an annualized basis are much higher, but the margin for error is smaller.

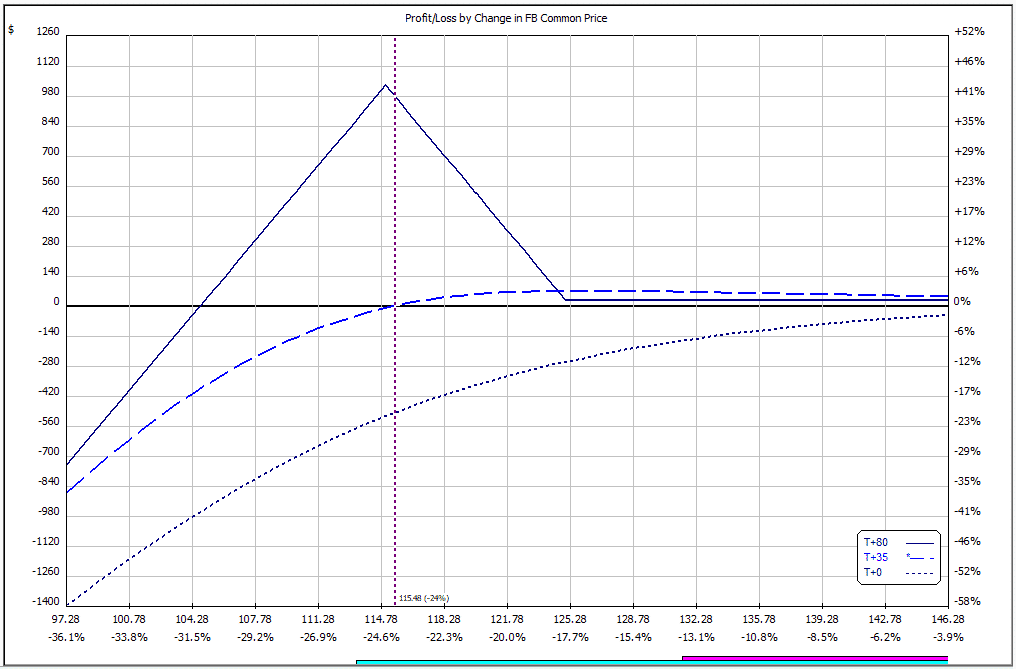

- PUT RATIO SPREAD

I’ve talked about put ratio spreads here recently and I do like them in the case when a stock has suffered a precipitous decline.

Going out to June and buying one $125 put and selling two $115 puts can be done for a slight credit. This means there is no risk at all on the upside and a large profit zone is created between $105 and $125.

Traders who think FB might continue to slowly decline and end in that area in a few months might consider this strategy.

As with the bull put spreads, the risk is that FB continues to fall hard in the early part of the trade.

- POOR MAN’S COVERED CALLS

Poor man’s covered calls are another strategy that I wrote about in detail recently.

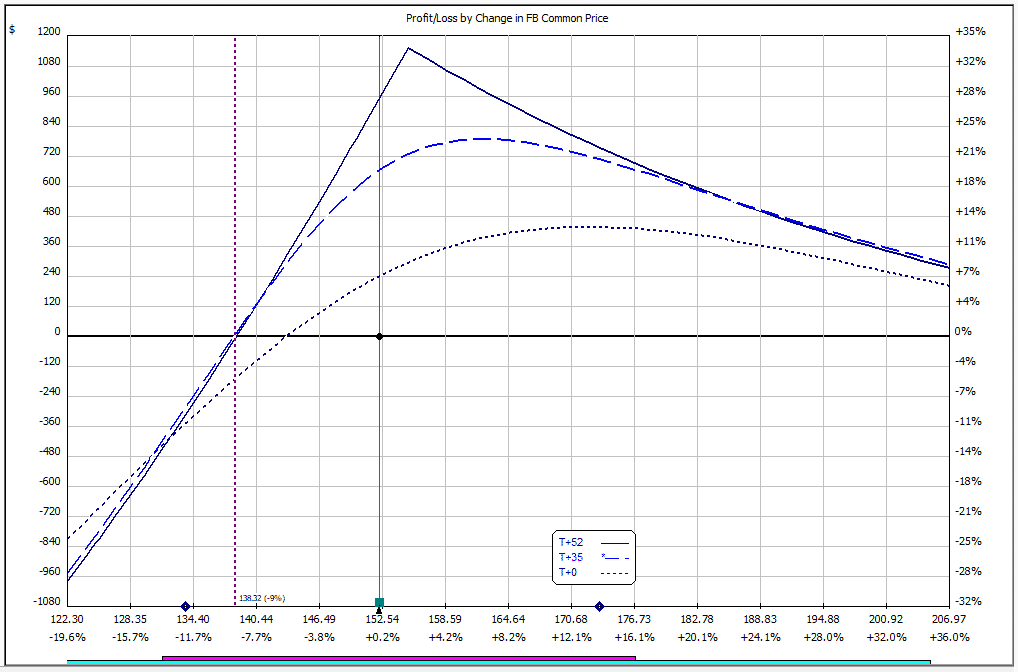

To execute this strategy a trader might by an in-the-money call expiring in January 2020 and sell a shorter-term, slightly out-of-the-money call.

These are three bullish trade examples, but traders could also do the opposite if they think the stock is going to remain bearish.

Either way, it should be interesting to watch this stock over the coming months.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.