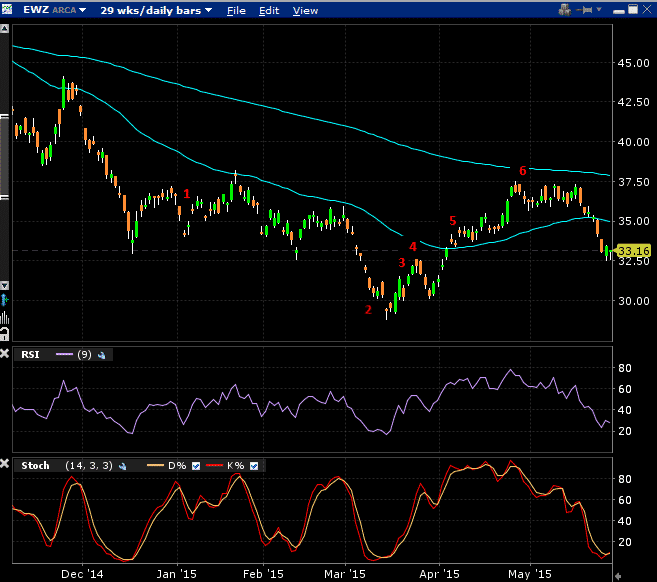

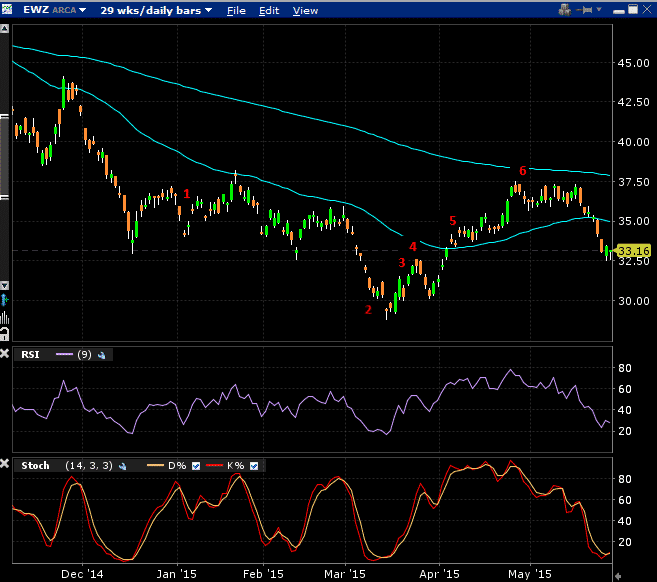

Following on from my post last week, I wanted to give another example of how cash secured puts can work using a trade I did earlier this year on EWZ. You can follow the trades on the chart below.

1. On January 5th, EWZ hit a low of $34.05, down over 8% from a high of $37.20 only 3 days earlier. I thought the move was a bit of an over reaction and I wanted to add some exposure to emerging markets. I sold a March 20th $32 put at $1.22.

2. On March 10th, EWZ dropped to $30.29 and I added to the position by selling an April 17th $30 put for $1.13.

3. On March 20th, EWZ closed at $31.54 so I was assigned on my initial put and bought 100 shares at $32.

4. On March 25th, I sold a June 19th $33 call turning the position into a cover call.

5. By April 7th, EWZ had rebounded to $33.82. I bought back the April $30 put for $0.08 as it was basically worthless. I could have let it expire but I thought it best to get rid of the risk for the sake of $8.

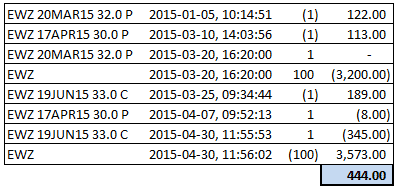

6. On April 30th, when EWZ was at $35.73, I sold the 100 shares and bought back the June $33 call for $3.45. Here is how the trades played out:

You can see the trade returned a profit of $444 before commissions. I had two sold puts open at the same time, so the capital at risk was equal to the strike price of the two puts less the two premiums received. $3,200 + $3,000 less $122 and $113 = $5,965.

The trade therefore returned a profit of 7.44% in 115 days which works out to roughly 23.6% annualized.

In comparison, over the course of this trade, EWZ moved from $34.05 to $35.73 for a return of just 4.93% or 15.7% annualized.

Get Your Free Covered Call Calculator

What do you think of this trading strategy? Let me know in the comments below and don’t forget to share this post on Facebook and Twitter.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

that is an awesome trade. selling cash secured puts and then if assigned turning them into covered calls is classic. i like that you put them on after EWZ had fallen. this was an incoming producing machine!!!

Gav,

Well done. This is a “bread and butter” trade strategy in my plan. Ewz has been a reliable performer with this approach. Likewise, I’ve enjoyed success with FXI in the last year as well as MSFT, INTC and GE. Because of the volatility in FXI covered call premiums have been nice and rich after assignment of shares, boosting returns.

Also been experimenting with 60/90 day calendars on FXI on the call side. Usually 1 strike out of the money. Calendars on high vol are not my go to trade, usually credit spreads would be my choice but FXI is so newsy (China that is) it moves nicely. My rule with calendars always is to sell more premium than I pay.

BTW my long vega hedges with SPY have been wonderful. I owe you a write up on that and will be working on it. Enjoy your corner of heaven my friend.

Looks like your profits came exclusively from the premium you got from selling the two naked puts. The sale of covered call was perhaps not necessary and a drag on your total profit, as you lost money on buying it back when you sold your stock at a good profit.

Perhaps selling covered calls in a rising stock is not such a good idea after all. Had you chosen to get your call exercised you would lose your winning stock profit and could still lose more money. This shows that covered calls make you lose your winners and leave your portfolio with weaker or losing stocks.

Ahmad