Earlier in the year, I published a post about the Dogs of the Dow Theory. Now that we are entering the 4th quarter of 2015, I thought it would be a good time to provide another update. As a reminder:

“The Dogs of the Dow is an investing strategy that consists of buying the 10 DJIA stocks with the highest dividend yield at the beginning of the year. The portfolio should be adjusted at the beginning of each year to include the 10 highest yielding stocks.” – Investopedia

The 2015 Dogs

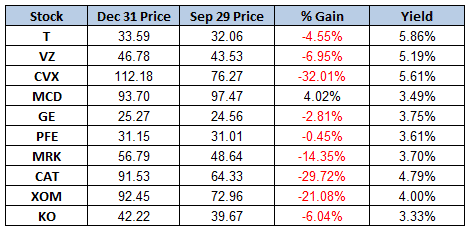

Below is the list of stocks that will make up the Dogs of the Dow theory for 2015. I’ve listed the beginning of year stock price and the current stock price so that you can see the performance of this year’s group:

It’s pretty fair to say that the Dogs of the Dow strategy has been pretty ordinary this year. CVX, CAT and XOM are all down in excess of 20% and only MCD has had a positive return so far this year. With the Dow Jones Index down nearly 10% for the year, it’s not surprising the Dogs have not performed well.

Some stocks would be close to even given the dividends received and the ability to sell covered calls. It is really the 3 laggards that are dragging the Dogs down.

Given the poor performance of some of these stocks, do you think there is a turnaround coming soon? Or is their more pain ahead? Let me know what you think in the comment section below.

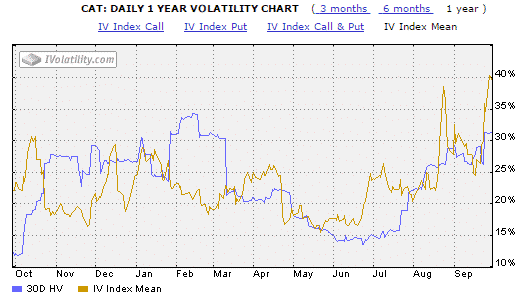

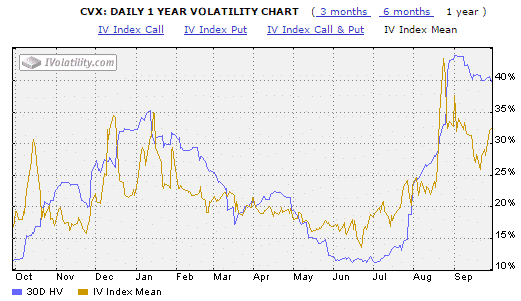

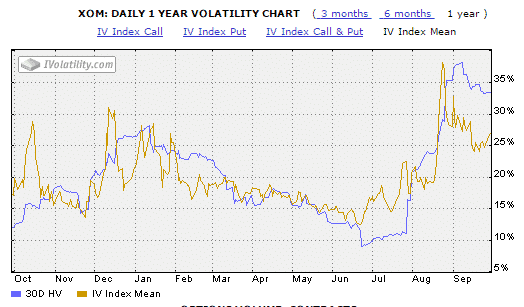

With implied volatility up in the higher regions of the range, there are some juicy option premiums available for those willing to take a punt on some of these beaten down blue chips.

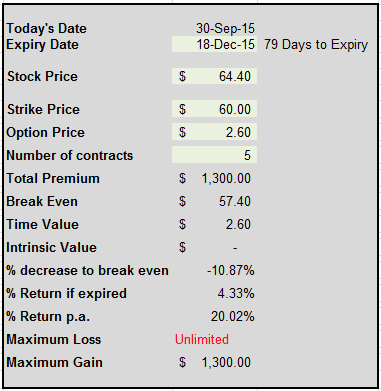

Implied volatility of 40% is very high for a Dow stock. High IV means high options premiums. With CAT currently trading at $64.40, the Dec 18th $60 puts are trading around $2.60 providing a healthy return for traders willing to bet on the stock not falling too much further.

Get Your Free Covered Call Calculator

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.