Each year, I like to take a look at the Dogs of the Dow. Given we are fast approaching the end of 2017, I thought it would be a good time to take another look at how this strategy has performed this year. As a reminder:

“The Dogs of the Dow is an investing strategy that consists of buying the 10 DJIA stocks with the highest dividend yield at the beginning of the year. The portfolio should be adjusted at the beginning of each year to include the 10 highest yielding stocks.” – Investopedia

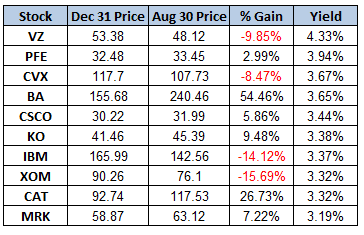

The 2017 Dogs

In 2016, the Dogs did really well. So far in 2017, it’s been a bit of a mixed bag. Boeing has experienced an amazing rally while CAT has also done very well. XOM, IBM, VZ and CVX have not done so well.

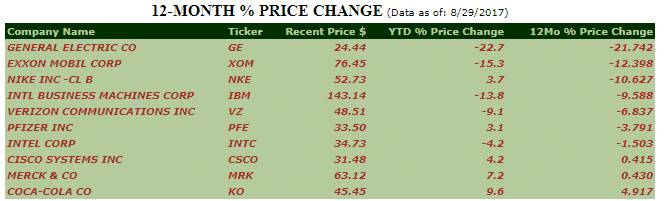

Dow Under Dogs for 2017

Another strategy that goes along with the same idea s the Dogs of the Dow is to buy the 10 worst performing Dow stocks over the last 12 months. Here’s what that list currently looks like:

Image Credit: http://www.dowunderdogs.com/pricechange.asp

It will be interesting to see how these strategies play out over the next 12 months. I’ll be sure to keep you updated.

Trade safe!