Contents

Continuing in the fundamental analysis series, we are now going to take a look at the Current Ratio, what it is, and how it might be helpful in evaluating an investment.

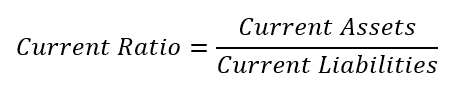

What is Current Ratio?

Also sometimes referred to as the Working Capital Ratio, the Current Ratio is a metric used to evaluate specifically a company’s short-term (one year or less) ability to cover debt with its current assets.

Current assets would include cash, accounts receivable, inventory and OCA (other current assets).

They are either cash now or expected to be liquidated and turned into cash within a year.

Current liabilities include accounts payable, wages, taxes payable, short-term debts and the current portion of long-term debt (that is, the amount of long-term debt expected to be paid within a year).

In general, it addresses the question of how likely a company would be able to pay all of its obligations should they all be due at once.

While this scenario is unlikely to occur in the real world, it does speak to the possible solvency of a company.

Numbers higher than 1 are generally preferable.

That being said, if the number is “too high”, it may suggest inefficient use of capital.

What counts as “too high” may vary from one industry to another.

Timing Is Everything

As the name suggests, this ratio is focused on things that are current, happening now.

Therefore, timing of when the ratio is calculated can impact the results.

Said another way, a company’s current ratio can be different within the same month, depending on when clients pay and/or when the company pays its employees (for example).

Similar to the Interest Coverage Ratio, discussed in the previous article, the Current Ratio is best used as a measure for determining trends when calculated over multiple periods.

As it is more sensitive to exactly when it’s being calculated, if calculating over multiple periods, it is preferable to calculate it at the same time of the month, and/or month of the quarter.

So not only would you want to look at, for example, the first month of the quarter, but maybe the first week of the first month of the quarter.

Or maybe look at the second week of the third month of each quarter.

So long as it is consistent in the timing, it is more likely to give you a better picture over time.

Other Considerations

As suggested above and similar to other fundamental metrics, the Current Ratio should really only be used to evaluate/compare companies within the same industry.

Also keep in mind, that while the Current Ratio is sensitive to when it’s calculated, it’s not necessarily very specific.

That is, many ratios would specifically exclude assets that cannot be easily liquidated; however, the Current Ratio includes all assets, regardless of how liquid they may or may not be.

If a company has a large accounts receivable, for instance, but it’s very aged (because the customers pay very slowly), the company may look more solvent than it is.

Likewise, companies with large inventories may similarly have high ratios, but if that inventory cannot be sold (or must be heavily discounted to do so), their ratio may be artificially inflated.

Conclusion

As with the rest of the metrics we’ve looked at, the Current Ratio is only part of the picture of a company’s finances.

It is also less useful as a singular data-point; one should look at the historical norms for that company and its peer group to best determine what a singular point might suggest about that company’s solvency.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.